Ah, the sweet scent of capitalism in the air! Ethereum, that digital darling, has climbed past $3,900 like a stubborn weed pushing through concrete. Derivatives traders are frothing at the mouth, and trading volumes are louder than a drunk poet at a Gorky reading.

On this fine day, August 8, 2025, Ethereum (ETH) boasts a market cap of $470.8 billion-12.2% of the crypto economy’s $3.87 trillion pie. Over the last 24 hours, $32.5 billion worth of ETH changed hands, dancing between $3,806 and $3,972. But beware, dear reader: greed is a dangerous game. The rally triggered liquidations totaling $103.10 million, with short-sellers getting absolutely wrecked to the tune of $76.15 million. 😅 Poor souls!

The 4-hour chart tells a tale of resilience: Ethereum rebounded from $3,351 on August 3 to flirt shamelessly with $3,972 today. It’s as if the coin itself decided to hit the gym and bulk up. Consolidation near these highs suggests it might be catching its breath before making another run for glory-or crashing spectacularly. Who knows? 🤷♂️ Meanwhile, the daily chart shows ETH climbing steadily since late July, pausing briefly at minor resistance levels before sprinting toward the elusive $4,000 mark. Will it succeed? Or will gravity intervene? Drama ensues! 🎭

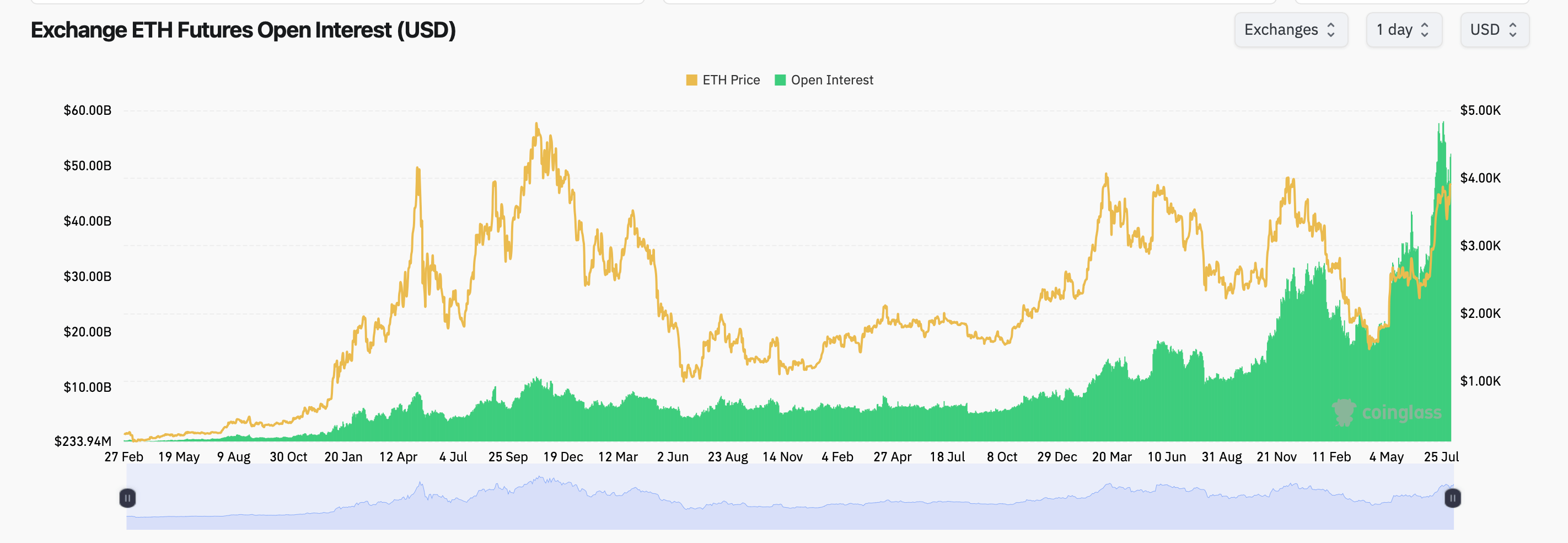

Futures open interest now sits at a jaw-dropping $52.19 billion (13.38 million ETH), with big players like CME, Binance, and Bybit hogging the spotlight. CME holds 1.63 million ETH ($6.35 billion), while Binance flexes with 2.64 million ETH ($10.30 billion). Bybit trails with 1.23 million ETH ($4.78 billion). Other exchanges-OKX, Gate, Bitget, et al.-are merely extras in this grand theatrical production. 🎬

Over the past 24 hours, CME gained +6.71% in open interest, Binance +1.87%, and Bybit +3.42%. Others faltered, but who cares about losers? The OI-to-volume ratio on CME is an impressive 1.6627, signaling deep institutional involvement. Ah, the rich-they always find ways to make things complicated. 🤑

In the realm of ETH options, calls dominate with 67.46% of open interest (2.045 million ETH) compared to puts at 32.54% (986,253 ETH). Calls accounted for 57.11% of trading volume yesterday, leaving puts in the dust at 42.89%. Top options contracts include the Dec. 26, 2025, $6,000 calls (60,644 ETH) and the Sept. 26, 2025, $4,000 calls (54,738 ETH). These numbers scream optimism-or perhaps delusion. Who can say? 🤔

With futures and options markets leaning heavily bullish, one wonders: are we witnessing the dawn of a new era, or just another bubble waiting to burst? High open interest and rampant liquidations suggest volatility lurks around every corner. So buckle up, comrades-the ride could get wild. 🎢

Read More

- US Crypto Regulators Finally Decide What They Actually Mean – Time to Buy?

- Tether’s Big Heist: $500B Valuation or Just a Stablecoin’s Wild Dream? 💸

- USD CNY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- USD VND PREDICTION

- EUR USD PREDICTION

- GBP MYR PREDICTION

- Silver Rate Forecast

- BNB PREDICTION. BNB cryptocurrency

2025-08-08 17:33