Ah, Bitcoin! The ever-elusive creature of the digital realm, still under the weight of existential dread on this fateful day of August 21, 2025. With a price tag of $113,326, it seems to be caught in a downward spiral, like a hapless soul trapped in a Gogolian farce. The market capitalization, a staggering $2.25 trillion, and a 24-hour trading volume of $37.27 billion, paint a picture of a grand carnival, albeit one where the clowns have forgotten how to juggle.

Bitcoin

Our daily chart, a veritable tapestry of despair, reveals that bitcoin has succumbed to a bearish malaise, following a double-top formation near the lofty heights of $124,517-oh, the irony! This level, a veritable fortress of resistance, now looms over us like a specter. The current trading zone, a mere shadow of its former self at around $113,500, is accompanied by a steady decline in trading volume, as if the market itself has lost the will to dance. The pattern of lower highs and lower lows confirms the emergence of a downward trend, reinforced by a heavier volume of sell orders. Key support lies between $112,000 and $111,500, while resistance sits between $117,000 and $118,000. Traders, those brave souls, may find themselves contemplating a price bounce off the $112,000 level, hoping for a miracle in the form of rising volume and bullish candle confirmation.

In the 4-hour timeframe, bitcoin experienced a sell-off so dramatic it could rival the most tragic of Russian novels, after hitting the $124,517 mark. What followed was a phase of mini-consolidation between $113,000 and $115,000, akin to a group of villagers huddling together for warmth in the dead of winter. Despite valiant attempts to rally, weak bullish candles with the momentum of a sloth suggest a potential dead cat bounce-if only the cat had nine lives! The local low of $112,353 remains a critical level, especially if retested on higher volume. A short position could be favored if price rejects the $115,000 zone, or on a confirmed breakdown below $112,000. A long entry remains plausible if the price stabilizes above $113,500 and establishes a higher low.

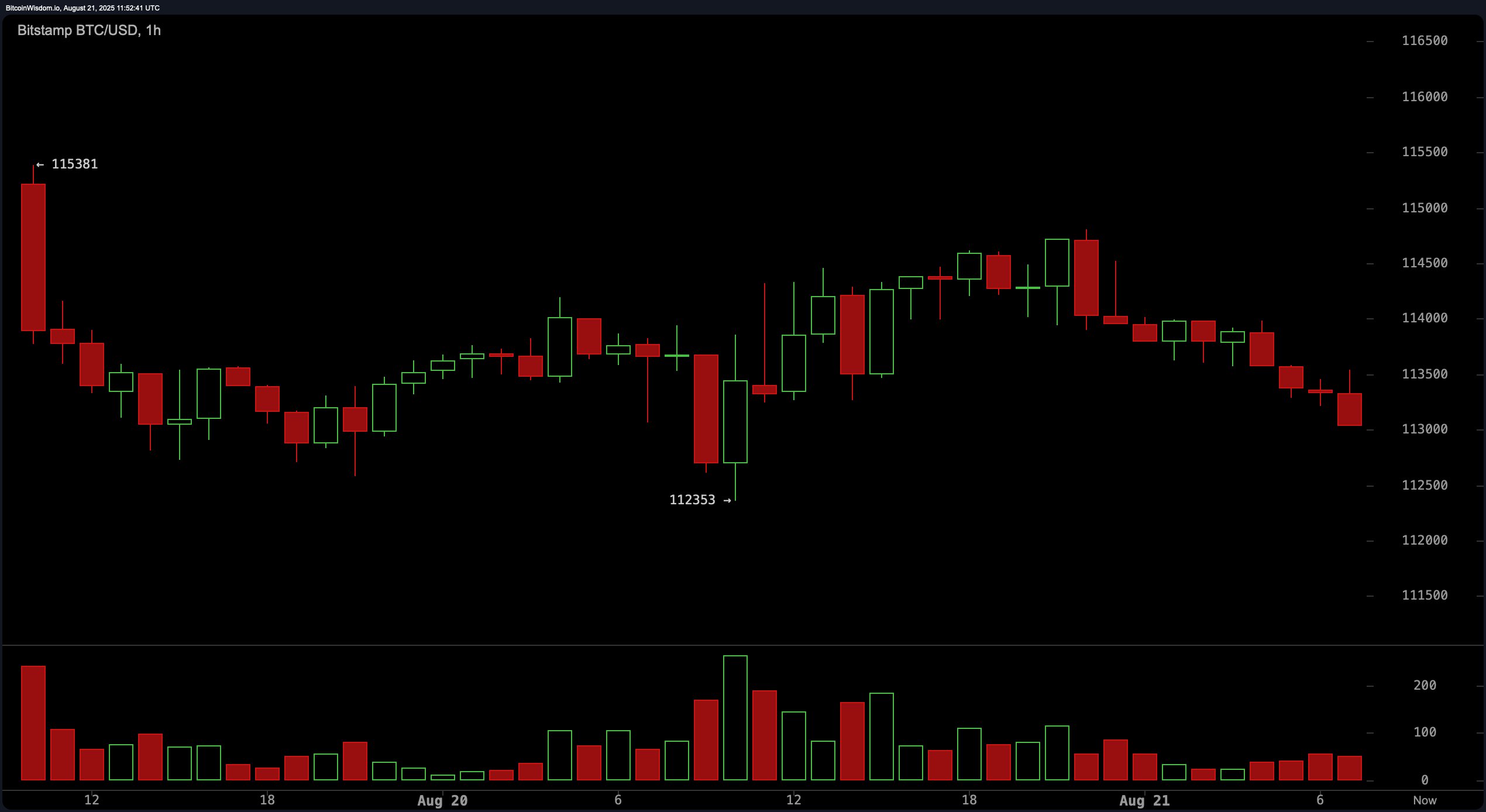

The 1-hour bitcoin chart reveals a weak upward rebound from $112,353, with lower highs indicating sustained selling pressure. The short-term structure supports a bearish outlook unless bitcoin decisively reclaims the $114,500 level. Support between $112,800 and $113,000 presents potential for quick bounce trades, while resistance near $114,000-$114,500 may offer shorting opportunities. Scalpers, those nimble creatures, may benefit from tight stop-loss entries near resistance and exits within a 0.5% to 1.5% profit range.

As for the oscillator readings, they support a neutral-to-bearish sentiment, much like a bureaucrat’s expression at a dull meeting. The relative strength index (RSI) is at 41, reflecting a neutral state, while the Stochastic oscillator and the commodity channel index (CCI) read 8 and -92, respectively, both indicating neutrality. The average directional index (ADX) is at 18, confirming a weak trend. Meanwhile, the awesome oscillator is negative at -1,779, and the momentum oscillator signals selling pressure at -5,651. The moving average convergence divergence (MACD) level stands at -304, aligning with a bearish signal-oh, the tragedy!

Furthermore, moving averages (MAs) reinforce the bearish technical landscape too. The 10-period and 20-period exponential and simple moving averages (EMAs and SMAs) are all issuing negative signals, with prices trailing below all short- and mid-term levels. The 30-period and 50-period EMAs and SMAs also support a continued downside move. However, longer-term indicators offer a glimmer of hope, as the 100-period and 200-period EMAs and SMAs suggest a buying trend, potentially cushioning a deeper correction-if only we could all be so lucky!

//markets.bitcoin.com/crypto/bitcoin”>bitcoin

remains under technical pressure, with the mid-term trend clearly biased to the downside. While opportunities exist for both scalping and swing trades, traders are advised to await volume confirmation and monitor macroeconomic triggers or ETF-related developments that could drive abrupt volatility-like a catapult in a farcical play!

Bull Verdict:

If bitcoin successfully holds above the $112,000 support and confirms a higher low with increasing volume and bullish candlestick formations, a short-term rebound toward the $117,000-$120,000 resistance zone is plausible. While the broader trend remains under pressure, a bullish reversal could take shape if key resistance levels are reclaimed with strength, particularly above $114,500-oh, the sweet taste of irony!

Bear Verdict:

With bearish signals dominating the daily and intraday charts, and bitcoin trading below critical short- and mid-term moving averages, the path of least resistance remains to the downside. Failure to hold the $112,000 support may trigger further selling pressure, exposing the $111,500 and lower zones, especially if reinforced by rising volume and bearish momentum indicators-truly, a comedy of errors!

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- SEI PREDICTION. SEI cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- FET PREDICTION. FET cryptocurrency

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- XRP XTRAVAGANZA: Is This the Crypto Comeback of the Century? 🚀💸

- Is Crypto Going to Lift You Higher or Slam Dungeon? 🌠

- EUR ILS PREDICTION

2025-08-21 15:58