Ah, the inevitable decline. Solana, once basking in the sunshine of a market boom, now finds itself struggling beneath the weight of its own supply, sinking faster than a poorly thought-out investment. It’s a dramatic turn of events, my friends. Let’s take a stroll through the dark alleyways of the crypto market and see how the usual suspects-Bitcoin, Ethereum, and XRP-are faring in comparison.

Bitcoin, XRP, And Ethereum: The Calm Before the Solana Storm

In an insightful post on the ever-vibrant X platform (formerly known as Twitter, though we all know no one’s calling it that), the on-chain analytics gurus at Glassnode have shared their analysis of a fascinating metric: the Percent Supply in Loss. This charming little number tells you just how much of each cryptocurrency’s circulating supply is currently submerged in the cold, dark waters of unrealized loss.

How do they measure this, you ask? Well, Glassnode wades through every transaction in the coin’s history to find out what price it was last traded at. If the last price is higher than today’s price, then congratulations! That coin is officially in the red. When the coins in question all pile up, you get the Percent Supply in Loss, and voila, you now know just how much of your crypto portfolio is quietly weeping in the corner.

Of course, there’s also the Percent Supply in Profit, the happier sibling. But since the sum total of these two must equal 100%, once you know one, the other is simply a subtraction problem away. It’s almost as easy as dividing by zero… almost.

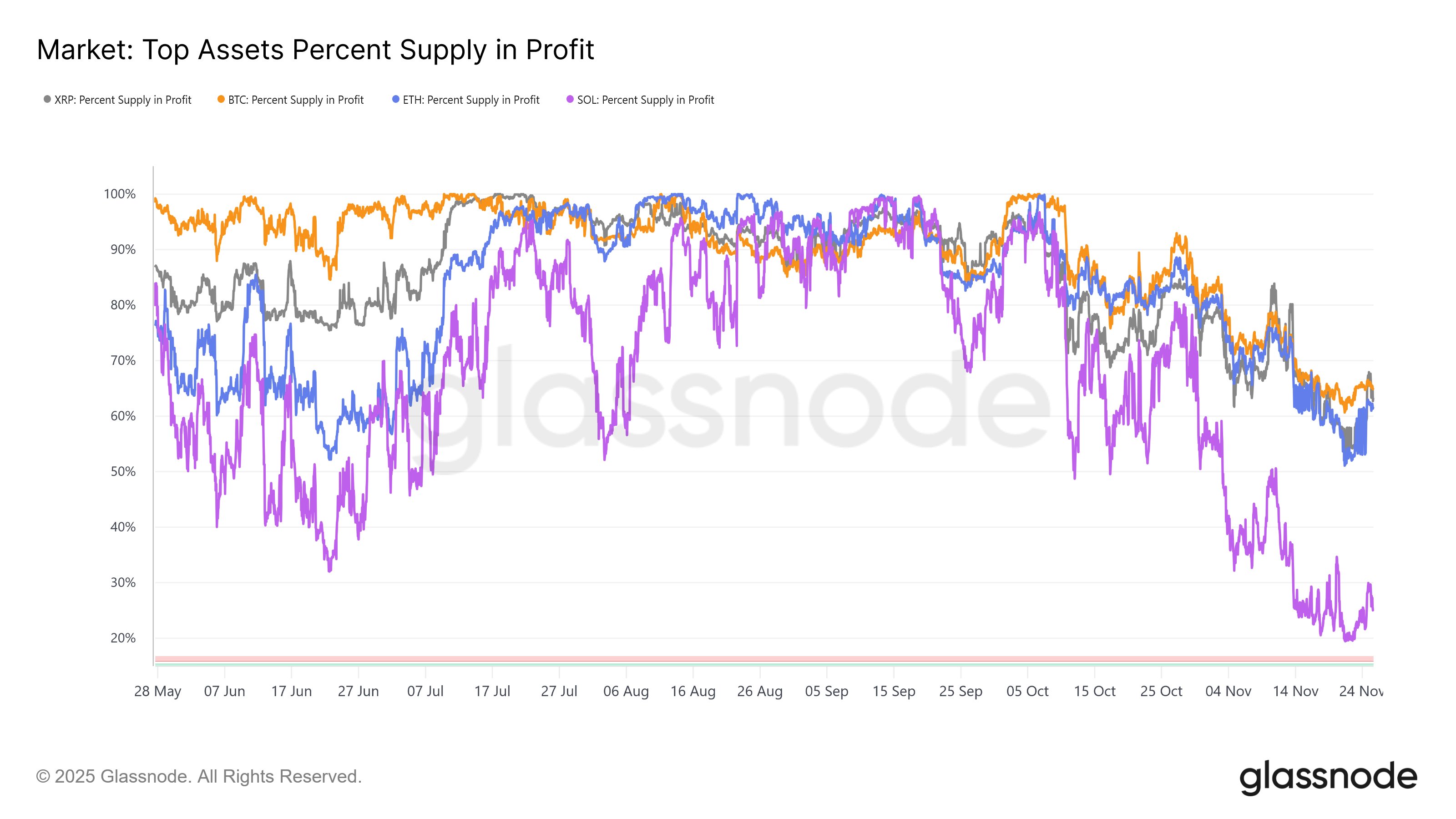

Now, behold the chart shared by Glassnode-proof that crypto has the emotional depth of a soap opera. Witness how the Percent Supply in Profit has dramatically fallen for all the top coins, sending the Percent Supply in Loss soaring. The downfall is palpable, but like any good tragedy, not all coins have suffered equally.

As you can see, the Percent Supply in Profit has dropped across the board, a casualty of the bearish market sentiment. However, Solana’s descent is far more spectacular. It’s like watching a slow-motion train wreck, and it’s not pretty. Today, a mere 25.16% of Solana’s supply is still in the green. The remaining 75%? Well, they’re now effectively underwater-drowning in the depths of crypto misfortune.

Meanwhile, Bitcoin, Ethereum, and XRP have had relatively milder declines in the Percent Supply in Profit. Bitcoin’s standing at 34.91%, Ethereum at 38.37%, and XRP at 36.70%. Despite the gloomy market conditions, these coins are still managing to keep a majority of their supply in the profit zone. It’s almost as if they have some kind of divine crypto protection… or at least better investor sentiment.

Now, one might wonder what this all means for the future. A high Percent Supply in Loss usually signals that the market has little appetite for selling. With so much of Solana’s supply now in the red, it could very well be that the sellers have reached exhaustion, while Bitcoin, Ethereum, and XRP still have a bit more fight left in them. Who knew crypto could be so… dramatic? 🍿

The Solana Price Saga

And yet, in the face of this tumult, Solana has experienced a brief recovery. Over the last few days, its price has managed to crawl back to the $137 mark, like a determined underdog clawing its way up the leaderboard. But for how long?

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Brent Oil Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Gold Rate Forecast

- Shiba Inu Shakes, Barks & 🐕💥

2025-11-27 05:25