Picture this: a Japanese startup named JPYC, which appears to have more imagination than a manatee caught inside a loom-playing around with something as neat as the first stablecoin pegged to none other than the noble yen. A yen at last! This delightful little innovation is supposedly backed by domestic savings and the toothsome wads known as Japanese government bonds.

JPYC: A Financial First-Past-The-Finish Line

Our friends at JPYC announced this electrifying contraption on a Monday. Naturally. The token, simply dubbed “JPYC”, mimicks a fiat currency, much like a gelded horse makes an effort to sound as graceful as its unaltered forebears. Up until now, the stablecoin world had been the playground of the dollar-tied tokens, with USDT and USDC acting like the popular boys at the school dance.

Now, Japan has leapt into this frolic of financial innovation. JPYC suggests its token will be stood on the end of a one-to-one backing line of domestic deposits and government bonds. It’s like building a soufflé with more fiscal responsibility than Uncle Fred on account settlement day. Through JPYC EX-assuredly named in the time before automatic spellcheck-this token is swinging into exchanges and the gentlemanly absence of fees is most appealing, as they plan to profit solely from JGB interests.

The piece de resistance is that JPYC initially struts into Ethereum, Avalanche, and Polygon, with grand visions of gracing more blockchains in the future. Reuters tells us JPY plans the humongous issue of 10 trillion yen worth of these tokens over the next three years-not to be outdone by a champagne cork-equivalent to a whopping $65.5 billion. Alas, USDC, the dollar’s dapper debonair stable-mate, boasts a market cap of about $76.3 billion. If JPYC plays its cards close to its chest-and with luck-it could be ready to tango upmarket with the big boys.

Moreover, Japan’s banking goliaths, namely Mitsubishi UFJ Financial Group, Sumitomo Mitsui Banking Corp., and Mizuho Bank, are plotting to chip in their own yen-backed token by the curtains of 2025. This trio looks after over 300,000 clients, enough to fill a small country, or a very large stately home.

The East Asian land rides the crypto-bandwagon, as the government ponders letting banks turn leathersellers and providing trading services via crypto exchange licenses. Meanwhile, across the Manchurian Express, the folks in China are taking more of the stance of a prudent grandmother at a child’s tea party-strictly no stablecoins for you!

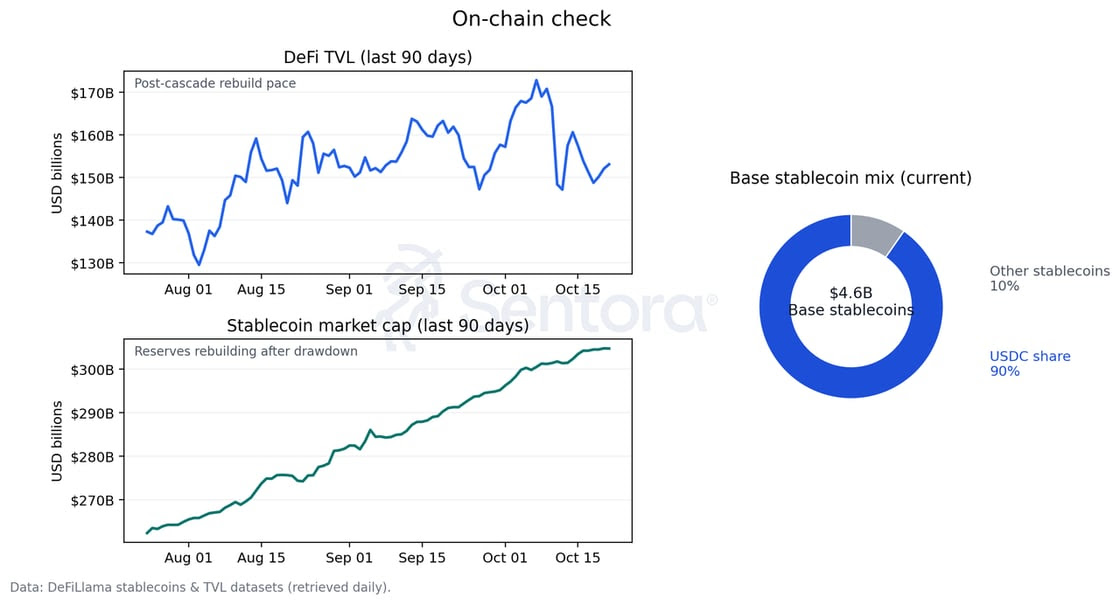

The Chinese city of Hong Kong toyed with the idea earlier in the year but had to consider mainland regulators’ warnings about letting private companies decide the worth of their own currency. Meanwhile, globally, digital assets tied to fiat are having frothy times with capital inflows. A chart shared by Sentora suggests they’ve hit a market cap of a rather splendid $308 billion.

Bitcoin Price

As things stand at the time of writing, Bitcoin is playing ball at around $115,200. Climber, dear thing, almost four percent over the past week!

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- Gold Rate Forecast

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- USD THB PREDICTION

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

2025-10-28 06:13