The crypto world was abuzz last week, with inflows skyrocketing to heights unseen since the dawn of time, or at least since the week before. Two titans, BlackRock and Ethereum, led the charge, making headlines and breaking records with a flair that could only be described as… well, crypto-flair!

This surge of capital into digital asset investment products wasn’t just a blip on the radar; it marked a steady series of positive flows, pushing assets under management (AuM) to an all-time high (ATH) of a staggering US$244 billion. Yes, you read that right-staggering, like a drunkard at a blockchain party.

Crypto Inflows Surge Sixfold as BlackRock and Ethereum Take the Stage

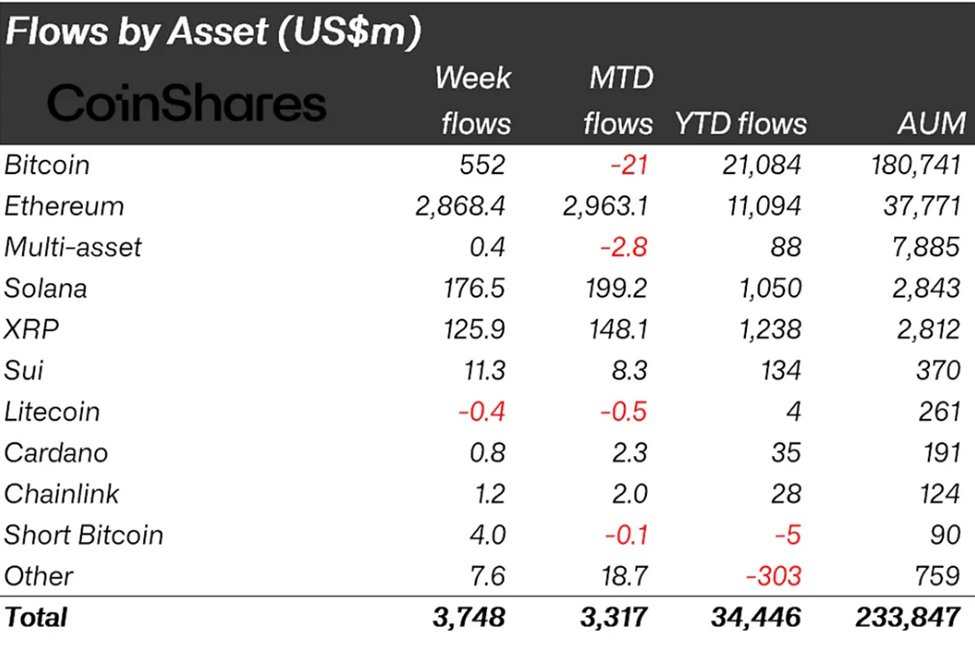

According to the latest CoinShares report, crypto inflows soared to $3.75 billion in the week ending August 16. For those keeping score at home, that’s a whopping 6.4x increase from the meager $578 million recorded the week before. Talk about a comeback!

CoinShares’ head of research, James Butterfill, couldn’t help but gush over the numbers. “This is the fourth-largest inflow on record,” he exclaimed, “a strong rebound after several weeks of what can only be described as a collective crypto hangover.” 🍾

But here’s where the plot thickens: while crypto inflows were surging, BlackRock’s iShares was the star of the show, accounting for a jaw-dropping 86% of the flows. That’s right, folks, $3.2 billion in positive flows to the financial instrument, more than enough to buy a small country-or at least a very fancy yacht. 🛥️

//beincrypto.com/wp-content/uploads/2025/08/image-277.png”/>

BlackRock’s dominance isn’t just a fluke. Its financial vehicle, iShares, remains one of the most popular instruments for institutional investors looking to dip their toes into the crypto waters without getting their feet wet. Even Harvard University, the cradle of future leaders and Nobel laureates, chose BlackRock’s IBIT ETF as its gateway into the crypto market. Imagine that-Harvard, the bastion of academic excellence, riding the crypto wave. 🌊

And if that weren’t enough, recent reports indicate that 75% of BlackRock’s Bitcoin ETF customers were first-time buyers. This suggests that the asset manager’s allure is so strong, it can turn even the most skeptical of investors into crypto enthusiasts. 🤩

Just a month ago, BlackRock’s Ethereum ETF inflows surpassed its Bitcoin fund, a testament to Ethereum’s growing popularity and the trust it inspires. It’s like the crypto world’s version of a David and Goliath story, except David is wearing a blockchain suit and Goliath is still trying to figure out how to send an email. 🧑💻

Ethereum Stole the Show, Bringing in 77% of Last Week’s Crypto Inflows

While BlackRock accounted for over 86% of the inflows, Ethereum wasn’t far behind, contributing a whopping 77% of the total weekly inflows. “Ethereum continues to steal the show, with inflows totaling a record US$2.87 billion last week… the inflows far outstrip Bitcoin, with YTD inflows representing 29% of AuM compared to Bitcoin’s 11.6%,” Butterfill added, sounding more like a sports commentator than a financial analyst. 📈

Bitcoin, the once-unquestioned king of the crypto realm, saw modest inflows of $552 million, a mere pittance compared to Ethereum’s gold rush. It’s as if Bitcoin is the old rock star who’s still playing sold-out shows, while Ethereum is the new kid on the block, dropping hit after hit. 🎵

Over the past few weeks, investor sentiment has clearly favored Ethereum over Bitcoin. The attention has been fueled by the recent frenzy around Ethereum, driven by institutions adopting ETH-based corporate treasuries. Tokenized assets have also soared to a $270 billion record, as institutions increasingly standardize on Ethereum. 🚀

With all this momentum, analysts predict that the Ethereum price may be on track to reach the $5,000 milestone, nearly 20% above current levels. If that happens, it will be a momentous occasion, worthy of a ticker-tape parade and a few rounds of celebratory crypto cocktails. 🥂

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- USD THB PREDICTION

- AI and Copyright: Mark Twain’s Take on the Modern Patent Circus

- Brent Oil Forecast

- Blockchain Dawn in the Developing World 🌍✨

- Gold Tokens: The New Gold Rush or Just Fool’s Gold? 🤔💰

2025-08-18 13:18