In the bustling sphere of American crypto ETFs, the month of August danced a curious tango, with Ethereum pirouetting to the forefront. Yet, just as the sun sets, the enthusiasm extinguished last week, leaving a haunting echo of substantial outflows on that ominous Friday. Ah, Ethereum, that embellisher of dreams, was once more leading the retreat, casting off a staggering $164.64 million from its vault, with Bitcoin trudging behind it, relinquishing $126.64 million. This whimsical retreat arrived at an intriguing juncture, as inflation data stubbornly clung to the stage, sending tremors through the hearts of institutional investors. 🎭

A Sudden Reversal At Week’s End

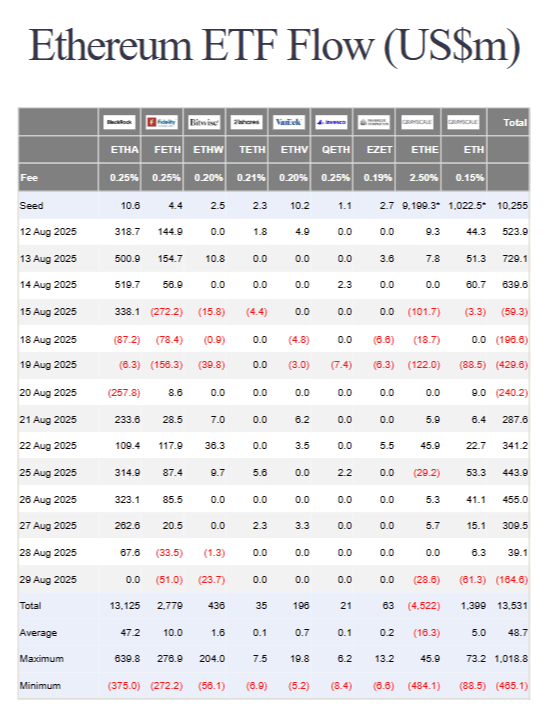

Oh, how the tables have turned! According to the wise sages at Farside Investors, the Spot Ethereum ETFs found themselves in a rather precarious situation, culminating the week with outflows that read like a tragic epic: $164.64 million. Fidelity’s FETH scrambled away with $51 million, Bitwise’s ETHW scuttled off with $23.7 million, Grayscale’s ETHE shed $28.6 million, and Grayscale’s ETH faded into the night with $61.3 million. Meanwhile, BlackRock maintained a serene composure, unshaken by either inflows or outflows, as its fellow travelers like 21Shares and VanEck chose to follow suit in this bizarre ballet of finance.

Friday’s outflows were a shockwave, a disruptive crescendo in the melodic rise that Ethereum’s Spot ETFs had composed since August 21. The melodrama culminated after a six-day inflow sonata, which had swelled to a whopping $1.876 billion, only to be abruptly silenced by Friday’s mass withdrawals. As the curtain fell, the total assets under management for Spot Ethereum ETFs dwindled to a mere $28.58 billion. It’s like watching a once-mighty river dry into a barren creek. 🌊

Ethereum ETF Flow: Farside Investors, where numbers appear to dance in despair

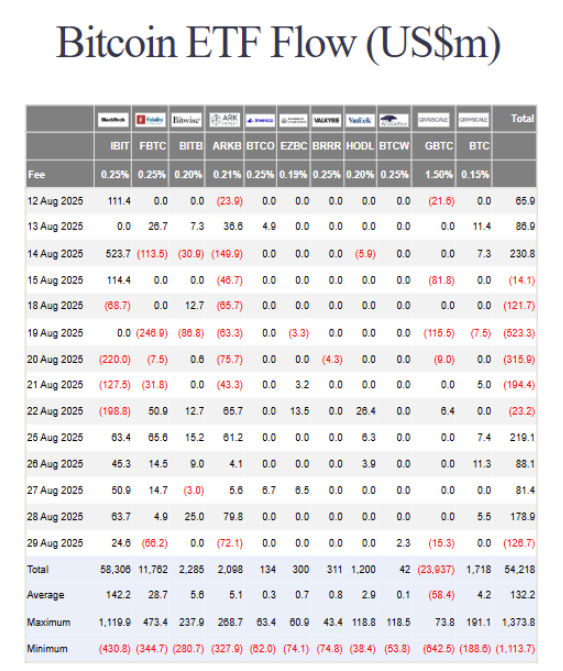

Simultaneously, the Bitcoin tier also felt the sting. For the first time since August 22, Bitcoin ETFs marked their first descent with a loss of $126.64 million, causing total assets under management to tumble to $139.95 billion. But fret not for all issuers; Fidelity’s FBTC bravely led this hesitant migration with $66.2 million, closely followed by ARKB’s $72.07 million and GBTC’s $15.3 million. Yet, in the grand spectacle, BlackRock’s IBIT shone brightly, welcoming $24.63 million in hopeful inflows, while WisdomTree’s BTCW quietly gathered $2.3 million amidst the chaos-bless those rare resilient souls! 🌟

Bitcoin ETF Flow: A Farside Investors’ tale of rise and fall

The root of this poignant exodus? Investors feasting on Friday’s inflation data laid out before them-an unsettling confection where the US core Personal Consumption Expenditures (PCE) index rose by 2.9% year-over-year in July, the swiftest ascent since February. With such nuance, fears burgeoned-will the Federal Reserve hold its course, or dare to embrace rate cuts like a long-lost lover? 💔

What May Lie Ahead This Week

As the curtain of a new trading week unfurls, both Ethereum and Bitcoin ETF flows may sway like willows in the wind, determined by investors’ evolving interpretations of that tricky data. Should inflation breathe fire, the timid institutional investors might yield to their caution, pulling back at week’s dawn. However, a glimmer of hope-a mere suggestion of cooling-could entice a resumption of inflows, particularly for Ethereum, where favorable fundamentals linger like an inviting breeze.

On the pricing side, Bitcoin hovers precariously above the $108,000 threshold, a mere flicker of optimism, but must strive to remain above the $110,000 mark to inspire any vibrant upward thrust. Currently, it finds itself trading at $109,910, caught in a nervous dance. As for Ethereum, a daily embrace above $4,500 could reignite bullish ardor, whereas a tumble beneath $4,400 might evoke another somber tale of weakness. Presently, it trades at $4,470, fluttering upwards by 1.7% in the past 24 hours, a symbol of resilient spirit amidst turbulence. 🦋

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Bitcoin Wakes Up, Pretends It Has Its Life Together ✨📉🚀

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

2025-08-31 18:07