Dear reader, behold the plight of the intrepid US issuers of spot Bitcoin ETFs, who, in a fit of madness, decided to let the public invest in digital gold-only to watch it flee like a startled penguin in a hurricane! 🐧💸 BTC $113,996 24h volatility: 0.4% Market cap: $2.27 T Vol. 24h: $42.73 B

Meanwhile, the valiant spot Ethereum ETFs, clad in their shimmering green armor, faced a similar fate, with outflows of over $1 billion on Tuesday, August 19. 🚨 ETH $4,299 24h volatility: 3.2% Market cap: $520.00 B Vol. 24h: $40.32 B

ETFs for both the top crypto assets saw their second-largest outflows this month, a performance so lackluster it would make a sloth weep. On Tuesday, Bitcoin outflows soared by 300% while Ethereum outflows doubled-proof that even the most resilient assets can’t escape the clutches of panic. 😱

Bitcoin and Ethereum ETFs See Three Consecutive Days of Outflows

Spot Bitcoin ETFs, in a tragicomic turn, saw $523 million in outflows on Tuesday, accelerating fourfold from Monday’s debacle, as per data from Farside Investors. One might say the market is now more volatile than a tea party in a tornado. 🌪️

Ethereum ETFs, ever the drama queens, also faced heavy losses, with outflows leaping from $200 million on Monday to $422 million. A veritable spectacle of financial despair. 🎭

Combined Bitcoin and Ethereum funds have logged three straight days of outflows totaling $1.3 billion-a sum so staggering it could fund a small island nation’s entire economy. 🏝️

This comes alongside a sharp Bitcoin price drop of 8.3% and a Ethereum price correction of 10.83% on the weekly chart, as if the crypto market had finally realized it’s not a casino but a haunted house. 🏚️

8/19 Bitcoin ETF Total Net Flow: -$523.31 million$IBIT (BlackRock): $0.00 million$FBTC (Fidelity): -$246.89 million$BITB (Bitwise): -$86.76 million$ARKB (Ark Invest): -$63.35 million$BTCO (Invesco): n/a$EZBC (Franklin): -$3.27 million$BRRR (Valkyrie): $0.00 million$HODL…

– Trader T (@thepfund) August 20, 2025

Fidelity Investments, ever the paragon of prudence, witnessed the largest withdrawals on Tuesday, with $247 million exiting its Wise Origin Bitcoin Fund (FBTC) and $156 million from the Fidelity Ethereum Fund (FETH), for a combined $403 million in outflows. One might say their funds are now more liquid than a toddler’s bedtime routine. 🍼

Grayscale, that stalwart of the crypto world, also faced significant redemptions, as the Grayscale Bitcoin Trust ETF (GBTC) lost $116 million and the Grayscale Ethereum Trust (ETHE) saw $122 million withdrawn. A tragedy of epic proportions, akin to losing your last slice of pizza. 🍕

BlackRock, the unshakable titan of finance, remained the most stable, with its Bitcoin fund IBIT seeing no outflows and its iShares Ethereum Trust ETF (ETHA) experiencing only a minor $6 million withdrawal. A beacon of calm in a storm of chaos. ⚓

Crypto Market Sentiment Flips Into “Fear” Zone

Note that the current three-day outflows in Bitcoin ETF and Ethereum ETFs come after weeks of consecutive inflows, and minor in comparison. A mere blip on the radar of a market that’s more fickle than a teenager’s fashion sense. 👗

Senior Bloomberg ETF analyst Eric Balchunas, ever the sage, noted on X that Ether ETFs made Bitcoin the “second-best” crypto asset in July, as investors increasingly shifted from Bitcoin ETFs to Ether ETFs. A true tale of betrayal, akin to a dog choosing a stranger over its master. 🐶

Ether ETFs Turn Bitcoin Into ‘Second Best’ Crypto Asset in July.. new from @SirYappityyapp and myself who awarded Ether ETFs as our ETF of the month for July. Normally we just pick one but the whole category caught fire

– Eric Balchunas (@EricBalchunas) August 18, 2025

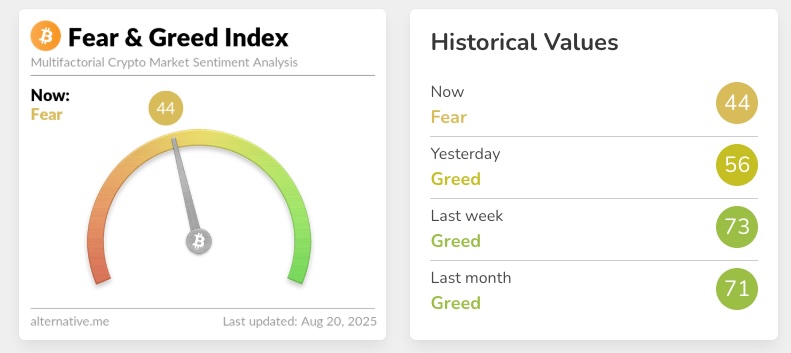

On Wednesday, August 20, the Crypto Fear & Greed Index, that fickle mistress, shifted to “Fear,” recording a score of 44 after an extended stretch of bullish sentiment, signaling increasing caution among investors. A warning sign as clear as a foghorn at sea. 🚩

Crypto Fear & Greed Index showing a shift to fear with a score of 44 on August 20, 2025. | Source: Alternative.me

The broader crypto market correction continued today, with BTC and altcoins under pressure. Total liquidations reached $462 million, including $381 million in long positions. A true testament to the market’s penchant for drama. 🎭

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Binance’s CZ Reveals Unpopular Secret: When to Buy & Sell Bitcoin (It’s Not What You Think!)

- Ethereum’s Wild Ride: Will This Crypto Riverboat Reach $4K or Crash a Paddle?

- Crypto Chaos: How Hackers Are Pulling Off the ‘Classic EIP-7702’ Wallet Heist

- Crypto’s Fancy New Suit: Institutions Crash the Retail Party 🎩💼

- STETH PREDICTION. STETH cryptocurrency

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

2025-08-20 21:23