Ah, Ethereum, the second-largest cryptocurrency in the universe (or at least the part of it we’ve bothered to map). It’s currently doing its best impression of a rocket 🚀, fueled by rising market liquidity and on-chain support that’s as sturdy as a sofa from IKEA (you know, mostly reliable, but occasionally baffling). The price has stabilized above critical support levels, which is financial jargon for “it’s not crashing, so let’s celebrate with a cup of tea ☕.”

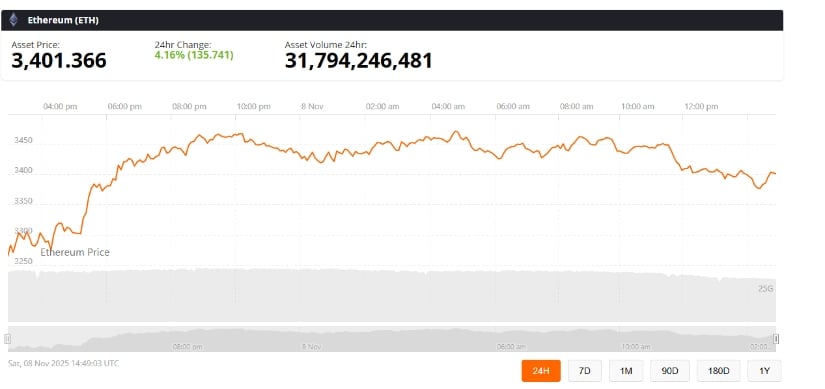

Investors are now as optimistic as a cat with a laser pointer, and analysts are pointing to $3,500 as the next big milestone. Because, you know, why stop at $3,499? That extra dollar is where the magic happens. 🪄

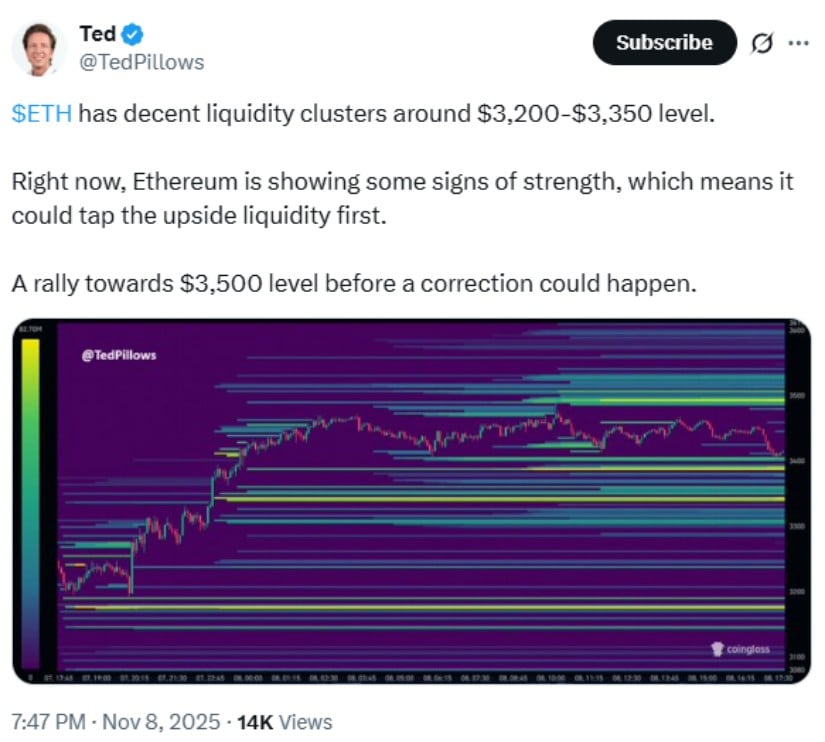

Recent market data reveals dense liquidity pools between $3,200 and $3,350, which is basically a financial safety net for Ethereum. It’s like a trampoline for prices, bouncing them higher with every sell pressure. Traders are treating this consolidation like a pre-game warm-up, stretching their portfolios for the big leap. 🏋️♂️

Short-Term Technical Outlook and Price Targets (or: Will It Go Up? Spoiler: Maybe.)

Technical analysis, that mystical art of reading squiggly lines on charts, suggests Ethereum’s candlestick structure is as bullish as a bull in a china shop. Higher lows, increased volume-it’s all pointing to the bulls taking the reins. The price is now eyeing $3,500 like it’s the last slice of pizza 🍕. Break through that, and we could see $3,700 or even $3,800 in the weeks ahead. Because why not?

This short-term optimism is as aligned with broader predictions as a spoon is with a bowl of soup. By the end of November, ETH could be lounging between $3,500 and $4,700. Deflationary issuance and staking growth are tightening supply faster than a belt after Thanksgiving dinner. 🦃

Strong Fundamentals: Ethereum’s Secret Sauce 🥄

Beyond the short-term hoopla, Ethereum’s long-term fundamentals are as solid as a brick house (though less likely to fall on a witch). Over 27 million ETH are staked, reducing available supply and keeping volatility in check. It’s like everyone decided to sit down and have a nice, calm cup of tea instead of trading like maniacs. ☕

Ethereum’s deflationary model is also doing wonders for its long-term outlook. Fewer tokens, more activity-it’s the financial equivalent of Marie Kondo’s “spark joy” philosophy. Analysts are as bullish as a herd of bulls in a field of red capes, especially with institutional interest and the potential ETF approval on the horizon. 🧑💼

Market Caution: Because Nothing’s Ever Easy, Is It? 🤷♂️

Of course, not everyone’s popping champagne just yet. Some analysts are waving red flags 🚩 about resistance near $3,500-$3,700. Fail to break through, and we could see a retracement to $3,200. Macroeconomic risks and liquidity constraints are also lurking in the shadows, ready to spoil the party. 🎉

But overall, the mood is cautiously optimistic. Traders are more confident than a peacock in a mirror, buoyed by positive on-chain data and improving indicators. If the bullish structure holds, Ethereum could soon be testing its upper limits like a kid on a sugar high. 🍭

Final Thoughts: Will ETH Moon or Just Hover? 🌕

Ethereum’s price action is once again the center of attention, like the popular kid at a school dance. Strong liquidity zones, favorable fundamentals, and staking growth are all pointing to a rally toward $3,500. Short-term volatility might still rear its ugly head, but Ethereum’s foundation is as solid as a rock (or at least a well-built LEGO tower). 🧱

In the grand scheme of the crypto universe, Ethereum’s performance is still the North Star for digital asset sentiment. If momentum keeps building, ETH could not only hit its near-term target but also kick off an extended bullish phase into 2025. So, buckle up, grab your popcorn 🍿, and enjoy the ride-just don’t forget to hodl. 🚀

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- ONDO PREDICTION. ONDO cryptocurrency

- IP PREDICTION. IP cryptocurrency

- Michael Saylor’s Bitcoin Shenanigans: ‘Bigger Orange’ and Market Mayhem!

- Trump’s Davos Hot Takes: Greenland, Crypto, and ‘I’m Kind of a Big Deal’

- EUR AUD PREDICTION

- Are ETH Holders Chasing Fool’s Gold with Ozak AI’s Promises?

2025-11-08 23:08