Ethereum Surges $4.6K – What’s the Big Deal? 🤔💸

54% in a month? That’s more than my gym membership. 🏋️♂️

54% in a month? That’s more than my gym membership. 🏋️♂️

DOGE flexed its muscles with a 5.6% gain in the 23-hour period ending August 13, climbing from $0.225 to $0.233 in a wild $0.0198 range (8.8% volatility).

Morning trade established $0.220 as a firm support level, backed by a volume that was more than your average Netflix binge-watch at 387.7M. Price took off between 12:00-20:00, soaring from $0.221 to $0.238 before the evening resistance said, “Not today!”

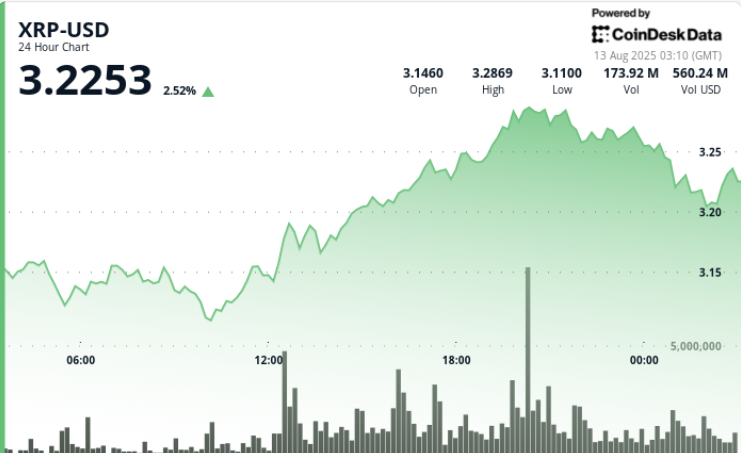

XRP has risen a sprightly 4% in the 24-hour period ending August 13, climbing from $3.15 to $3.25 within a $0.20 range (6% volatility).

The bulk of the gains occurred between 12:00 and 20:00, when the price waltzed from $3.15 to $3.30 on a volume that could make a whale blush-exceeding 140M units. Resistance forms at $3.30 as buying momentum slows, while support consolidates at $3.25-$3.26, showing orderly profit-taking without breaking the bullish structure. Bravo! 👏

Fartcoin [FARTCOIN] took a brutal 21% nosedive in the past 24 hours, as investor optimism turned sour faster than milk in the sun.

This surge has sent Bitcoin’s dominance tumbling from 65% to 59%, as traders decide to play musical chairs with altcoins. 🎶

’Tis said Pump.fun’s upward momentum springs from a most vigorous purchasing of its own tokens – a practice one might compare to a merchant frantically buying back his own wares to appear popular. Between the 5th and 11th of August, a princely $33.13 million worth of PUMP was repurchased, consuming nigh onto 97.29% of their weekly earnings! 💰 This rare display did diminish the number of tokens in circulation to 354 billion, a mere fraction of the grand total of one trillion. A most curious endeavor, wouldn’t you agree?

According to Pantera’s brain trust, the genius behind this move is that DATs can grow their net asset value per share by generating yield, which is just a fancy way of saying they’ll hoard more crypto over time. Apparently, this is better than simply buying tokens outright or through an ETF. Because, you know, why do things the easy way when you can make it complicated? 🤷♂️

From a technical perspective, this repeated rejection is akin to a child trying to reach the cookie jar on the top shelf-frustratingly close yet utterly out of reach. The psychological barrier of $120,000 looms large, a fortress that seems impervious to the bullish knights. If Bitcoin doesn’t muster the courage to decisively conquer this citadel, it risks stalling like a car out of gas on a lonely road. 🚗💨

In an announcement that must have startled some distinguished pigeons in the park, ALT5 Sigma Corp. declared a rather ambitious capital raise through a mechanism that is both registered and stealthily private, akin to a secretive council meeting about the best way to bake bread. The objective? To construct a digital asset treasury strategy, with a strong focus on World Liberty Financial’s beloved WLFI token, which one might say is like the child nobody pays attention to at the family reunion.

July’s US CPI is hanging tight at 2.7% year-over-year-totally chilling and giving a hefty boost to Fed rate cut bets. Yes, you heard that right, it’s up to a delightful 93.9% for September!