Ah, another FOMC day, another opportunity for the markets to don their most dramatic masks and perform the grand ballet of uncertainty. Bitcoin, that darling of the digital realm, has once again chosen to consolidate, as if pausing to admire its own reflection in the murky waters of financial indecision. The selling pressure, ever the uninvited guest, has descended like a flock of crows, pecking at the price and dragging it from the lofty heights of $116,000 to the more modest $112,000. The bears, those tedious creatures, have not yet claimed dominion, but the hawkish squawks of the Fed chairman threaten to dampen the bulls’ spirited prance. 🌪️

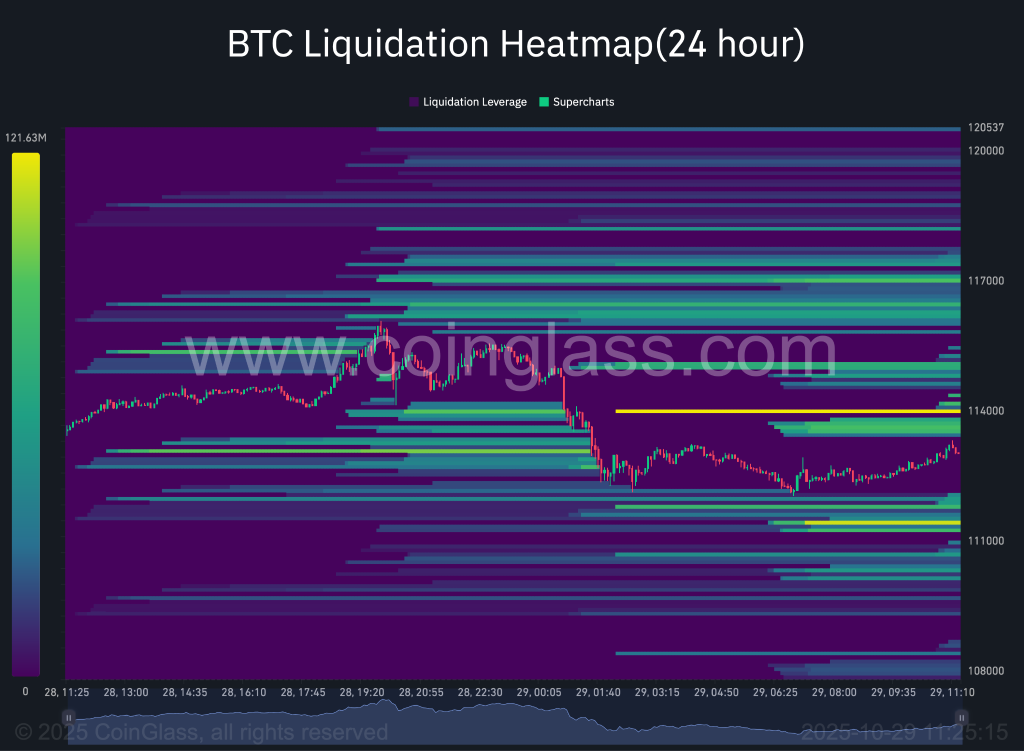

Bitcoin’s price, ever the coquette, has retraced its steps with the grace of a prima ballerina, avoiding the lower liquidity levels around $111,000, where $100 million in longs lie in wait like eager suitors. Traders, those fickle beings, hover like moths around a flame, seeking an entry point while eyeing the $114,000 mark with suspicion, for there, $121 million in shorts lurk like shadows in the night. 🕵️♂️

Liquidity levels, those fickle barometers of trader sentiment, paint a portrait of indecision, as the price lingers between the piled longs and shorts, like a guest unsure whether to leave the party or stay for the champagne. The FOMC, ever the arbiter of financial fate, may yet tip the scales: a rise above $114,000 could awaken the shorts, while a fall below $111,000 might send the longs tumbling like dominoes. 🎭

Whither Goest Thou, Bitcoin? 🧭

Despite the FOMC’s impending theatrics, Bitcoin remains ensconced within its bullish fortress, a rising parallel channel that would make even the most stoic architect blush. The lower-timeframe chart reveals a rebound from support so robust, it could only be described as a phoenix rising from the ashes. Yet, the FOMC’s verdict looms like a storm cloud, threatening to either propel the price above the channel’s average zone or shatter its support like a glass slipper at midnight. 🌩️

The hourly chart, that trusty oracle, reveals Bitcoin’s strength, validated by a rebound so vigorous it could only be described as a triumph of will over uncertainty. Volume spikes have made their appearance, but the true star of this drama is the hourly MACD, teetering on the brink of bullishness, as if whispering, “The bears’ days are numbered.” Meanwhile, the stochastic RSI, ever the optimist, has rebounded from the oversold zone, promising a continued ascent in the hours to come. 📈

The Final Act: Will FOMC Crown Bitcoin Above $115,000? 👑

Bitcoin, ever the protagonist of this financial saga, consolidates within its rising channel, testing mid-range support near $112,500 with the poise of a seasoned actor. The chart, that grand stage, hints at a potential bounce toward the $115,000-$117,000 zone, should the bulls hold their ground, aligning perfectly with the mid-channel Fibonacci retracement. Yet, should they falter, and the support trendline crumble like a house of cards, a sharp decline toward $108,000-$106,000 awaits, a dramatic correction fit for a Shakespearean tragedy. The FOMC, ever the director of this play, will soon reveal which act unfolds. 🎬

Read More

- Tether’s Big Heist: $500B Valuation or Just a Stablecoin’s Wild Dream? 💸

- Altcoins? Seriously?

- Gold Rate Forecast

- Shocking! Genius Act Gives Crypto a Glow-Up – Jokes, Dollars & Digital crazy!

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Will BNB Smash $1,000? The Wild Crypto Ride You Can’t Miss! 🚀

- 🚀 Doge Goes Legit in Japan: From Memes to Money Moves! 💼

- 🐳 Crypto Whales Drive Memecoins to New Heights – Floki, Pepe, SHIB!

2025-10-29 10:37