So, Bitcoin decided to play the clingy lover again, bouncing between $112,800 and $113,200 from 9 to 11 a.m. Eastern on August 21, while derivatives metrics proudly displayed their steady open interest-like a seasoned gambler refusing to fold-and a sneaky uptick in put activity that’s making market watchers clutch their coffee beans.

Futures Positioning: The Great Venue Race, and Binance Plays the Wallflower

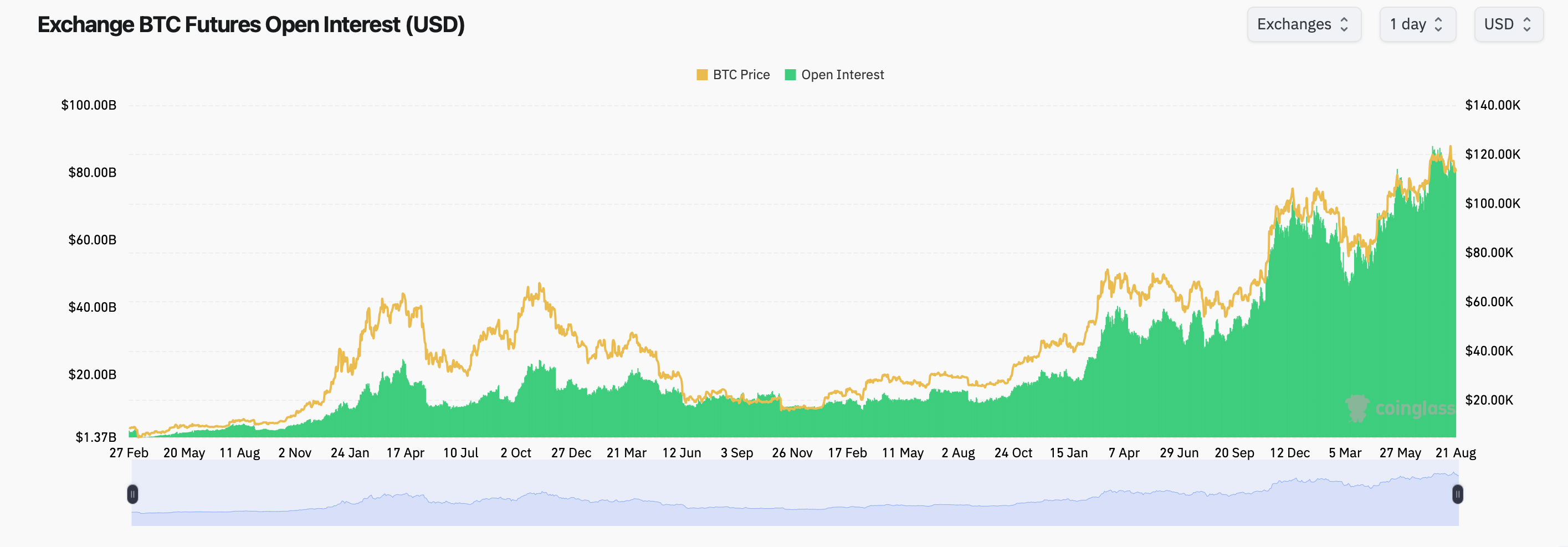

Total bitcoin futures open interest (OI) hit a rather respectable 711.18K BTC, worth roughly $81 billion-because nothing says “I’m serious” like a number that’s nearly large enough to buy a small country. It’s up 0.59% over four hours and a modest 1.05% in a day, proving once again that Bitcoin’s mood swings are as unpredictable as a cat on a keyboard. The OI-to-24-hour volume ratio stands at 1.1181, which might be one of those numbers that make traders nod sagely or scratch their heads.

In the grand market dance, CME leads with $16.70 billion in notional open interest, commanding about a fifth of the stage, followed closely by Binance with $14.44 billion, because nobody wants to be the wallflower at this financial prom. Bybit and Gate are treading the boards with $9.29 billion and $8.59 billion respectively, reminding everyone that the market remains a cozy club of a few heavy hitters.

Elsewhere, the crowd includes Bitget ($6.04 billion), OKX ($4.18 billion), MEXC ($3.27 billion), and a smattering of other exchanges that seem keen to remind us that crypto trading is a competitive sport with plenty of room for everyone-as long as you like betting big.

BTC Options: The High-Flying $140K-$200K Call Extravaganza (Because Why Not?)

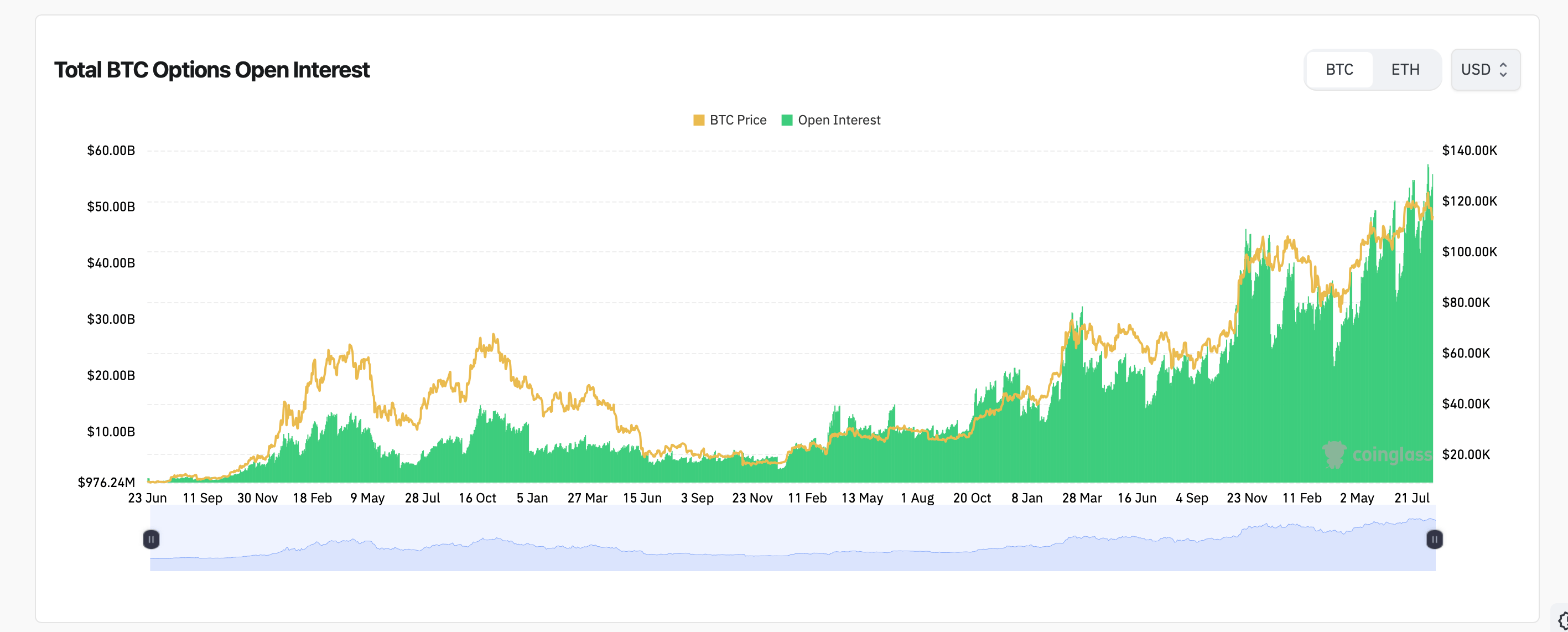

In options land, coinglass.com reveals a tilt towards calls-meaning folks are betting the price will rise, with 59.05% open interest at a whopping 268,086.55 BTC. Meanwhile, puts are feeling shy at just 40.95%. Over the past day, trading has shown a tiny preference for puts-probably because traders like to hedge their bets and hide under their desks-at 52.40%, with calls trailing at 47.60%. Essential volatility entertainment!

Most of the action’s at the high end-like a VIP section-focusing on strikes at $140K and $200K, with the September 2025 $140,000 call leading the charge with 10,785.3 BTC. The Dec. 26, 2025, $140,000 and $200,000 calls come next in line, because apparently traders think the price will do a rollercoaster over the next four years. On the put side, the $95,000 strike is holding firm, with 8,122 BTC in open interest-that’s the market making a bold move at the “what if” stage.

Recent trading shows folks are hedging their bets on a quick dip, with the August 22, 2025, $112,000 puts trading around 1,765.5 BTC. The $114,000 and $120,000 puts are also busy, probably from traders who have mastered the art of “better safe than sorry.” Calls, however, are more circumspect, with the $115,000 and $110,000 strikes trading in the 1,100 range, and the $140,000 call still making noise in the background. It’s like a high-stakes poker game, but everyone’s really just guessing what’ll happen next.

All in all, options and futures combined reveal a market that’s almost chuckling at the volatility, yet still riding a high of near-cycle peaks. And, with U.S. Federal Reserve boss Jerome Powell set to speak at Jackson Hole, it promises to be an interesting week-grab your popcorn (or your crypto dada, if you’re feeling fancy).

$303M in Crypto Liquidations: The Market’s Version of a Gentle Breeze or a Thunderstorm?

Liquidations came and went, with over $302.58 million in positions wiped out-roughly enough to buy a small island-or at least a really fancy yacht. Long traders lost $98.48 million, while the shorts got hit for $204.10 million, possibly because they bet on a fall that was more like a gentle slope. 84,016 traders felt the heat, and the biggest single liquidation was a $39.08 million BTC-USDT order on HTX-because nothing says “morning coffee” like a billion-dollar wipeout.

In shorter timeframes, the liquidations were more subdued but still notable: $91.03 million over 12 hours, $39.86 million over four, and $14.40 million in the last hour. Short liquidations often outpace longs in recent moments, perhaps reminding us that nobody is safe in this game of market musical chairs. The overall scene? Modest, yet telling-a market apparently undecided whether to celebrate or panic. Stay tuned for what Jerome Powell’s speech might do, unless we’re all just going to sit here and watch Bitcoin dance.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- SEI PREDICTION. SEI cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- FET PREDICTION. FET cryptocurrency

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- Czech Bank Bets on Bitcoin: A Million-Dollar Moon Shot! 🚀💰

- Bitcoin Faces ‘Nation-State Rug Pull’ Risk, Warns Willy Woo

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

2025-08-21 18:28