As August limps to its inevitable conclusion, Ethereum continues to chug along like an old locomotive fueled by dreams and gas fees so low they might as well be imaginary. Positive net issuance? Check. Steady onchain use? Double-check. Transaction costs that won’t make you cry into your coffee? Triple-check. Let’s dive into this circus of numbers and see what’s really going on beneath the blockchain bonnet.

The Inner Workings of a Digital Behemoth 🤖

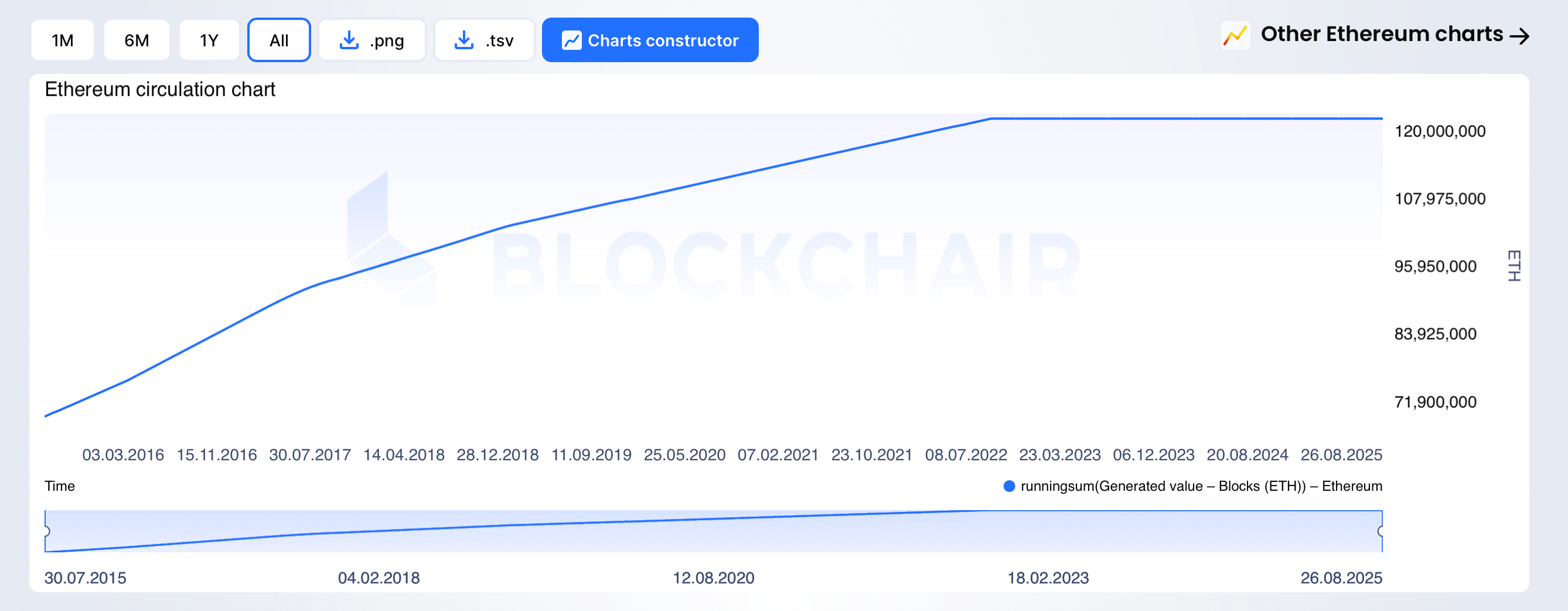

According to Blockchair, Ethereum’s circulating supply has flatlined since its transition to proof-of-stake (PoS), hovering around 120 million ETH-currently sitting at a cool 121,009,974, per Ultrasound Money. That’s right, folks, the network added +17,877.70 ETH in just seven days. Meanwhile, about 18,652.30 ETH was issued, but don’t worry-they burned 774.60 ETH to keep things “balanced.” Annualized growth rate? A modest +0.771%. So basically, we’re printing money slower than your grandma knits socks. 🧦

Since EIP-1559 rolled out four years ago, over 4.6 million ETH have gone up in smoke. Burn leaders include standard ETH transfers (~376,607 ETH), Opensea (~230,051 ETH), and Uniswap V2 (~227,221 ETH). Oh, and let’s not forget Tether’s USDT (~210,560 ETH) because stablecoins love drama too. The burn tempo? About 2.16 ETH per minute. Not bad for a system that occasionally feels like it’s running on fumes. 🚀

Meanwhile, Ethereum’s cumulative size has grown to roughly 1.3 terabytes. Yes, you read that correctly. It’s like storing all of human knowledge… or maybe just everyone’s NFTs. 😅 Costs remain absurdly low compared to the early days, with base fees averaging 16.3 gwei over the past week. Who needs inflation when you can have deflationary vibes?

Ethereum Usage Trends: Slow and Steady Wins the Race 🐢

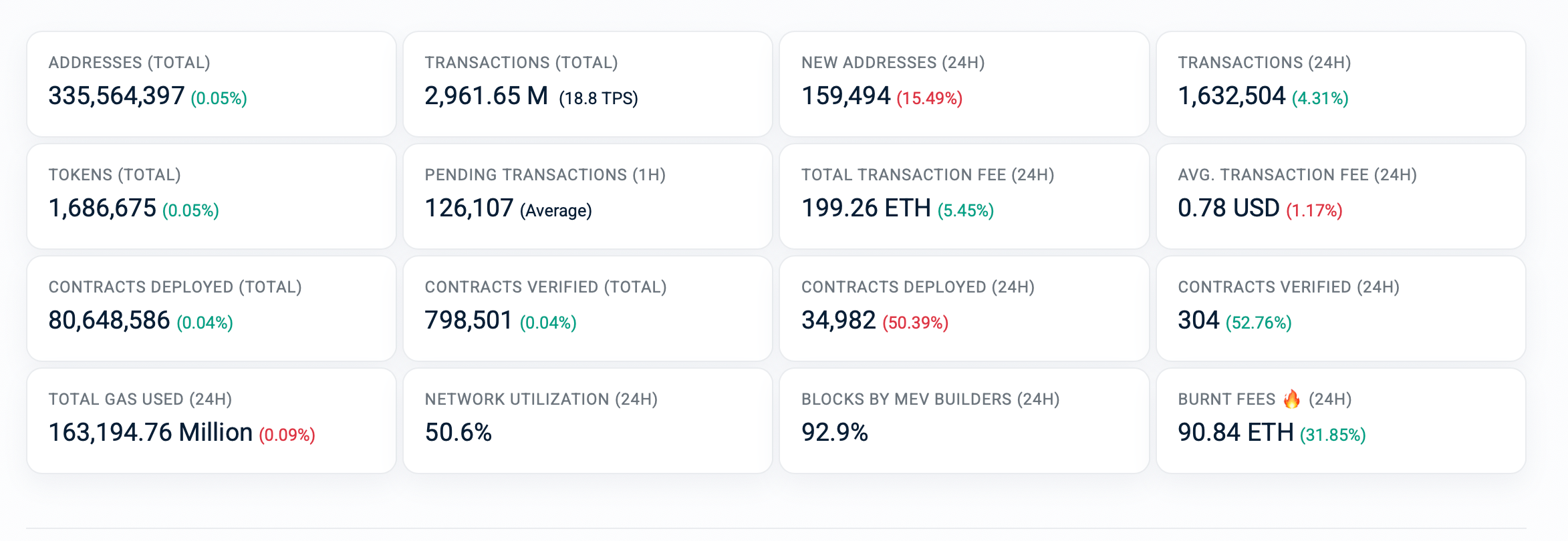

Data from Etherscan shows 335,564,397 total addresses and 2,961.65 million cumulative transactions. That’s 18.8 transactions per second-a pace faster than your morning jog but slower than Elon Musk’s Twitter rants. Over the last 24 hours, Ethereum processed 1,632,504 transactions with total fees of 199.26 ETH. Average fee? A laughable $0.78. Burned fees? Just 90.84 ETH. At this rate, we’ll need another century to burn through Jeff Bezos’ lunch budget.

Contract activity remains robust, with 80,648,586 contracts deployed and 798,501 verified. MEV builders dominate block construction, responsible for 92.9% of blocks in the last day. New address creation? Down slightly to 159,494. But hey, who needs new users when the old ones are busy hoarding their riches?

Holders and Hoarders: The Wealth Gap Widens 💸

Speaking of hoarding, Ethereum’s rich list reveals some eyebrow-raising stats. Out of 390,602,961 holders, the top 10 control 61.02% of all ETH. The top 100? A staggering 72.96%. If this were a pie chart, most of us would be fighting over crumbs while the whales feast on caviar. 🐳

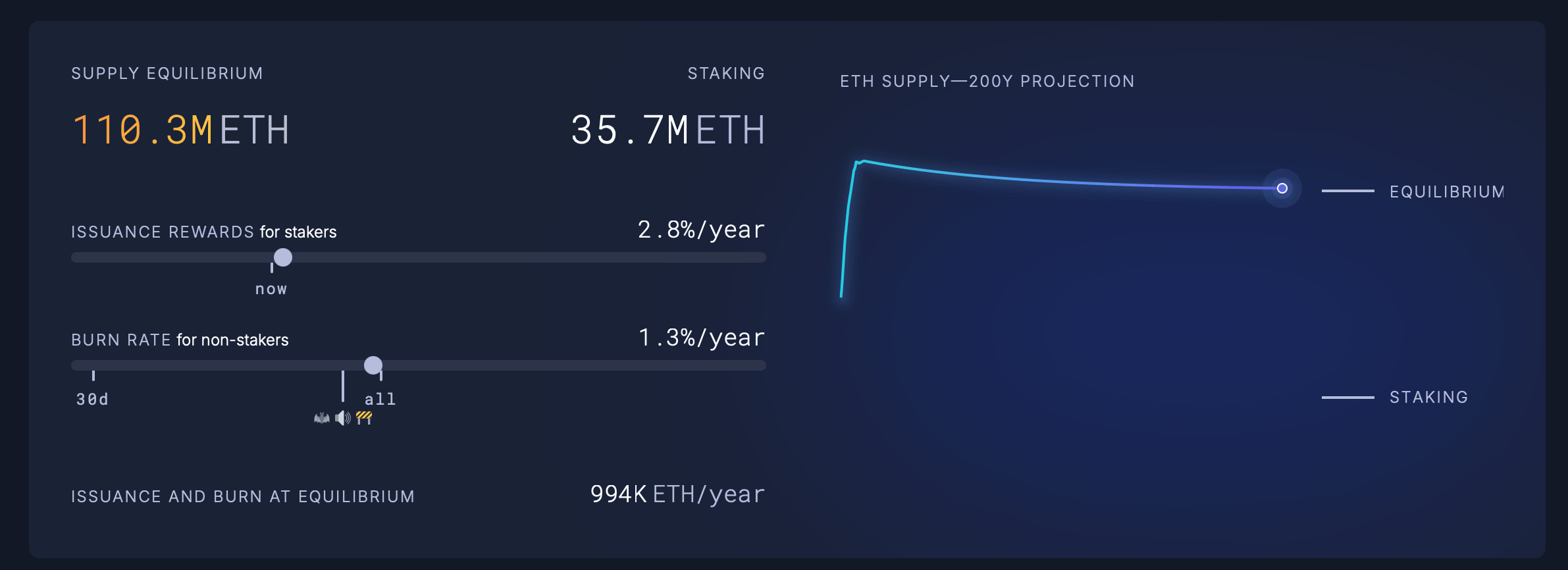

Ultrasound Money predicts a steady-state supply near 110.3 million ETH, with staking rewards around 2.8% annually and non-staker burns near 1.3%. Sounds fair enough until you realize the rich will only get richer. Ah, capitalism-it never sleeps, even in crypto form.

In summary, Ethereum is humming along like a well-oiled machine, processing millions of transactions daily while keeping fees low enough to avoid riots. Liquidity flows freely, governance tilts toward the elite, and the rich keep getting richer. Is this progress or just another chapter in humanity’s endless quest for digital gold? Either way, buckle up-the ride isn’t stopping anytime soon. 🎢

Read More

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- EUR USD PREDICTION

- USD THB PREDICTION

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

- Gold Tokens: The New Gold Rush or Just Fool’s Gold? 🤔💰

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- Why XRP Won’t Leap: A Tale of Hope, Despair, and a Bit of Chuckle 💥🚀

2025-08-28 05:29