Imagine this, dear readers, in the grand world of digital treasures, Tether’s XAUT has just pulled off a rather splendid trick. It’s like the scruffy underdog in a fairy tale who suddenly becomes the prince, or in this case, the king of tokenized gold assets. Yes, you heard right, XAUT has overtaken PAXG in market cap, becoming the shiniest star in the tokenized gold sky.

- Tether mints a whopping $436.94 million worth of XAUT tokens, enough to make a dragon hoard blush.

- XAUT overtakes PAXG in market cap, becoming the largest tokenized gold asset, much to the chagrin of its competitors.

- This mint raised tokenized gold’s market cap by a staggering 20%, a feat that would make even the most jaded investor sit up and take notice.

Tokenization, my dear friends, is turning the old world of gold investing on its head. On Monday, August 11, CEX.io released a report that detailed the biggest trends in the tokenized gold industry. And what a report it was! The biggest event in recent months has been Tether’s XAUT surpassing Paxos Gold in market cap. It’s like the new kid on the block who suddenly becomes the most popular kid in school.

On August 8, Tether minted 129,047.917 XAUT tokens, worth about $436.94 million. This not only made it the biggest gold tokenized asset by market cap but also pushed the total market cap of tokenized gold by 20%. Imagine that, a single minting event causing such a stir!

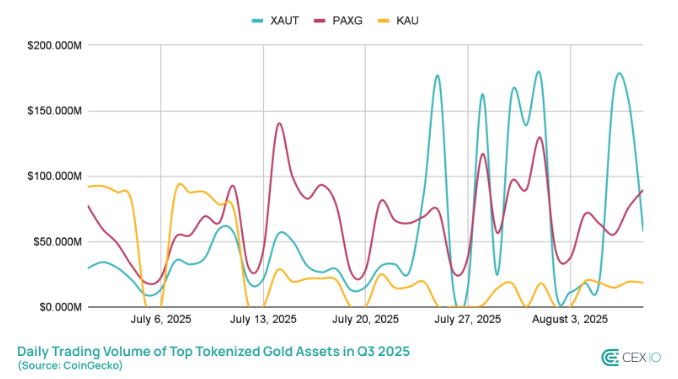

This mint came as XAUT overtook PAXG in terms of trader engagement and active holders. Since July 25, XAUT’s trading volume surpassed both PAXG and KAU in daily trading volume. It’s like a race where the tortoise suddenly starts sprinting and leaves the hare in the dust.

XAUT also dominated in terms of new tokenized gold holders. In 2025, the number of XAUT holders rose by 173%, compared to a mere 29% for PAXG. While PAXG still boasts a larger userbase, with a seven-fold advantage, the gap is closing faster than a hungry crocodile’s jaws.

Macroeconomic conditions favor tokenized gold

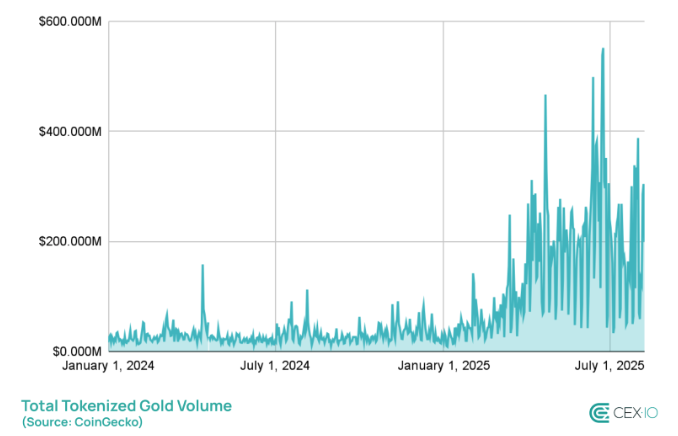

As the original safe-haven asset, gold has always been a beacon of hope during turbulent times. Recently, the macroeconomic uncertainty has been a goldmine (pun intended) for tokenized gold. Since President Donald Trump announced his tariffs on major U.S. trading partners, tokenized gold volumes have seen multi-week rallies. PAXG, XAUT, and KAU volumes all benefited, with some experiencing quadruple-digit growth. It’s like watching a fireworks display, but with numbers instead of sparks.

Tensions in the Middle East, sluggish labor market growth, and other negative economic indicators have all contributed to the growing interest in tokenized gold. Notably, in the second quarter of 2025, tokenized gold volume surpassed $19 billion, overtaking major gold ETFs. It’s a new era, and XAUT is leading the charge, much to the delight of investors and the envy of competitors. 🚀💰

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- USD CNY PREDICTION

- Gold Rate Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Silver Rate Forecast

- Brent Oil Forecast

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

2025-08-11 22:42