ETH Soars Past Netflix 😲: Is $5,000 the New Magic Number? 🚀

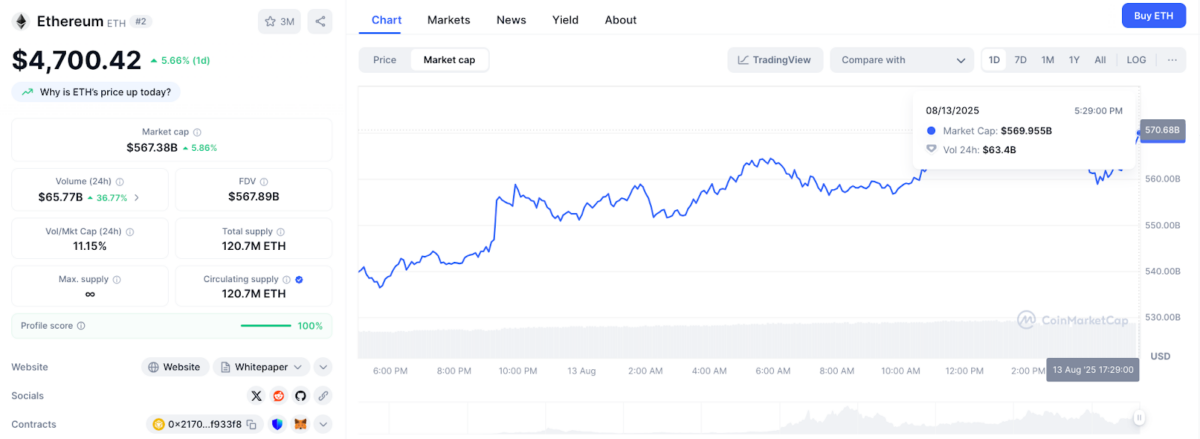

Ethereum (ETH) Price Action, August 13, 2025 | Source: CoinMarketCap

Ethereum (ETH) Price Action, August 13, 2025 | Source: CoinMarketCap

Ethereum’s [ETH] ascent beyond the $4,000 threshold has ignited a fresh frenzy among both retail traders and the big wigs in suits. Who knew digital coins could cause such a ruckus?

Choreo, that titan of wealth management, has decided that Bitcoin ETFs are the new caviar. The firm splashed $6.5 million across several Bitcoin-centric funds – an announcement made in a filing to the SEC so dry it could cure a martini. Their pièce de résistance? A whopping 51,679 shares of BlackRock’s iShares Bitcoin Trust ETF (IBIT), worth over $3 million as of June 30. Truly, they’ve outdone themselves. Or have they merely joined the queue for the next financial bubble? 🫣

This, dear reader, represents an increase of 87.7% in but six months, and a staggering 192.7% since the same time last year. Such meteoric growth is attributable, in no small part, to the fund’s investments in companies whose treasuries are liberally sprinkled with Bitcoin, including Strategy, Block, Coinbase, Marathon Digital Holdings (MARA), and the rather enigmatic Metaplanet.

Chainlink [LINK] is strutting around like it just won the lottery. Seriously, it kicked off August with a jaw-dropping 35.34% weekly candle, leaving Ethereum [ETH] in the dust with its measly 21%. At this rate, LINK is practically doing the cha-cha while ETH is still trying to figure out the Macarena. 💃

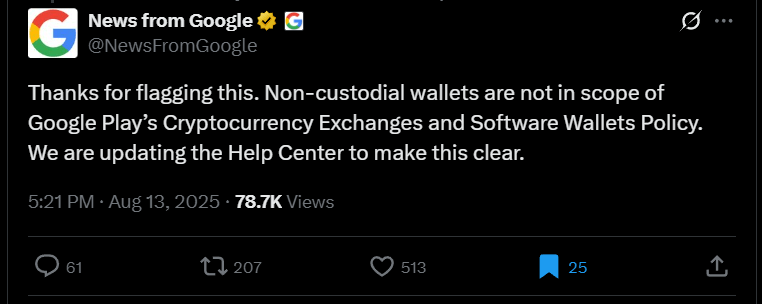

In a rather peculiar twist, Google sheepishly admitted to accidentally banning all non-custodial crypto wallets from its beloved Play Store. But fear not, dear crypto enthusiasts! They’ve promised to fix their blunder and clarify that these wallets don’t need to be government-licensed banks or registered money services businesses (MSBs). Phew! 😅

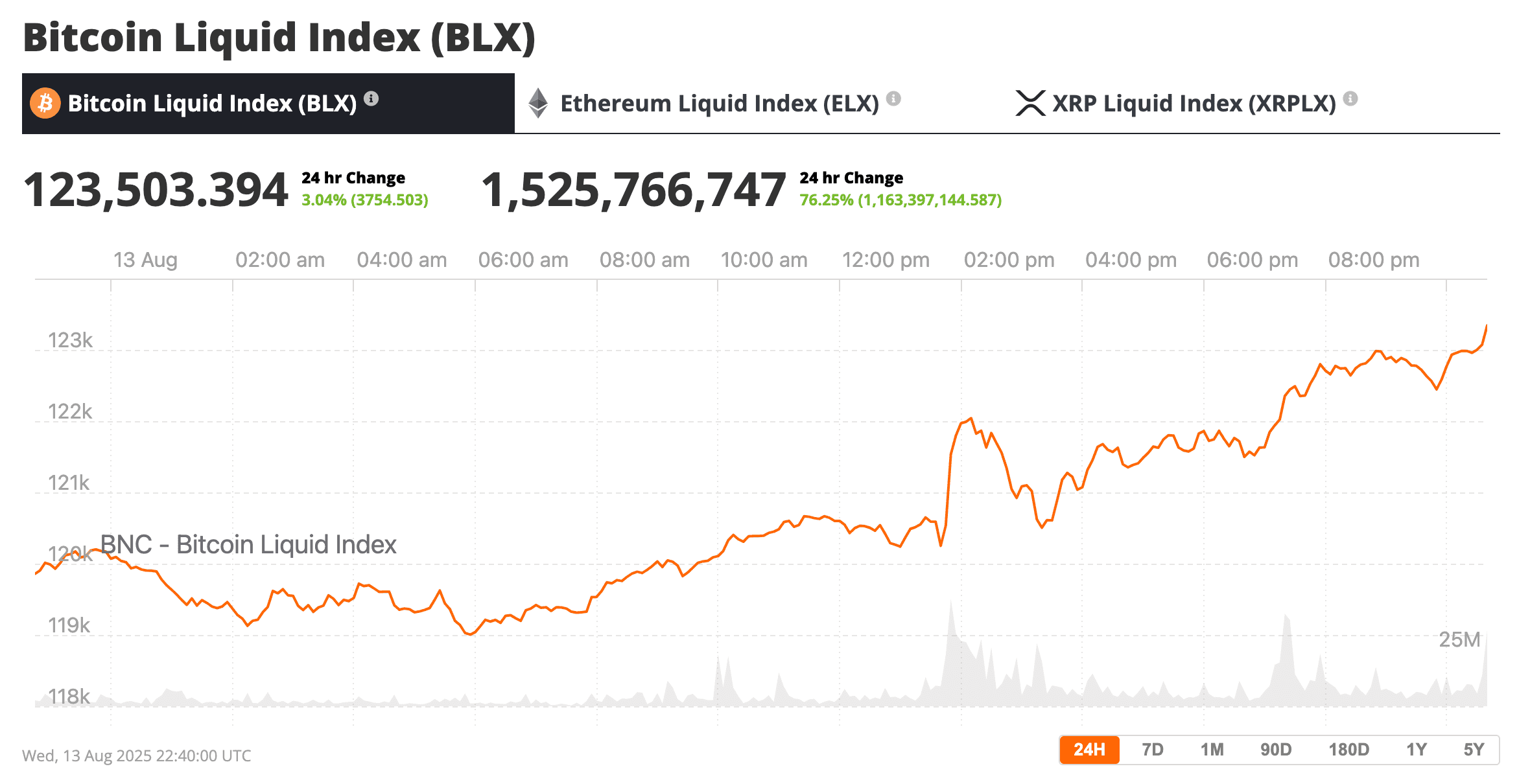

Bitcoin done broke its previous records, but don’t ask me to round up that many dollars unless you want me robbing riverboats-source: Bitcoin Liquid Index

But wait! Just a day prior, the July US CPI print revealed that inflation, that ever-elusive specter, held steady at 2.7% year-over-year. Unchanged from June, it seems inflation is as stubborn as a mule, refusing to budge from its forecasted 2.8%. The overall CPI crept up a mere 0.2%, a whisper compared to June’s more boisterous 0.3%. Talk about a slow-motion race! 🐢

According to the Delaware State Department’s dusty scrolls, Canary Capital filed on a Wednesday, a day as mundane as a clerk’s cough, yet pregnant with the promise of riches untold. Though a formal filing with the Securities and Exchange Commission (SEC) may tarry like a reluctant lover, the stage is set for a spectacle most grand. 🎭

Mark your calendars, darling: Oct. 29, 2025 is when the fun begins. Developers in the US will need to cozy up with local regulators as either money services businesses or money transmitters (how delightfully vague!). Meanwhile, our EU friends must register as crypto-asset service providers (CASP)-because nothing screams “cutting-edge” like a three-letter acronym, am I right? 🙄