In a Nutshell (Because Who Has Time for More?)

- Ethereum hit $4,950 like a cat chasing a laser pointer, only to fall off the table. Now it’s clinging to $4,500 support like a drunkard to a lamppost.

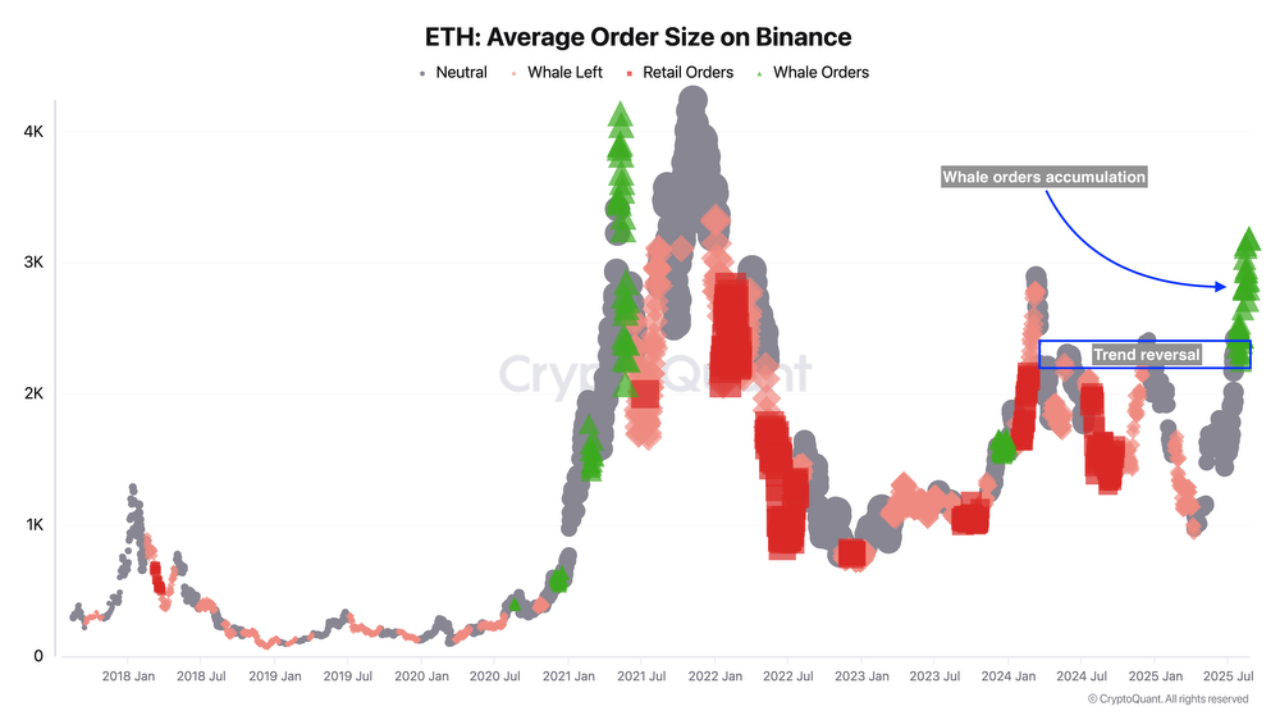

- Whales have been splashing around, adding $1.6 billion in ETH this week-probably while sipping something bubbly.

- Historical data whispers ominously: September likes to kick August’s gains down the stairs. Will ETH tumble or triumph?

Ah, Ethereum. The cryptocurrency market’s equivalent of a soap opera star-one minute basking in glory at an all-time high of $4,950, the next sobbing into its volatility towel as it tumbles back to $4,550. It’s up 8% for the week but down 4.5% in the last 24 hours. Truly, a tale of two timelines.

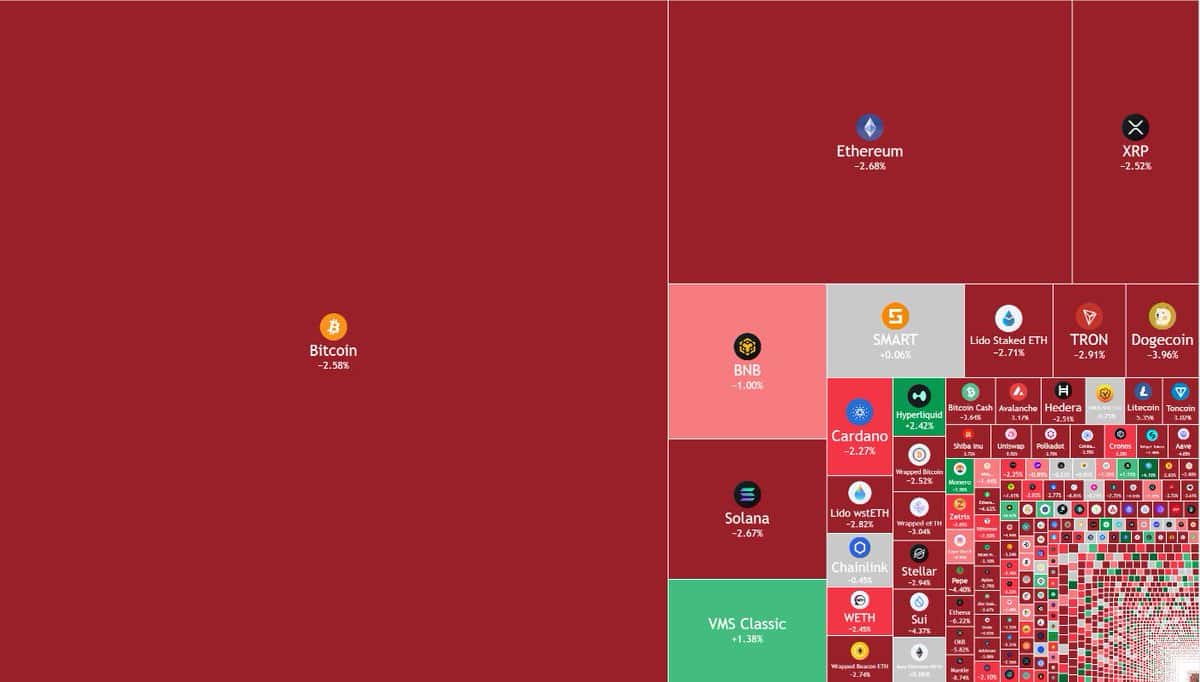

And oh, what a chaotic little timeline it is! A whopping $720 million in liquidations swept through the market faster than you can say “oops.” Bitcoin and Ethereum longs bore the brunt of it, with nearly $500 million wiped out like crumbs from a banquet table. Analyst Lennaert Snyder summed it up nicely: “ETH took liquidity above $4,880 and flushed leveraged longs.” Ah yes, nothing says financial sophistication quite like flushing someone else’s money down the drain.

Now, dear reader, imagine Ethereum teetering on the edge of $4,500 support like a nervous acrobat on a tightrope. If it falls, we’re looking at a potential drop to $4,300-a level that might make even the most stoic crypto enthusiast reach for the smelling salts. On the flip side, reclaiming $4,693 could send ETH gallivanting toward $4,880 again. But let’s not get ahead of ourselves; hope is a fragile thing in these parts.

“$ETH took liquidity above $4,880 and flushed leveraged longs.”

“Currently testing ~$4,500 support, but it doesn’t look strong.”

“Best case scenario for the bulls is to reclaim $4,693 rangelow ASAP.”

“If we lose here, Ethereum will probably retest the $4,300 start impulse.”

– Lennaert Snyder (@LennaertSnyder) August 25, 2025

Meanwhile, whales are swimming laps in the deep end of the pool. Wise Crypto reports they’ve added over $1.6 billion worth of ETH recently, which either means they know something we don’t-or they’ve got more money than sense. Either way, they seem particularly fond of the $4,590-$4,760 range, describing it as a cozy demand zone complete with Fibonacci retracement cushions.

But wait! There’s more drama because history loves repeating itself like your least favorite relative at family gatherings. Historical trends suggest that September enjoys raining on August’s parade. If this pattern holds true, Ethereum might find itself staring wistfully at lower levels unless it can rally above $4,690. Failure to do so could mean a trip back to $4,300-or worse.

So there you have it, folks: Ethereum’s current state is part tragedy, part farce, and entirely unpredictable. Whether it rises like a phoenix or flops like a fish out of water remains to be seen. Place your bets wisely-or just sit back and enjoy the show. 🍿📉📈

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Bitcoin Wakes Up, Pretends It Has Its Life Together ✨📉🚀

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

2025-08-25 16:47