Oh, Bitcoin! The rollercoaster of the crypto world, where one minute it’s soaring to the stars, and the next, it’s diving into the abyss. Well, recently, our favorite cryptocurrency king fell to $112,500 not once, but twice this month. Is it the end of the world? Not quite! Let’s take a closer look at what’s really happening.

Here’s the scoop: this plummet is mostly due to those pesky leveraged positions-oh, the drama they cause! But fear not, it’s probably just a temporary blip, considering the wider market’s relatively calm nature. Phew, right?

Guess What? Bitcoin Investors Aren’t the Culprits!

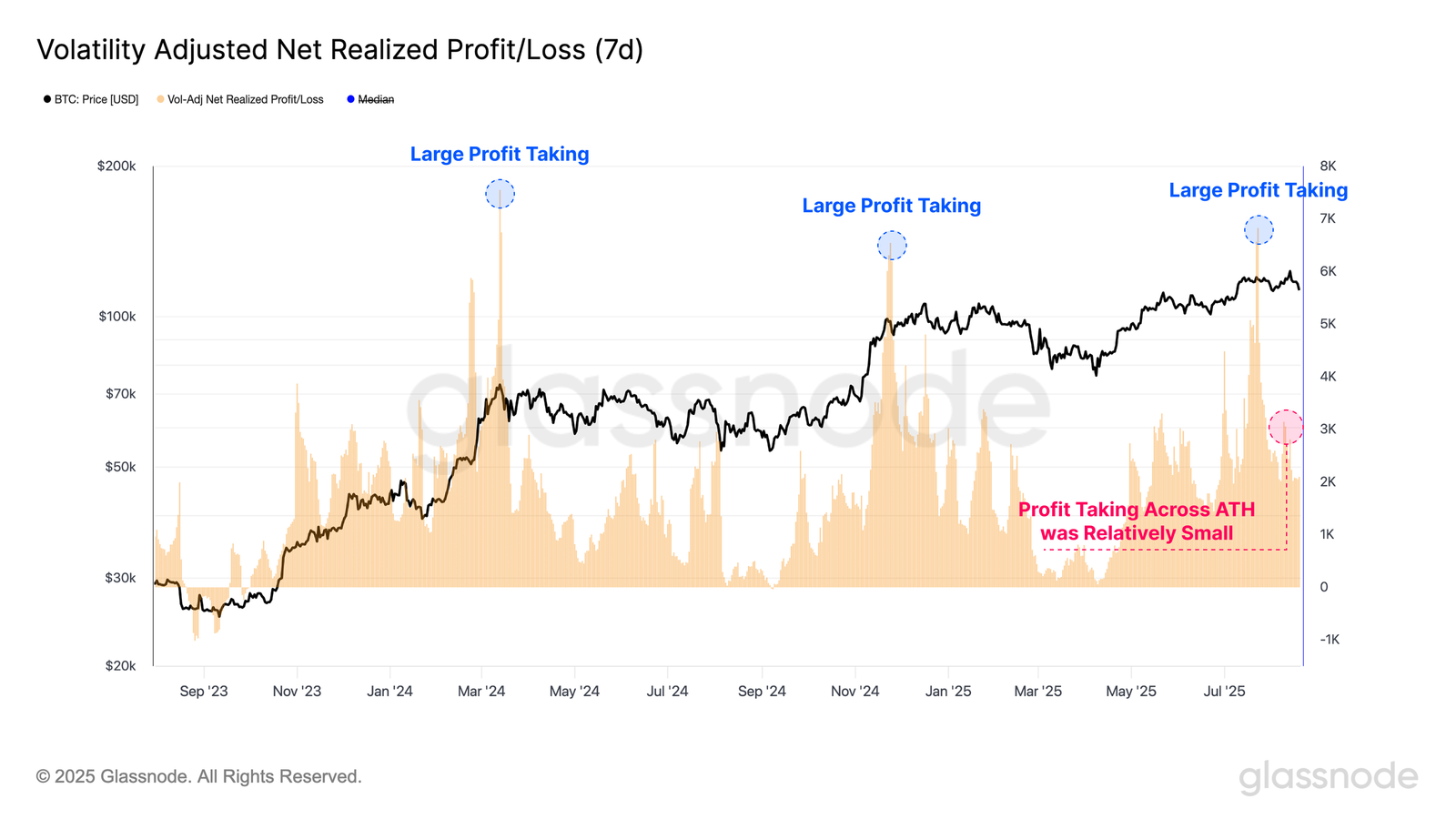

It’s all about the futures market, baby! Bitcoin’s mood swings are highly influenced by what’s going on there. The “on-chain profit-taking” is almost as quiet as a mouse at a library during this market’s recent ATH (all-time high) formation. So no, it’s not the Bitcoin investors who are behind the recent drop.

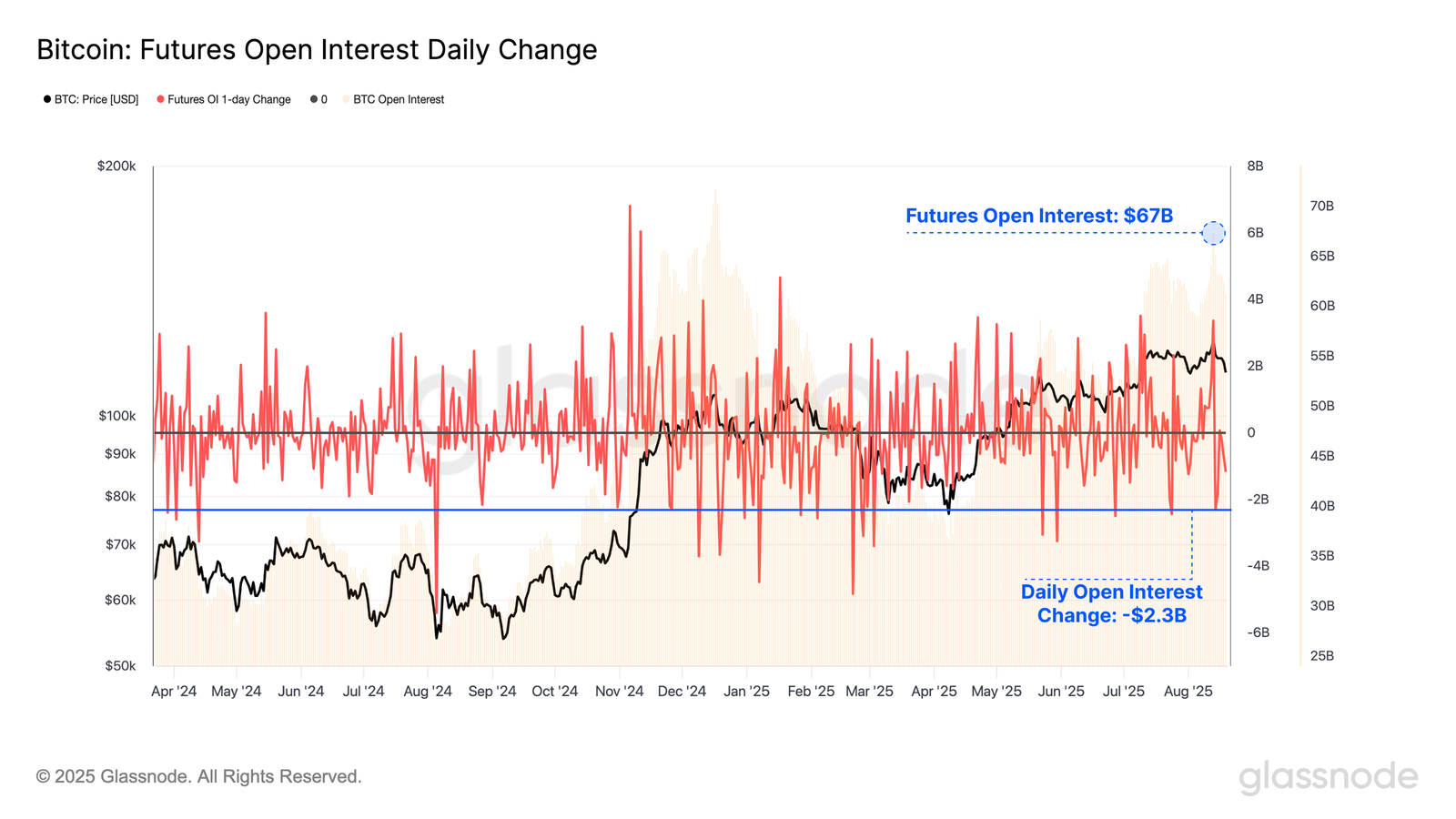

We’ve got $67 billion in open interest with Bitcoin futures, which basically means there’s a lot of leverage floating around. And as we all know, leverage is a bit like a trampoline: a little bounce can turn into a massive crash-yikes!

Let’s talk numbers: During the last dramatic sell-off, a whopping $2.3 billion in open interest just vanished. That’s one of the biggest drops we’ve seen in ages. Only 23 days in trading history have witnessed a bigger wipeout. Ouch! This little episode is a stark reminder of how speculative and volatile the market is. A small price change can trigger a domino effect that wipes out leveraged positions faster than you can say “HODL.”

Want more juicy crypto gossip? Get your daily dose in Editor Harsh Notariya’s Daily Crypto Newsletter here.

But wait, there’s more! According to the Volatility-Adjusted Net Realized Profit/Loss metric, profit-taking is looking a bit… well, “meh” lately. During earlier breakout moments (like when Bitcoin hit $70,000 and $100,000), there was some serious profit-taking. But when Bitcoin tried to break past $122,000 this July? Not so much. The market couldn’t quite muster the strength to push those prices higher. No strong buying pressure equals less momentum to go up. Think of it like trying to push a car uphill with no fuel in the tank. Not gonna happen!

Bitcoin Bounces Back, Just Like a Superball!

Hold onto your hats, folks! Bitcoin’s price is currently chilling at $114,200, after bouncing off the support level of $112,526-twice this year. This means we’re likely to see a recovery, since the drop was mostly fueled by those wild leverage-driven sell-offs. That support level is stronger than a double shot of espresso in the morning!

If Bitcoin can muscle its way past the $115,000 mark and turn it into support, we could see it skyrocket toward $117,261. And if that happens, we might be heading for $120,000 soon. The bulls could be on a roll-just don’t forget to hold onto your seat!

But… and here’s the big “but”: If Bitcoin can’t break through $115,000, or if the selling pressure increases, it could dip back down below $112,526. And that could mean a drop all the way to $110,000 or even lower! In that case, the bullish dreams could be shattered, and we might be in for a longer bear market. Hold your breath, folks-this ride’s not over yet!

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Bitcoin’s $110K Tango: Will It Waltz Higher or Stumble? 💃🕺

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Lido’s $10M Buyback: A Masterplan or a Muddle? 🤔

- ADA’s Descent: A Tragicomedy of Errors (And a Pennant)

- Crypto’s Fancy New Suit: Institutions Crash the Retail Party 🎩💼

- GBP EUR PREDICTION

- Bitcoin Faces ‘Nation-State Rug Pull’ Risk, Warns Willy Woo

2025-08-21 07:54