Ah, Solana, the plucky little cryptocurrency that thinks it’s a high-wire acrobat! 🪩 At press time, it was wobbling near $203, having just clambered back above the $200 mark after a rather undignified tumble earlier in the day. A tiny rebound, you say? Well, it was just enough to keep its daily losses to a mere 1%, but let’s not kid ourselves-this tightrope walker is looking a bit shaky. 😬

The bulls, those ever-optimistic creatures, have managed to reclaim the $200 mark, but the on-chain charts are whispering (or rather, cackling) that this victory might be as short-lived as a chocolate teapot. 🍫☕

Long-Term Holders: Sitting Pretty or Ready to Jump Ship? 🚢

The first warning sign comes from the Net Unrealized Profit/Loss (NUPL) of long-term holders. Oh, NUPL, you mischievous metric! You’re like a crystal ball that shows whether investors are sitting on piles of paper profits or staring into an abyss of losses. And guess what? When NUPL is high, it’s like a dinner bell for profit-takers. 🔔

On August 28, Solana’s long-term holder NUPL hit 0.44, its highest in six months and practically kissing the March 2 peak of 0.4457. And what happened after that earlier spike? Why, Solana took a nosedive from $179 to $105 in less than two weeks-a 41% correction! Ouch. 😵💫 A more recent example? July 22 saw a 23% slide after another NUPL high. It’s like history is repeating itself, but with more dramatic flair. 🎭

The latest NUPL reading has dipped slightly to 0.40, but it’s still higher than a giraffe on a unicycle. 🦒🚲

For token TA and market updates: Fancy more of these delightful insights? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. You know you want to. 😉

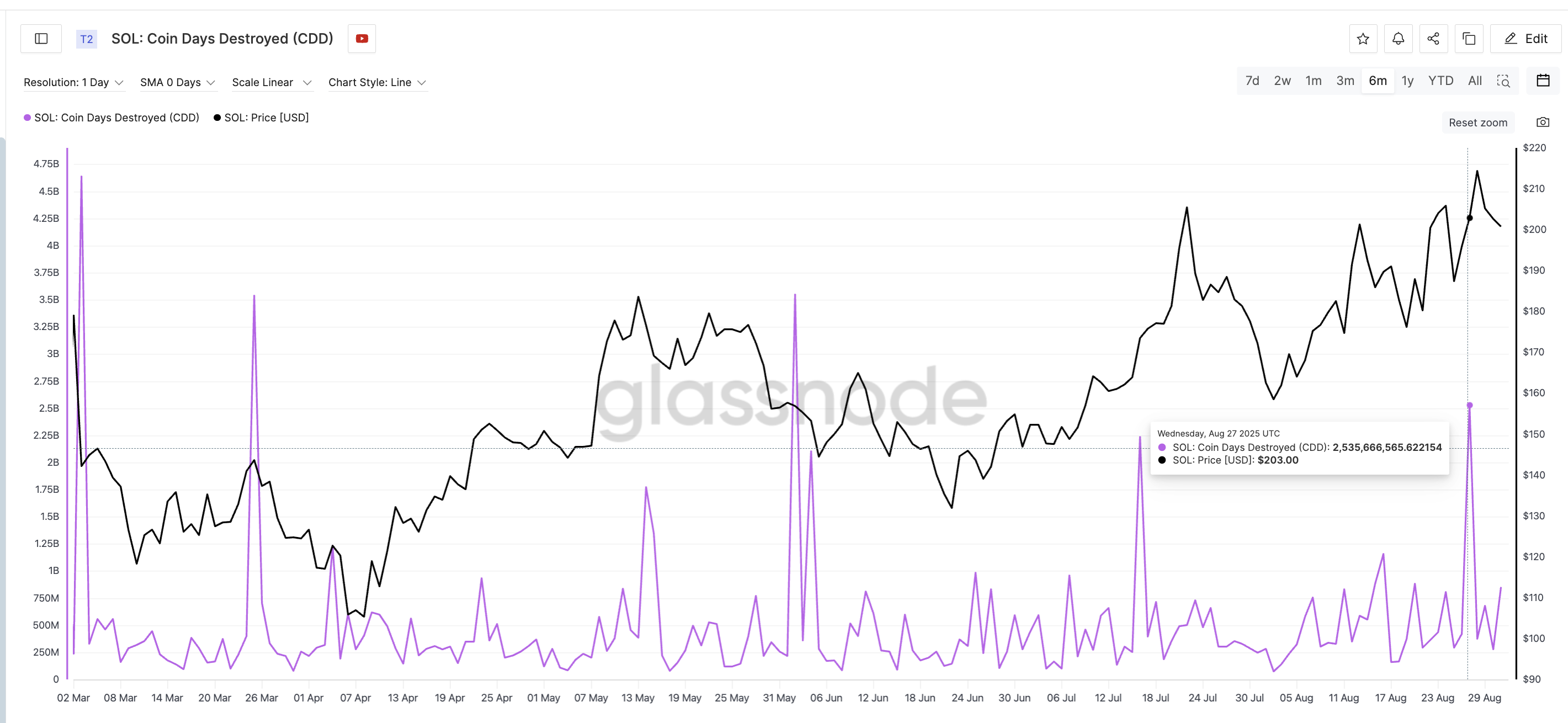

Coin Days Destroyed: The Profit-Taking Canary in the Coal Mine 🦜

Now, let’s talk about Coin Days Destroyed (CDD), the metric that’s like a detective sniffing out profit-taking. Every time CDD spikes, Solana’s price seems to take a header. It’s like clockwork, but with more schadenfreude. 🕰️

Take March 3, for instance. Solana’s price dropped from $142 to $118-a 17% plunge. Then, on March 25, it slipped from $143 to $105. Even when the correction was delayed, like after July 16, the eventual drop from $205 to $158 showed just how reliable this signal can be. It’s like the universe saying, “I told you so.” 🌌

The latest spike came on August 27, with Solana trading near $203. The correction has barely started, but the pattern suggests long-term holders are already selling into strength, just as the NUPL data hinted. It’s like they’re all at a party, but someone just turned off the music. 🎶🔇

Key Solana Price Levels: Will the Bulls Hold On, or Will They Go Splat? 🦬

The technical chart is like a circus act gone wrong. Solana is teetering near $203, turning the $201 resistance into temporary support. But the bulls’ case is as fragile as a house of cards-it’ll only hold if the daily close stays above that level. 🏠

A dip below $196 or $191 would send momentum into a bearish tailspin, and breaking $175 would confirm a deeper correction. It’s like watching a tightrope walker without a net. 🤡

On the upside, the bulls need to reclaim higher ground pronto, but with long-term holders sitting on gains and CDD showing coins on the move, the risk of further downside is as real as a pie in the face. 🥧😲

However, the bearish trend would fizzle out if Solana manages to reclaim $207 cleanly, with a complete candle forming above that level. For now, the metrics suggest this $200 rebound might be as stable as a three-legged stool. 🪑

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Bitcoin’s $110K Tango: Will It Waltz Higher or Stumble? 💃🕺

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- 🐑 Trump’s $93M Memecoin Heist: Comedy or Cash Grab?

- Trump, Bitcoin, and Ethereum Shenanigans: The Week Crypto Went Wild 🚀💰

- Ethereum Price On A Rocket? But What If It Crashes? 😅

- Bitcoin’s Bitcoin Boogie: Stablecoins & a Sputtering Dollar Spark Crypto Chaos! 💸🚀

- Ethereum’s Wild Ride: Will This Crypto Riverboat Reach $4K or Crash a Paddle?

2025-09-01 23:48