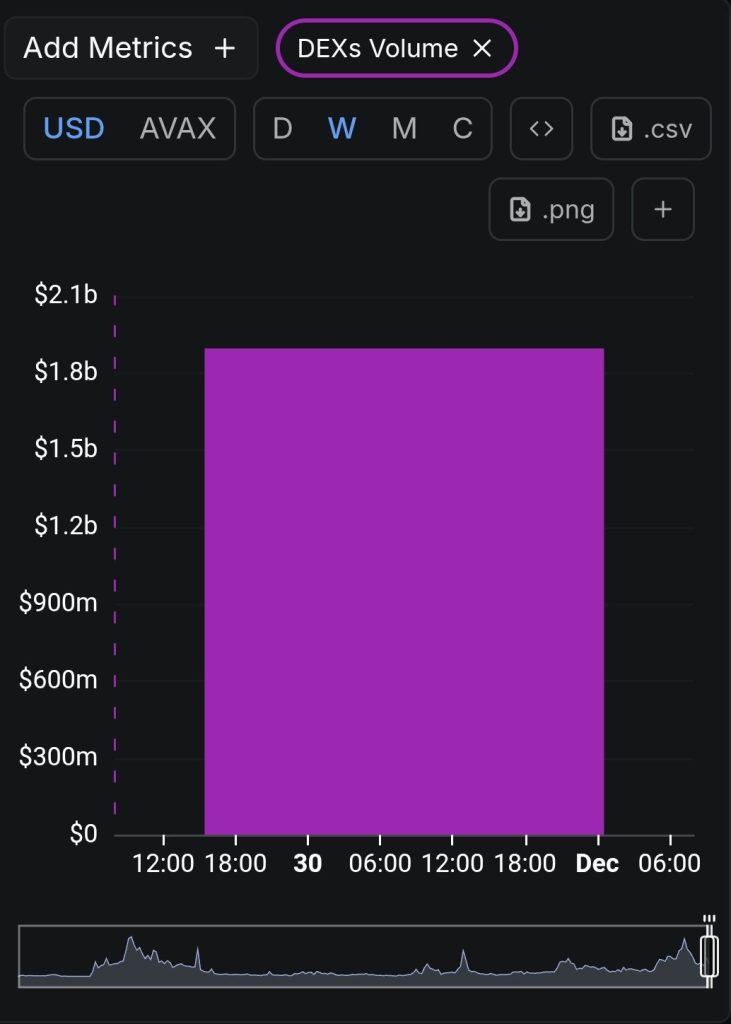

Ah, Avalanche, the plucky little snowball that thinks it’s an avalanche. 🏔️ This week, it’s rolling down the hill with a bit more oomph, thanks to a sudden burst of on-chain activity. DEX trading volumes have shot up like a wizard’s fireball, hitting a whopping $1.8 billion in the last 24 hours. AVAX is hovering around $14.68, bouncing off its long-term support zone like a troll on a trampoline. Could this be the start of something big, or just another false alarm? Only the Great A’Tuin knows for sure. 🐢

DEX Frenzy: $1.8 Billion in Volume-Someone’s Been Busy! 💸

Avalanche’s on-chain activity has gone from “meh” to “marvelous” overnight. DEX volumes have surged, liquidity is flowing like a river of gold, and users are back in the game. It’s like a party in the DeFi pools, and everyone’s invited-even the goblins. 🧙♂️

What does this mean? Well, it’s not just the tea leaves saying it-the numbers are shouting:

- Liquidity is rotating into AVAX like a well-oiled trebuchet. 🪨

- Volatility is spicier than a dragon’s breath in AVAX DeFi pools. 🐉

- Users are back, and they’ve brought snacks. 🍿

This spike is as notable as a dwarf with a height complex, especially since it’s happening while AVAX clings to its support zone like a barnacle on a ship. Could the big players be plotting something? 🧐

Technical Gibberish: Falling Wedge or Fancy Hat? 🎩

The weekly chart is still stuck in a falling wedge pattern-a bullish reversal setup, they say. AVAX has been bouncing off the lower support like a rubber chicken at a circus. It’s trading at $14.68, snug in its long-term support band, which has historically been the launchpad for counter-trend rallies. So, is this the calm before the storm, or just another day in Discworld? 🌩️

The rebound has everyone crossing their fingers for a 60% to 70% upswing. The weekly RSI is looking perkier than a witch’s cat, signaling weakening bearish momentum. Meanwhile, the CMF is rising like a phoenix, showing capital inflows and buying pressure. Accumulation phase? Breakout potential? Sounds like someone’s been reading the Book of Omens. 📖

If AVAX holds its ground around $15, the next stops on this wild ride could be:

- $22-$25: Mid-range resistance, where the wedge gets interesting. 🧩

- $32-$35: The first major breakout zone-pop the champagne! 🍾

- $55.80: The full wedge target, if history repeats itself. 🕰️

What’s Next for Avalanche? Will 2026 Be Its Year? 🎉

Avalanche is at a crossroads-on-chain activity is buzzing, and technical support is as sturdy as a dwarf’s beard. The DEX volume spike suggests the market is waking up from its nap, and the falling wedge pattern hints that sellers might be running out of steam. With AVAX at $14.68, the next few weeks could be as dramatic as a Lancre witch trial. If it keeps this up, 2026 might just be the year Avalanche goes from snowball to snowstorm. ❄️

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Shiba Inu’s Zero Removal: A Tragicomedy of Errors

- OP PREDICTION. OP cryptocurrency

- Bitcoin & Gold: Because Money is Weird

- Shiba Inu Shakes, Barks & 🐕💥

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- If Your Altcoins Were Parties, They’d Be Dead 🥳 – The Cryptocurrency Comedy of Errors

2025-11-29 12:08