Imagine this: the entire financial universe holds its breath, waiting for a number-just one lousy number-to tell it what to do next. And then, just like that, the number shows up, and everyone realizes they still have no idea what’s going on.

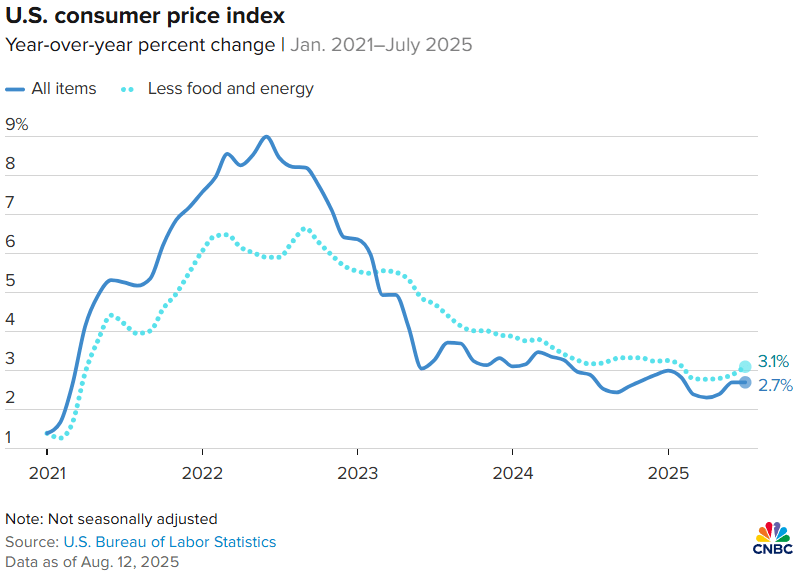

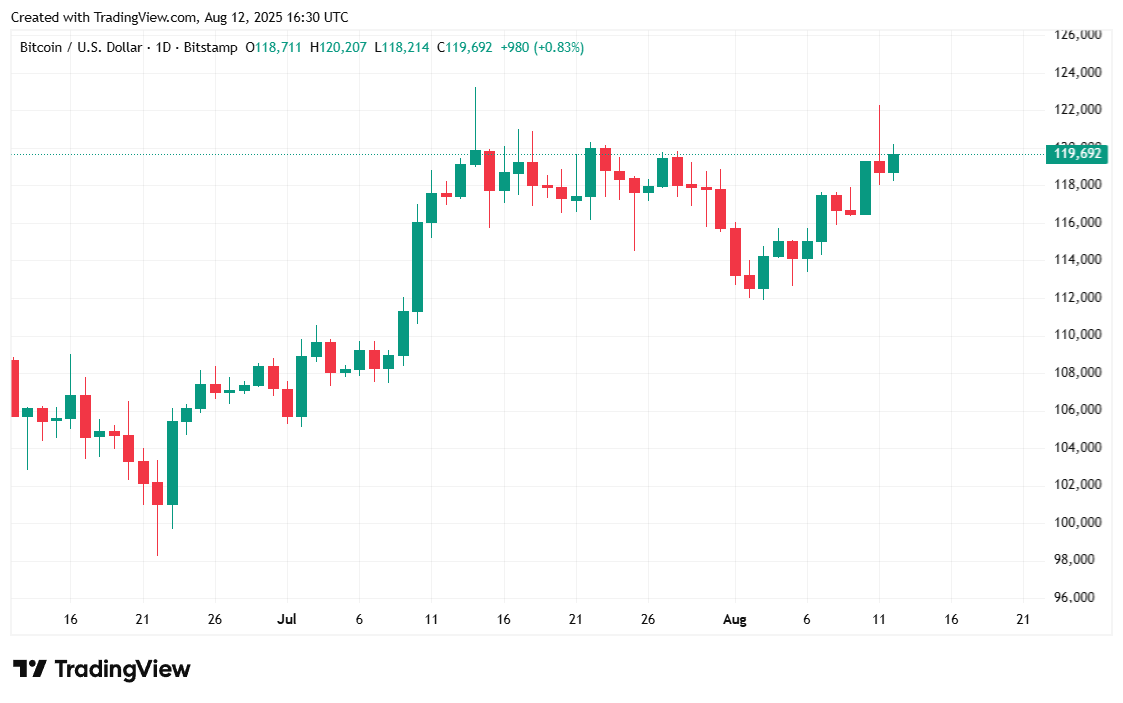

So, here we are. The U.S. Department of Labor Statistics released its July Consumer Price Index (CPI), and let’s just say it’s about as clear as mud. 🌧️ Overall inflation? Meh, lower than expected at 2.7%. But wait! Core inflation-because apparently, food and energy don’t count in “core” anything-shot up to 3.1%, the highest since dinosaurs roamed the Earth (or at least since 2023). Bitcoin, in true existential crisis mode, decided to sit this one out, hovering stubbornly around $119K after a brief flirtation with $122K over the weekend. Ah, romance.

Some analysts, who clearly have too much time on their hands, are blaming all this on tariffs. Yes, tariffs-the same ones that were supposed to save the economy but instead seem to be giving it indigestion. Stephen Miran, White House Chairman of the Council of Economic Advisors, appeared on CNBC to explain why this is nonsense. “Look,” he essentially said during his interview, “one thing gets pricier, another gets cheaper. That’s life. Stop overthinking it.” Wise words, though I suspect he secretly just wanted to go home and binge-watch something on Netflix. 🛋️

A Quick Peek at the Chaos Metrics

At the time of writing, Bitcoin was clinging to $119,898.64, according to Coinmarketcap, down a smidge by 0.46% in the last 24 hours but still managing a respectable 5.9% gain for the week. It’s been bouncing between $118,159.03 and $120,193.39, which is probably more exciting than your average Tuesday. Unless you’re into interpretive dance or competitive napping, in which case, carry on.

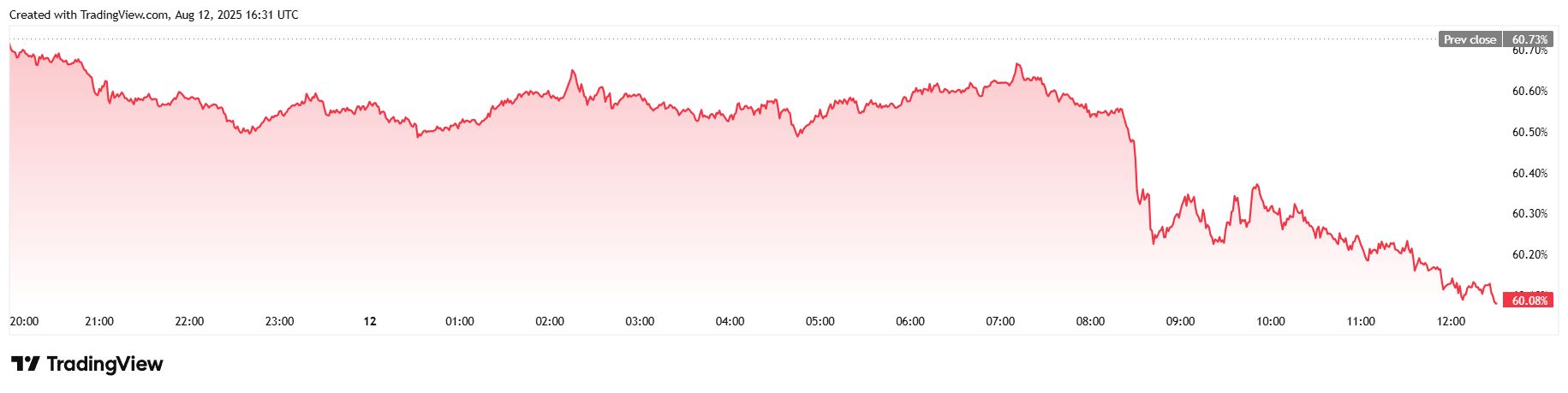

Meanwhile, the 24-hour trading volume took a little tumble, dropping 15.82% to $73.98 billion. Market capitalization followed suit, easing off by 0.71% to $2.38 trillion. And Bitcoin dominance? Oh, it plummeted to 60.08%, a 1.09% dip, proving once again that altcoins are having their moment in the spotlight-or at least pretending they are. 🎭

And finally, total Bitcoin futures open interest fell 2.09% to $80.80 billion, while liquidations hit $56.33 million. Long positions bore the brunt of the pain, losing $43.83 million, while shorts walked away relatively unscathed, shedding only $12.50 million. Moral of the story? If you’re going to gamble with Bitcoin futures, bring snacks. You’ll need them. 🍿

Read More

- Gold Rate Forecast

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- USD CNY PREDICTION

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Shiba Inu Shakes, Barks & 🐕💥

- USD VND PREDICTION

- Silver Rate Forecast

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- GBP MYR PREDICTION

- BNB PREDICTION. BNB cryptocurrency

2025-08-12 21:09