Oh, Bitcoin-our beloved digital gold-decided to throw a tantrum and hit a cheeky little low at $107,000. Yes, you read that right. Just when we thought it might soar into the sunset, it did a dramatic dip, making investors shudder with fear and steal a quick glance at other shiny coins. Meanwhile, Bitcoin ETFs are looking like last season’s fashion-completely out of style, with inflows drying up faster than my patience during a Monday morning meeting.

Bitcoin (BTC) hits local bottom at $107,000

The great rollercoaster today saw Bitcoin, that unpredictable darling, tumble to a modest $107,000 on some exchanges-just shy of its two-month low. Yesterday, September 1st, 2025, it even flirted below $107,500 on CoinGecko, proving that fondos everywhere are clutching their bedsheets and wondering if this is the end or just a hot flash.

Image by CoinGecko

But wait! If you blinked, you might have missed the rebound. Now, Bitcoin’s strutting back at $110,900-trying desperately to stay above the coveted $110,000 level. Classic case of ‘up and down, just like my mood swings.’

Trading volume? A modest $46 billion-because nothing says “market confidence” like liquidations-$74 million worth of Bitcoin positions got liquidated in the past 24 hours. Longs? Well, they got hit with a $37 million whammy.

And just to sprinkle some drama-Bitcoin’s dominance slipped slightly overnight to 57.8%, as altcoins-those eccentric cousins-are grabbing more limelight:

- Bitcoin dominance: 57.8%

- Ethereum dominance: 13.8%

- Other cryptocurrencies: 28.4%

Looks like liquidity has decided to tiptoe into altcoins, leaving Bitcoin to pout in the corner.

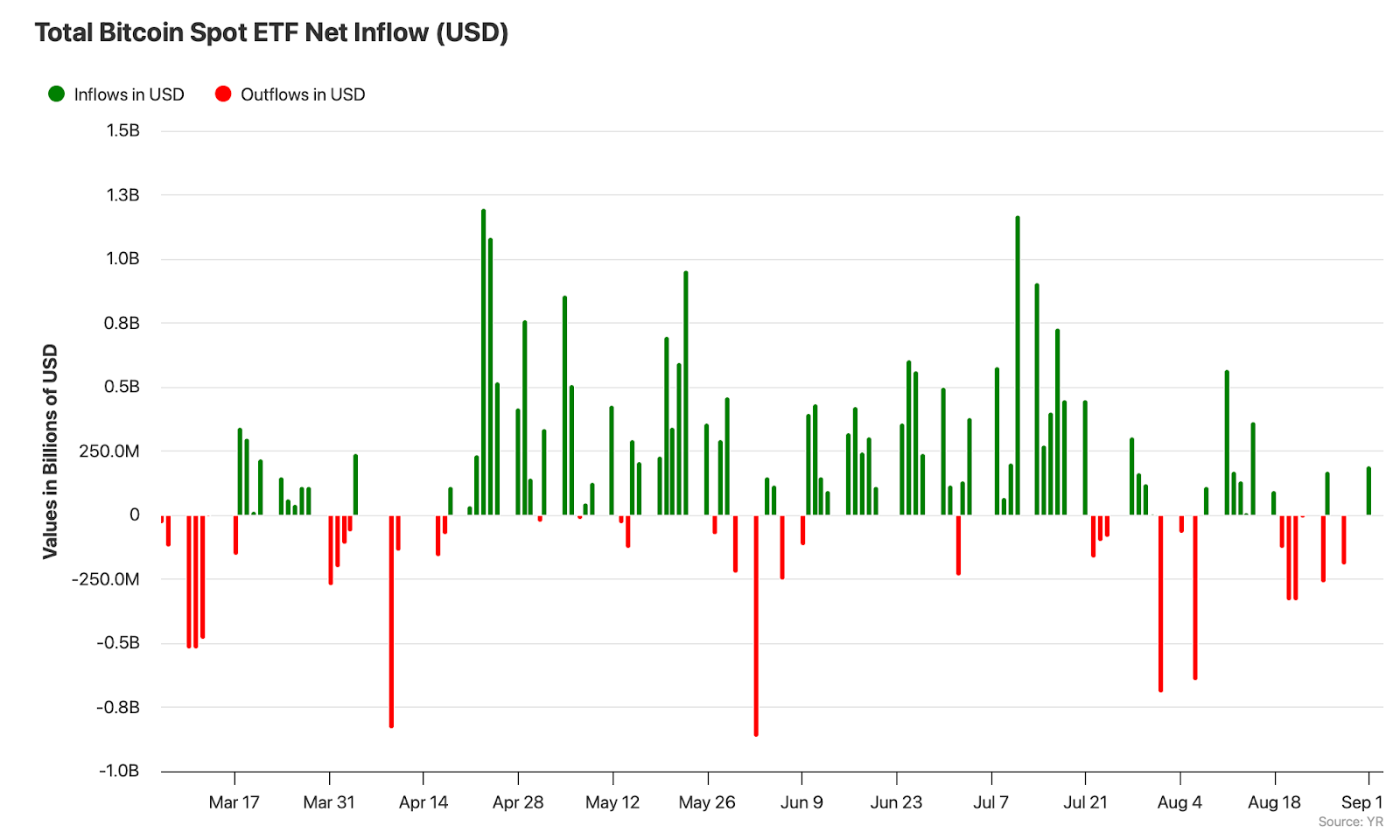

Bitcoin ETFs Losing Steam: Investors Are Giving the Cold Shoulder

Oh, the heartbreak-spot Bitcoin ETFs in the U.S. are shrinking faster than my patience during a long Zoom call. Since mid-July, inflows have been eerily dwindling, with only a tiny $192 million making its way into all Bitcoin ETFs combined yesterday-proof that even the most devoted fans are maybe sleep-shopping instead.

Image by Bitbo

BlackRock’s IBIT, which proudly boasts a market cap of $83 billion, is now the seventh-largest ETF in the U.S.-trailing behind giants like VOO, IVV, and even QQQ, because apparently, Bitcoin ETFs are just not cool anymore. Total AUM dropped from $155 billion mid-August to $142 billion-like a balloon deflating after a birthday party. Ethereum ETFs, however, are holding their own, slightly climbing from $22 billion to $24 billion.

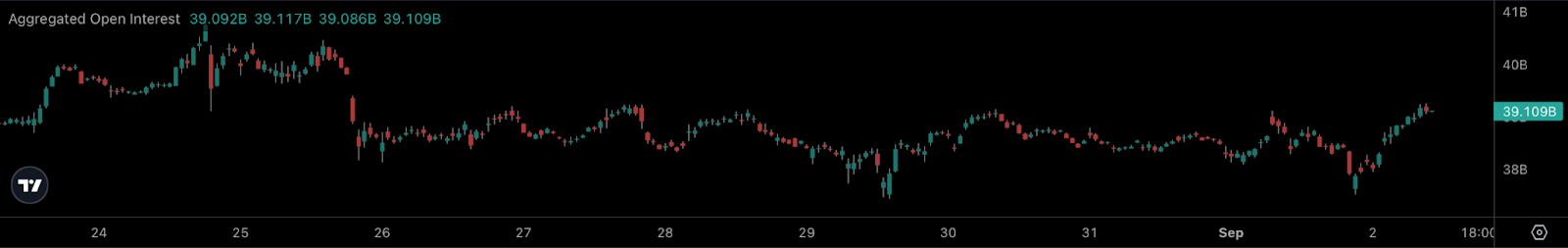

Bitcoin’s Open Interest Nears $40 Billion-Could Bulls Be Getting Confidence?

Now, hold onto your hats-Bitcoin’s open interest (fancy term for the total value of futures contracts) is nearing the $40 billion mark, flirting with weekly highs. If you’re into numbers, that’s almost three times what it was last year at $15-16 billion-talk about a glow-up! 🌟

Image by CoinAlyze

This uptick hints at a spicy future-more volatility on the horizon and investors showing some interest, or at least pretending to. Meanwhile, institutional investors are making it rain, leading to speculations that Bitcoin’s bull run isn’t quite over yet. If history rhymes, Q4 of the post-halving year might just turn into the financial climax we’ve all been waiting for.

WLFI Debuts via Rocket Fuel-Everyone’s Talking About It

Enter WLFI, the new kid on the block by World Liberty Financial. Launched yesterday, it shot above $0.3 faster than you can say ‘pump and dump,’ creating a market cap of a jaw-dropping $8.26 billion-because why not? Now floating around $0.22, WLFI is the 27th biggest crypto, with a fully diluted valuation over $22 billion. Yes, billion, with a B.

But it’s not all rainbows and unicorns. The crypto community is shaken-80% of WLFI’s supply is locked up in mystery vaults, making it ripe for manipulation, like a bad soap opera plot. The launch netted insiders a cool $5-6 billion-definitely a debut to remember. 😅

Venus Protocol Not Hacked! – Just a Scammer’s Delight

Early morning whispers suggested Venus Protocol had been drained of $30 million-scandal! But fear not, dear reader, it was just a false alarm. Turns out, a user fell for a classic phishing scam, approving a malicious transaction and handing over $27 million to the villains-because apparently, trusting strangers online is still a thing.

PeckShield, that wise cybersecurity guru, swiftly debunked the hacking rumors, reminding us that in crypto-land, scams are more common than cat memes. Meanwhile, Bunni DeFi also got its own shady attention, losing $2.4 million, before the team could hit pause. Keep your wits about you-cybercriminals are busy bees, or rather, busy needles in a haystack.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Binance’s CZ Reveals Unpopular Secret: When to Buy & Sell Bitcoin (It’s Not What You Think!)

- Ethereum’s Wild Ride: Will This Crypto Riverboat Reach $4K or Crash a Paddle?

- Crypto Chaos: How Hackers Are Pulling Off the ‘Classic EIP-7702’ Wallet Heist

- Crypto’s Fancy New Suit: Institutions Crash the Retail Party 🎩💼

- STETH PREDICTION. STETH cryptocurrency

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

2025-09-02 20:54