In a world where the spirits of traders rise and fall like the tides, the coin known as Optimism (OP) finds itself in a peculiar dance with fate. From the lofty heights of $0.82, it has gradually descended to the more modest abode of $0.70, as if guided by an unseen hand that favors the sellers. Buyers, with their valiant efforts, struggle to reclaim the lost ground, their rallies small and fleeting, like the last rays of sunlight before nightfall.

Open Interest and Price Dynamics Reveal Cautious Sentiment

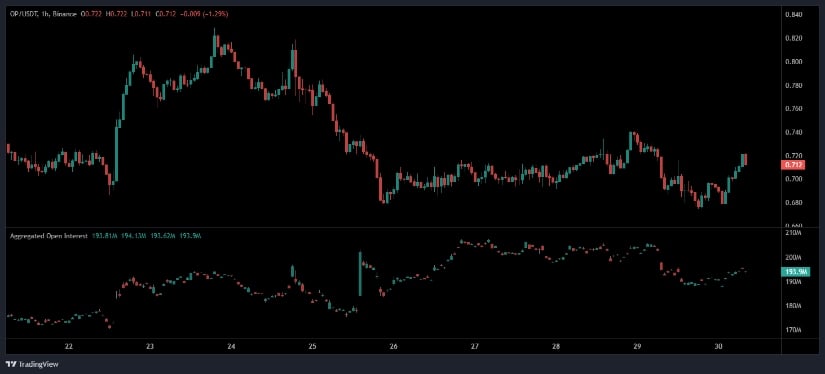

The hourly charts of OP/USDT tell a tale of retreat and volatility, with the price slipping from its peak of $0.82 to the $0.70 region. These charts, like the pages of a well-worn book, reveal the story of a market where small, hopeful rallies fail to break through the formidable resistance, a testament to the buyers’ diminishing strength. Yet, despite the weakening price, the aggregated open interest stands firm at nearly $193.9 million, a sign that many traders prefer to hold their positions, perhaps waiting for the storm to pass or for a new wind to carry them to higher shores.

This steadfast open interest amidst falling prices is akin to a gathering of shadows, where market participants position themselves for what they believe to be an inevitable descent, their hesitation a clear indication of the spot buyers’ reluctance to commit fully to the cause.

The intricate relationship between price and open interest serves as a compass for navigating the uncertain waters of the market. Should the price continue to wane while open interest ascends, the selling pressure could grow, pushing the coin beneath the critical $0.70 threshold. On the other hand, if open interest diminishes while the price stabilizes, it might suggest that the shorts are closing their positions, potentially paving the way for a much-needed rebound. Thus, the vigilant monitoring of open interest becomes a vital tool for predicting the coin’s next move in this tempestuous sea.

Market Data Confirms Bearish Pressure and Volatile Trading

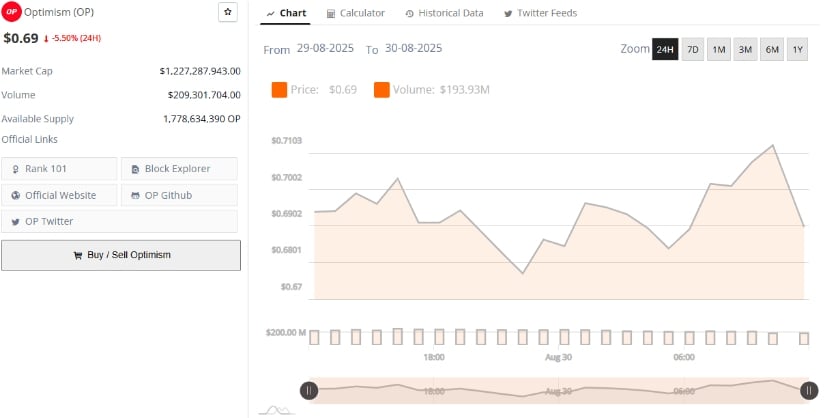

According to the wise scribes at BraveNewCoin, OP now trades close to $0.69, a sharp 5.5% decline over the past 24 hours. With a market capitalization of about $1.22 billion and a daily trading volume surpassing $209 million, the coin occupies a mid-cap position, ranking 101st in the global cryptocurrency hierarchy. The price action over the last day has been a testament to the coin’s struggle to remain above $0.70, with multiple tests of the $0.67 support level reinforcing the dominance of bearish forces.

Over the course of 24 hours, the token has oscillated between $0.67 and $0.71, a range marked by high volatility but lacking a clear direction for a sustained rally. This pattern of indecision, where liquidity remains active but sentiment leans towards pessimism, paints a picture of a market in turmoil, where the absence of strong buying pressure threatens to send the coin into deeper waters.

The repeated failure of buyers to breach the $0.71 resistance weakens the coin’s prospects for a near-term recovery. Without a significant influx of buying pressure, the risk of the coin retesting lower support levels grows, further eroding the fragile confidence of investors.

Technical Indicators Point to Oversold Conditions but Lingering Downside Risk

On the daily charts, the application of Bollinger Bands and MACD indicators provides a glimpse into the soul of the market. Currently priced around $0.712, OP hovers near the lower Bollinger Band at $0.65, a position that historically signals oversold conditions, possibly heralding a short-term reprieve. However, the mid-Bollinger Band resistance at $0.74 and the upper band near $0.83 serve as distant goals for any recovery rallies, a reminder of the challenges that lie ahead.

The MACD, with its lines and histogram, tells a tale of continued bearish pressure, the MACD line below the signal line and the histogram negative. Yet, the narrowing gap between the lines hints at a possible deceleration of bearish momentum, a glimmer of hope that a trend reversal might be on the horizon, should buying volume increase significantly.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- USD CNY PREDICTION

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

- Crypto Chaos: How Hackers Are Pulling Off the ‘Classic EIP-7702’ Wallet Heist

2025-08-30 20:44