Farewell, ambiguous murmurs of “soft power” and “impact investing”—those cherished phrases tossed about over tepid coffee at embassies while the samovar idles in the background.

We greet, instead, the cold arithmetic of benchmarking, the relentless march of quantifiable KPIs, and sovereign capital deployed with a surgeon’s steely eye—metrics reigning where dreams once fluttered feebly. Bravo, modernity: you have arrived, briefcase in one hand, abacus in the other!

Twentieth-century architects constructed Bretton Woods and the Marshall Plan with the resolve (and exhaustion) of men haunted by the drizzle at dawn. Their dreams: Europe restored, the world stitched back together with dollars and diplomacy. Our epoch? Just as perilous. The tools, however, have been gently—almost mischievously—replaced. From the craggy ruins of Ukraine to the sere optimism of sub-Saharan Africa, frontier economies seek financial credibility in a world where trust is more endangered than the Caspian seal, and perhaps twice as slippery.

Faith in aid? Alas, that’s been mugged by inefficiency and an endless river of competing PDFs. The latest American initiative—whose acronym sounds as if invented by an overzealous dogecoin enthusiast—heralds not charity but pixel-perfect delivery, powered by technology and the stubborn hope that code is less fickle than men. Time to welcome our algorithmic overlords! 🤖

Tokenization: the destination to which all these winding roads inevitably lead. Woe to anyone still clutching a ledger and quill; the blockchain does not pause for sentiment.

BlackRock—Prophet, Pied Piper, or Merely Profitable?

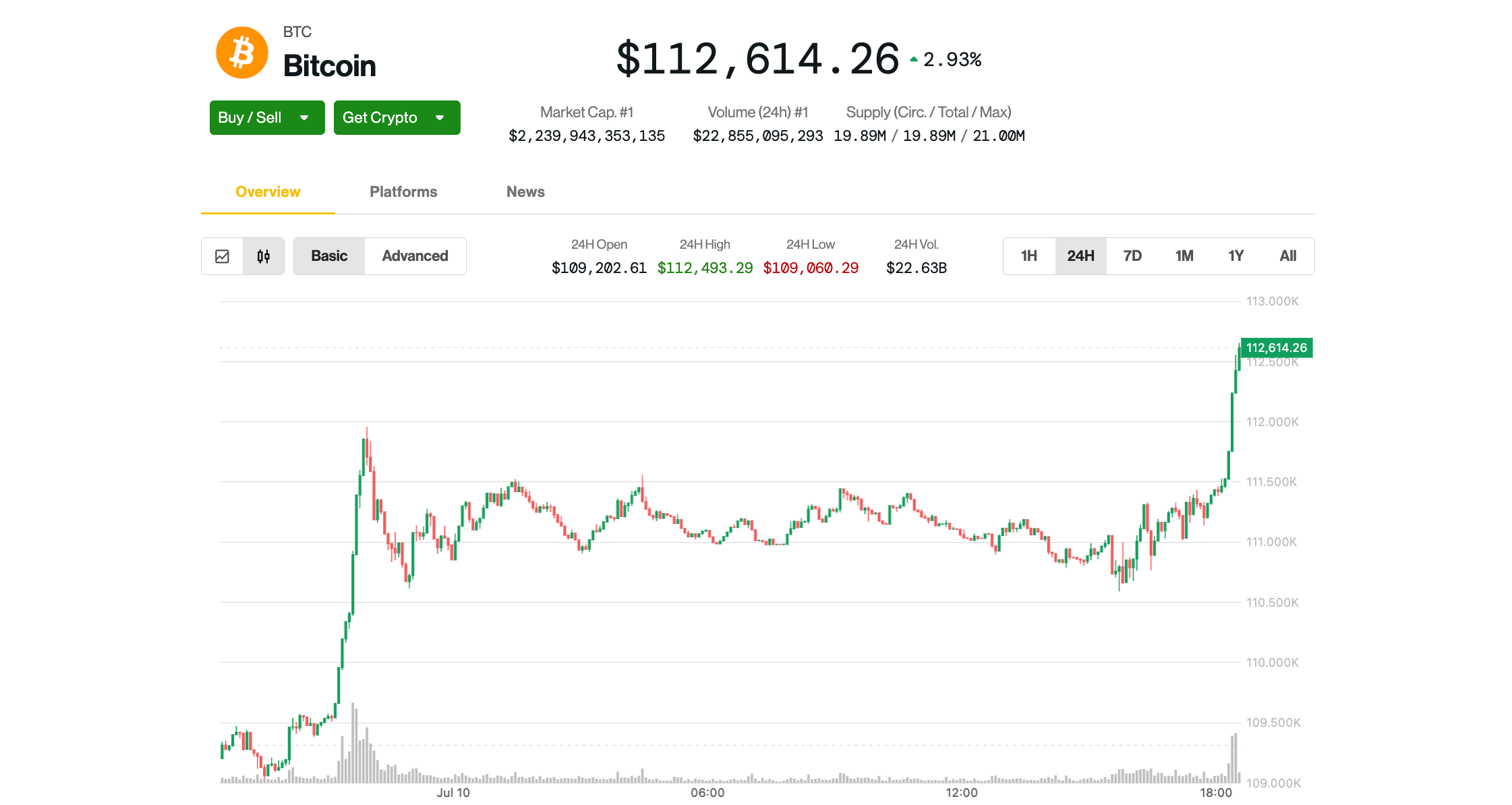

One cannot help but observe BlackRock’s iShares Bitcoin Trust (or IBIT, to its few sincere friends) attracting billions like a samovar draws the weary country squire—somewhere between a miracle and a mugging at the banya. Inflows exceed $14 billion, fees climb towards heaven, and ETFs themselves take on the air of giddy transcendence. Surely Plekhanov did not see this coming.

Institutions once as wary as an aunt at a Moscow soirée—wincing at the volatility—now embrace digital assets with something resembling love. Or greed. Or, if you’re feeling generous, both. The implication is delicious: what was once the dangerous domain of upstart markets—the so-called “frontiers”—is now a field where asset managers play with their new toys. Bitcoin, meet the boaedrooms of high finance; try not to break anything.

So too are new bridges being built: not of stone, but of code—blockchain registries where deeds, water pumps, and dreams are tracked. Those hearty buyers of Bitcoin ETFs may soon eye the wilds of the frontier not as a jungle to fear, but as a hunting ground for exponential returns. May the best algorithm win—and bring a sturdy umbrella, just in case.

The Poetry of Data Entry (An Ode for Unsung Scribes) 📝

Forgive me, reader, for invoking romance where none ought to reside. Data entry, that most humble of activities, stands as the invisible pillar beneath every grand design: water bottle here, corrugated panel there, a bolt of inadequate fabric on its journey to a leaky tent. Thousands enter numbers, most only dream of glory.

Today, alas, this ledger lies torn between a dozen squabbling officialdoms—an unending waltz from UN spreadsheet to NGO CRM to the PDF graveyard that is the local government server. But what if each act—each bottle, each roof—were immortal: tokenized, bound forever to a smart contract, with geolocation and timestamp, perhaps a polite emoji appended for posterity? Lo! An immutable ledger: finally, an audience for all those lonely Excel files.

No more are aid workers bound to paper’s tyranny. Under this new regime, from Sumy’s muddied water pump to Sudan’s elusive medicine shipment, the bureaucracy evaporates. A bottle of water, a strip of steel, a tokenized sigh: all tracked, all verified, and—if the gods will it—paid in real time, leaving inefficiency to slumber eternally where it belongs.

Behold, a global, ceaseless market—commodities and dreams traded twenty-four hours a day, all visible to anyone possessed of Wi-Fi, curiosity, and no small amount of skepticism.

24/7 Markets: The New American Dream (Or Nightmare?) 🇺🇸

Commodity markets, with all the agility of a provincial carriage horse, still rely on systems that Tolstoy would find outdated. Paper trails, manual ledgers, prices whispered between men with murky motives—a paradise for delay and corruption, but a purgatory for progress.

Contrast this with tokenized markets: a contractor in South Sudan secures tomorrow’s price by moonlight, a Tbilisi banker surveys collective dreams with a click, and somewhere in Washington, a bureaucrat wonders if this is all worth the headache. 🌚

As China sweeps across the Global South with buckets of credit of unknown temperature (and Russia funds a carnival of destabilization), the United States frowns, shuffles its papers, and ponders something new: a model powered not by largesse, but by relentless transparency, public ledgers, and the hope that software can save us from ourselves. Donors might even read the paperwork, for a change!

Here at AUSP, we have watched with bemused horror and guarded optimism; the lesson is simple—trust remains rarer than an honest tax collector. Tokenization, it must be admitted, will come; one must only hope it is not preceded by a parade of disasters. For now, focus on the noble logbooks, upon which the vaguest hope of recovery hangs. Save the tokens for the after-party.🍾

Whatever the sages of Bretton Woods accomplished with pen and paper, today’s disruptors must seek with code and server. The next financial order will be constructed on ledgers that never sleep—and, if we are lucky, occasionally dream.

A note, for the legalists in the back: The above opinions are the grumblings of the author and do not, under any reasonable construction, reflect those of CoinDesk or its frequently caffeinated affiliates.

NEAR Protocol Enthusiasts Now Officially Smug: Token Gains 5%

Bitcoin: More Records Than My Grandfather’s Attic ($112,700!)

Sui’s Bullish Breakout Proves Gravity Is Merely a Suggestion

Who Needs Yen? $75M of Tokyo Property Gets Blockchained by GATES

German State Lender Issues €100M Blockchain Bond—Beer Not Included

DAOs 2.0: Now With 20% More Unpredictability!

Bitmine Immersion Plunges 20%—Stock Tries Swimming Lessons

BIT Mining Surges 250% after Solana Pivot—Writers Out of Metaphors

Europe’s Watchdog Eyes Malta—Fast-Tracked MiCA or Espresso Break?

Circle Whispers USDC Revenue Secrets to ByBit—Sources Gossip

Rumble and MoonPay Join Forces—Crypto Wallet Incoming, Beware Moons

Alibaba’s Ant Group Hooks Up With Circle’s USDC—Blockchain Romance Blooms

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- SEI PREDICTION. SEI cryptocurrency

- FET PREDICTION. FET cryptocurrency

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- EUR ILS PREDICTION

- USD CNY PREDICTION

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

2025-07-10 20:19