Ah, Ethereum! The digital currency that dances on the edge of a knife, now tantalizingly close to the illustrious price of $4,811. It seems the U.S. inflation data has decided to play the role of a benevolent fairy godmother, sprinkling a little magic dust over the market and sending ETF inflows soaring like a catapulted potato. The Consumer Price Index, bless its heart, rose a mere 2.7% in July, a smidgen below the 2.8% forecast. Who knew numbers could be so dramatic?

According to the latest gossip from the U.S. Bureau of Labor Statistics (BLS), this delightful twist of fate has cranked up the odds of a September Federal Reserve rate cut to a staggering 82.5%. Naturally, this has sent the cryptocurrency enthusiasts into a frenzy, with Ethereum currently trading at $4,409.12-up a cheeky 5.4% in the last 24 hours. Trading volumes? Oh, just a casual $47.9 billion. No big deal, right?

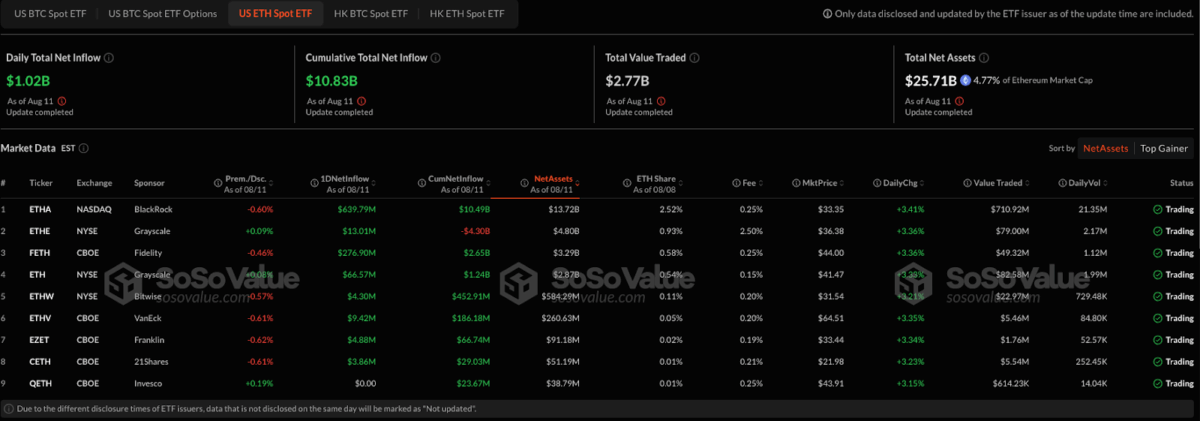

But wait, there’s more! U.S. spot Ethereum ETFs have been on a shopping spree, raking in over $1 billion on August 12 alone, led by none other than BlackRock’s ETHA, which decided to break records with a single-day haul of $639 million. Talk about a shopping cart full of digital coins!

As a result, the total assets under management for ETH ETFs have ballooned to a staggering $19.2 billion, marking a 58% monthly surge. According to Sosovalue, as of August 11, U.S. spot ETH ETFs are now holding a princely sum of $25.71 billion in net assets, which is a mere 4.77% of Ethereum’s total market cap. Just a drop in the ocean, really.

Technical Momentum Builds

Crypto analyst Javon Marks, who apparently has a crystal ball, claims that Ethereum has rallied a jaw-dropping 261% since it decided to break free from its long-term resistance trend. Now, it’s eyeing that tantalizing target of $4,811.71, which is just a hop, skip, and a jump away-less than 10% to go! Who knew cryptocurrencies could be so optimistic?

After climbing ~261% since breaking out of the displayed resisting trend, $ETH has broken $4,400 and is now starting to approach its target at the $4811.71 level!

Ethereum has just under +10% to go before reaching this target and has made monumental progress towards doing so!

– JAVON⚡️MARKS (@JavonTM1) August 12, 2025

The charts, those fickle friends, indicate a recovery from a prolonged downtrend that lasted longer than a bad soap opera. Prices have pushed through resistance levels in 2024, and now we’re all holding our breath for the breakout.

However, Ethereum is now trading more than 8.9 million units daily. And let’s not forget the ETF products like FETH, which have also been busy, with $9.62 million traded in just one day. The fee structures? Oh, they’re as competitive as a catfight, ranging from 0.25% to 2.50%.

Market Risks Emerge

But hold your horses! The rally has caught the attention of some unsavory characters. According to the on-chain tracker Spot On Chain, the Infini Exploiter has been busy selling off 1,771 ETH for a cool $7.44 million in DAI at a price of $4,202. Who knew hackers could be so entrepreneurial?

Hackers are capitalizing on the $ETH price surge to liquidate stolen assets.

1️⃣ Infini (@0xinfini) Exploiter sold 1,771 $ETH for 7.44M $DAI at $4,202 yesterday.

The neobank was hacked for $49.5M in Feb 2025, and the exploiter still holds 9,154 $ETH ($39.2M).

2️⃣ Radiant Capital…

– Spot On Chain (@spotonchain) August 12, 2025

Meanwhile, the Radiant Capital Exploiter has also joined the party, liquidating 3,091 ETH and pocketing $13.26 million in DAI at $4,291. Both of these charming individuals still have a hefty stash of stolen ETH, just waiting for their moment in the spotlight.

So, here we are: Ethereum is on the rise, buoyed by favorable macroeconomic conditions and a hearty interest from institutions through ETFs. The technical indicators suggest that more gains could be on the horizon, possibly reaching that elusive $4,811. But beware, for lurking in the shadows are the hackers, ready to stir the pot and bring a dash of volatility to this wild ride.

Read More

- USD CNY PREDICTION

- Gold Rate Forecast

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- USD VND PREDICTION

- Silver Rate Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

2025-08-12 19:37