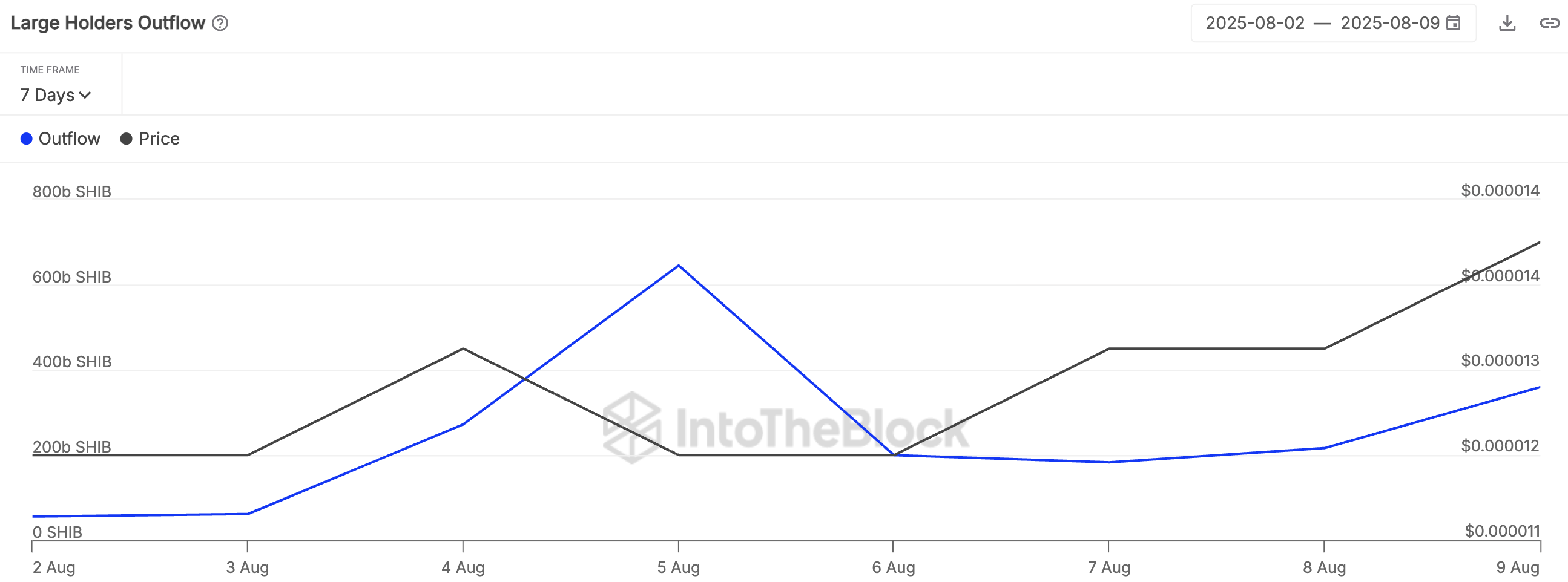

Pray, allow me to acquaint you with the most intriguing of spectacles: the Shiba Inu (SHIB), that darling of the digital realm, has witnessed an outpouring of activity from its largest holders-one might say, a veritable whale exodus-that would make even Mr. Darcy raise an eyebrow. Between Thursday and Saturday, outflows from those grand repositories of centralized exchanges doubled with all the subtlety of Lady Catherine de Bourgh entering a drawing-room. According to the learned sages at IntoTheBlock, a staggering 183.03 billion SHIB departed large holder addresses on the 7th of August. But lo! By the 9th, this figure had swelled to an eye-watering 359.6 billion-a maneuver accompanied, no less, by a modest ascent in price from $0.000013 to $0.000014. 😅

To clarify for those unacquainted with such matters, “large holders” are defined as any address possessing more than 0.1% of the circulating supply. In the case of SHIB, these include not only individual whales but also some of the industry’s most illustrious exchanges. Coinbase, Binance, and Upbit reign supreme among them, collectively guarding billions of dollars’ worth of SHIB as though it were the Crown Jewels. 👑

When coins depart these exchange-linked coffers, one cannot help but suspect that they are being spirited away into private custody-a move far more indicative of accumulation than any vulgar sell-off. Indeed, it seems our whales have grown weary of leaving their treasures in plain sight, much like a gentleman safeguarding his finest port from overzealous guests. 🍷

A Tale of Outflows and Prices

From the 2nd to the 6th of August, both price and outflow volumes languished in a state of insipid stagnation, resembling a ball where no one dares take the first dance. Yet midweek saw a sudden shift-a breaking of the calm-as though large holders had resolved upon a new strategy, whether through coordinated withdrawals or opportunistic buying spurred by recent price declines. Exchanges, acting as liquidity hubs and custodians of some of the largest SHIB wallets, find themselves at the mercy of such movements, which can alter the available supply on the open market with alarming alacrity. ⚡

While spikes in large holder outflows might occasionally suggest panic selling during tumultuous times, the current trend whispers a different tale-one of withdrawal from exchanges with every intention of holding fast. Should this pattern persist, and should the exchange float diminish further, even the faintest breeze of fresh demand could send prices soaring faster than Mrs. Bennet upon hearing of a wealthy bachelor in the neighborhood. 💨📈

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

- Gold Rate Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- USD THB PREDICTION

2025-08-10 15:19