In the grand theater of the markets, where fortunes rise and fall with the whims of the crowd, the humble memecoin, $WIF, stands poised like a protagonist in one of life’s great dramas. Recent price movements, those fleeting whispers of the collective soul, suggest a stirring within its charts-a potential rally toward the fabled $1.34 resistance level. Ah, resistance! That stubborn wall which, like a stubborn mule, refuses to budge without a fight. Yet, for those traders who watch with the patience of a saint and the cunning of a fox, the upside promises much. 🧐✨

The Ascending Triangle: A Stage for Ambition

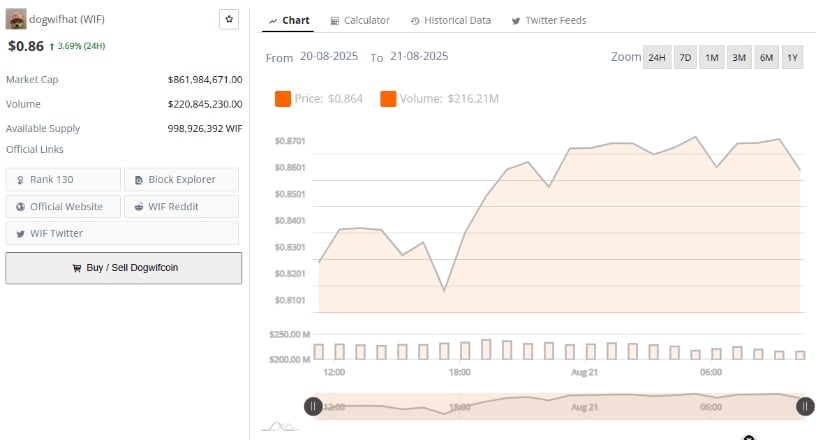

Behold, the price of $WIF has confined itself within an ascending triangle, a geometric prison of its own making. Higher lows creep toward the $1.00 resistance barrier, like a timid suitor approaching his beloved. The $0.85 support, tested time and again, stands firm-a loyal friend in times of uncertainty. Should $WIF breach the $1.00 threshold, it may embark on a journey upward, with $1.34 as its next great quest. But alas, the market is a fickle mistress, and nothing is certain but uncertainty itself. 🤔📈

The Relative Strength Index (RSI), that cold and calculating observer, reads a modest 43-neither overbought nor oversold, like a man standing in the middle of a bridge, undecided which way to leap. This neutrality leaves room for momentum to gather, like a storm brewing on the horizon. Should the price surge above resistance, the RSI may enter overbought territory, a signal as clear as a bell, beckoning buyers to join the fray. 🔔💸

Support and Resistance: The Dance of the Titans

Trading volume, that barometer of conviction, remains stable yet subdued, as if the market waits with bated breath for the drama to unfold. The $0.85 support, tested like a faithful hound, holds its ground, a bastion of buying interest. Should it falter, lower levels at $0.75 and $0.65 await, like safety nets beneath a tightrope walker. Resistance at $1.00, a stubborn gatekeeper, has repelled advances thus far. Yet, a breakthrough here would be a triumph, clearing the path to $1.34-a level of historical significance, where past battles were won and lost. 🏰⚔️

Technical Indicators: The Whispers of the Oracle

The Bollinger Bands, those sentinels of volatility, show the price confined within their embrace, a sign of consolidation. This calm before the storm often precedes a breakout, with the bands expanding like the lungs of a man taking a deep breath. A move above the upper band could signal a surge in volatility, a sharp ascent like a rocket breaking free from gravity. Conversely, a break below the lower band might herald further decline or prolonged stagnation. 🚀🌀

The MACD, that enigmatic seer, shows the MACD line hovering below the signal line, a stalemate of momentum. A crossover to the upside would be a bullish herald, a clarion call for a breakout. Yet, continued bearish divergence could spell trouble, a warning of selling pressure lurking in the shadows. 🦉🔮

In this grand tapestry of charts and indicators, the key levels of $0.85 and $1.00 stand out like beacons in the night. A breakout above $1.00 could propel $WIF toward its $1.34 destiny, a journey fraught with peril and promise. Traders, ever vigilant, must watch for volume surges and indicator confirmations, ready to seize opportunity while managing risk. For in the markets, as in life, the only certainty is uncertainty, and the only wisdom is to remain prepared. 🛡️🎭

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- SEI PREDICTION. SEI cryptocurrency

- Cardano ETF Drama: Will ADA Make You Rich or Just Confuse You? 🤔

- SPX PREDICTION. SPX cryptocurrency

- FET PREDICTION. FET cryptocurrency

- Bitcoin Faces ‘Nation-State Rug Pull’ Risk, Warns Willy Woo

- Czech Bank Bets on Bitcoin: A Million-Dollar Moon Shot! 🚀💰

- Bitcoin Wakes Up, Pretends It Has Its Life Together ✨📉🚀

2025-08-21 20:46