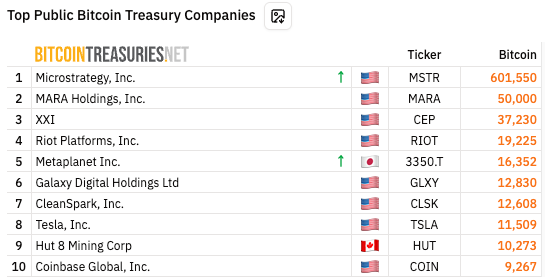

A total of 16,843 Bitcoin, or about $2 billion, is currently being prepared for sale. Even before the majority of this liquidity reached the market, the mere act of moving coins caused a dramatic reaction: spot exchanges saw a rush of defensive selling, and Bitcoin’s price instantly fell by more than $6,000 per coin. This, dear reader, is the issue with the low-float rally dynamics of Bitcoin: volatility increases and liquidity quickly evaporates when big holders choose to cash out. Panic-driven exits in anticipation of this whale distribution contributed to a 300% increase in daily trading volume, a spectacle that would have been comical if it weren’t so costly. Technically speaking, Bitcoin is still above short-term support at about $111,000 per day. However, buyers are stepping away in real time, as indicated by the reversal near $122,000. Should Galaxy Digital begin to execute the entire sales tranche, the subsequent leg down could potentially test the $107,000-$110,000 range. The long-term upward trend of Bitcoin remains intact, but swift reversals are more than possible, and weeks of consistent accumulation can be overtaken by a single large seller. As the market processes this $2 billion in liquidation, traders should keep an eye out for additional whale movements and brace themselves for more explosive swings. 🌊