September, that month of mirth and mystery in the crypto world, has often been the harbinger of gloom. Bitcoin and Ethereum, the two titans of the digital realm, have frequently stumbled during this enigmatic period, with history painting a picture of sharp declines or tepid performances. Yet, as we peer into the crystal ball of 2025, the landscape appears to have shifted subtly, perhaps even whimsically. Both assets have ascended to new all-time highs, ETF flows have become the new maestros of market liquidity, and whispers of rate cuts are once again in the air.

The eternal question looms: Will September’s shadow once again darken the crypto horizon, or has the cycle itself been transformed? Will Bitcoin and Ethereum, those steadfast companions, continue to march in unison, or will fate deal a different hand to one of them? 🎭

Exchange Reserves and Withdrawals Tell a Mixed Story

Bitcoin’s exchange reserves, much like a shrinking wardrobe, have dwindled by about 18.3% since last September, while Ethereum’s reserves have modestly declined by approximately 10.3%. This curious phenomenon, especially given their proximity to all-time highs, suggests a long-term accumulation trend. Fewer coins now rest on exchanges, eager to be sold, like reluctant guests at a party.

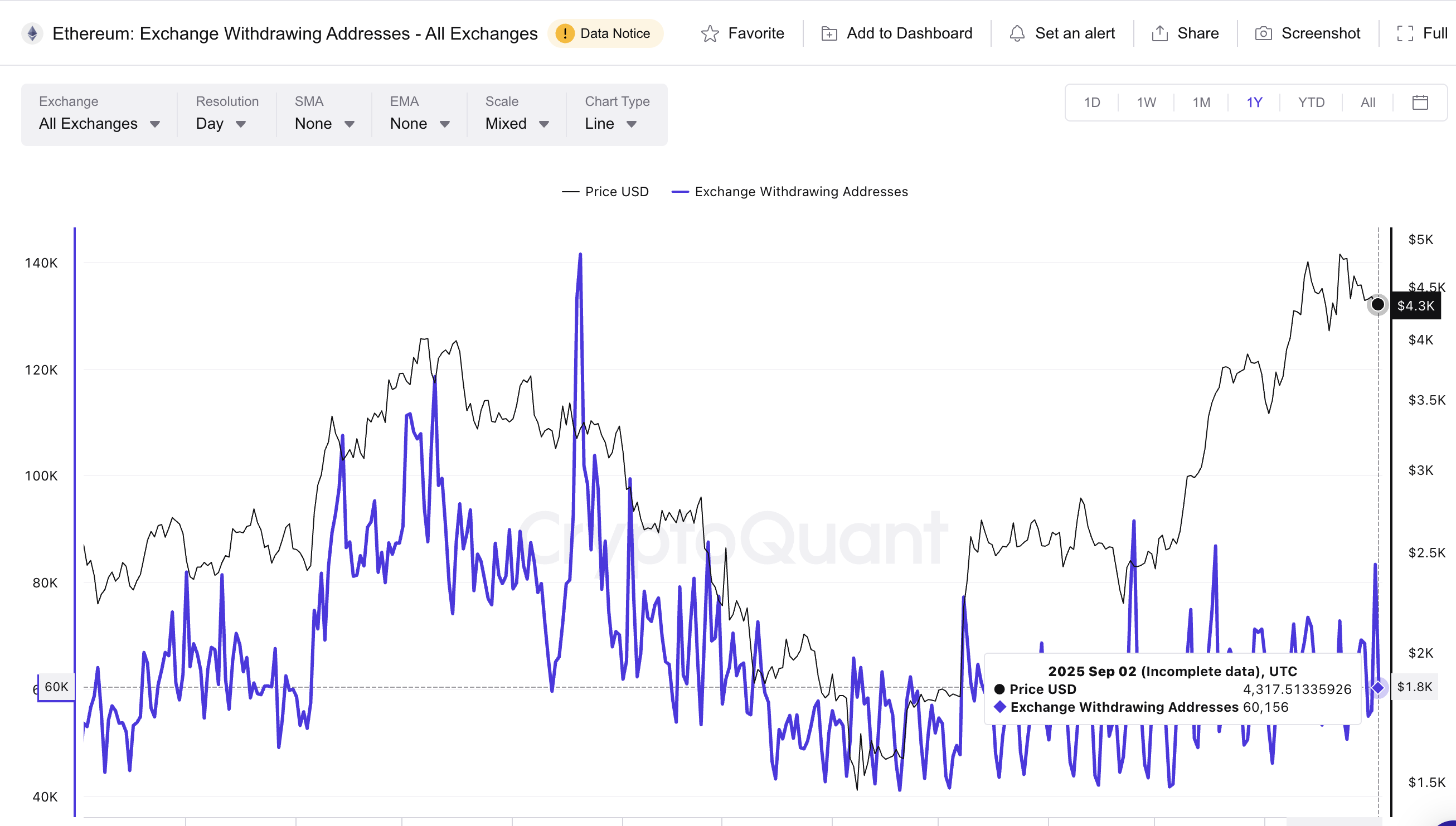

However, the tale of withdrawing addresses adds a layer of complexity, much like a plot twist in a novel. Ethereum’s withdrawing addresses have climbed from 53,333 in 2024 to over 60,000 this year, a bullish sign of stronger self-custody and accumulation. Bitcoin, on the other hand, has seen a precipitous drop in withdrawing addresses, from 35,347 last year to a mere 11,967 at press time. This could indicate a weaker preference for self-custody, but there’s more to the story, isn’t there? 🕵️♂️

Even though Bitcoin’s accumulation demand seems lackluster on the surface, it leaves room for price growth if a positive driver, such as the September 2025 rate cuts, materializes. Given Bitcoin’s history of stronger ETF inflows in September compared to Ethereum, the low number of withdrawing addresses might be less a sign of weakness and more a prelude to incoming demand. 🚀

Profit Supply and the Risk of Selling Pressure Looms On Both

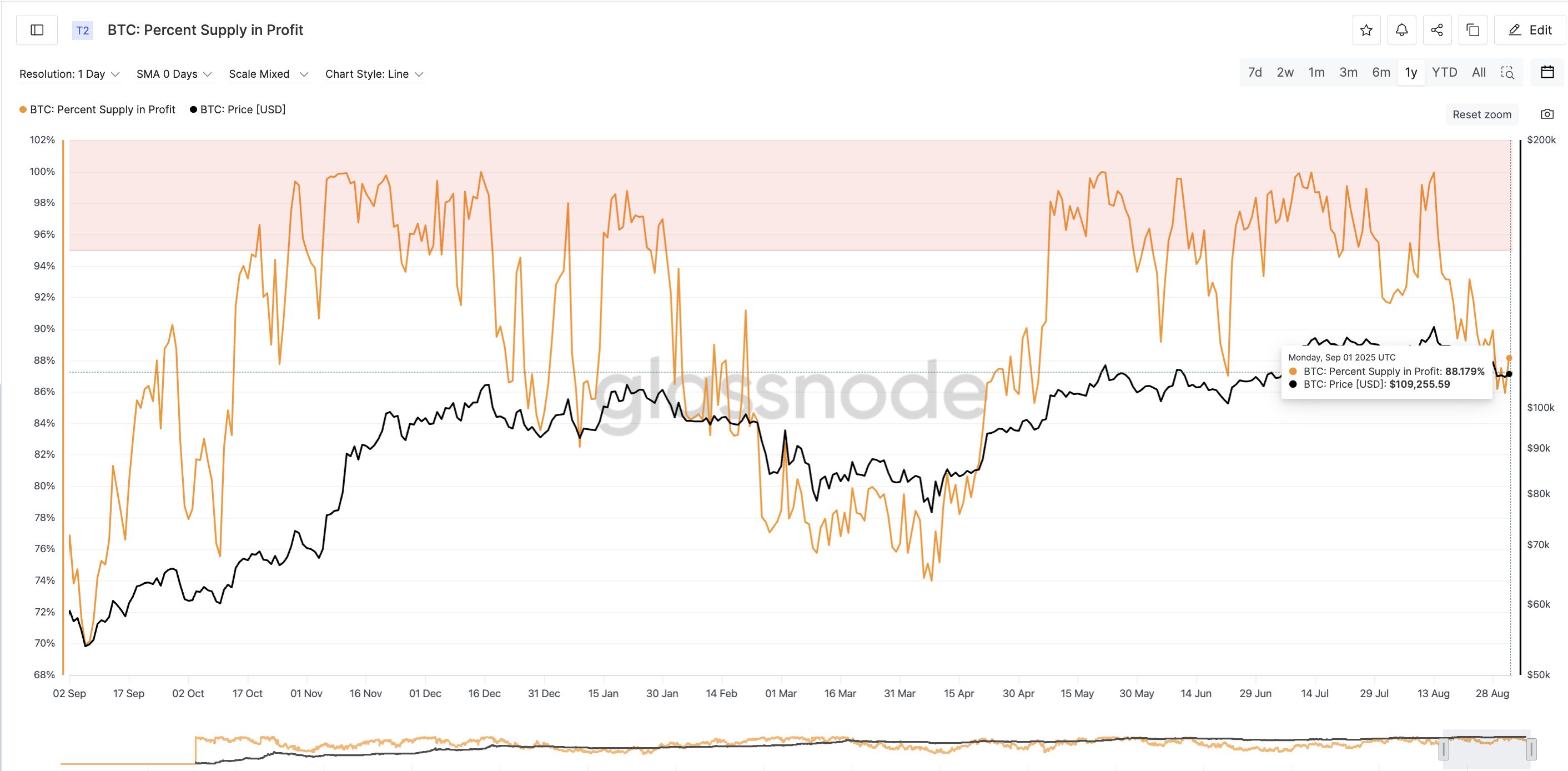

Both Bitcoin and Ethereum now boast a significantly higher percentage of supply in profit than a year ago. For Bitcoin, this share has risen from 76.91% in September 2024 to 88.17% in September 2025. Ethereum’s percentage has soared even higher, from 73.83% to 92.77%. This means that most holders are sitting on gains, a situation that historically encourages profit-taking. 🤑

With both assets flirting with record highs during what is typically the weakest month for crypto, September could witness increased selling pressure-unless structural inflows provide a counterbalance. From a purely numerical standpoint, Ethereum remains the higher-risk candidate. 🎲

ETFs Add a New Dimension in 2025

This year introduces a variable that past Septembers lacked: ETF flows. Since their inception, Bitcoin ETFs have attracted around $54.5 billion in lifetime inflows, while Ethereum ETFs, the newer entrants, have garnered about $13.3 billion. In the last 30 days, Ethereum ETFs have seen net inflows of $4.08 billion, compared to outflows of $920 million for Bitcoin ETFs. Many have declared ETH the winner in this cycle. 🏆

Ethereum is eating Bitcoin as lunch

Last 30 days:

ETH ETF netflow +4.08B

BTC ETF netflow -920M– Maartunn (@JA_Maartun) August 29, 2025

However, a closer look at September data reveals a different story. For September 2025 so far, Ethereum ETFs are already in the red with nearly $135 million in net outflows. This mirrors a similar trend from last September, which was also negative. Bitcoin, by contrast, began this September with $332 million in net inflows, akin to September 2024, when BTC ETFs logged $1.26 billion in gains. 📈

This pattern suggests that September and rate cuts have consistently favored Bitcoin over Ethereum in terms of ETF flows. Despite Ethereum’s strong summer inflows, its September performance has historically shown weakness. 🌞🌧️

As Jeff Dorman astutely observed:

“BTC is gold, but very few care about gold. ETH is an app store-and tech investing is a bigger market,” he said on X.

This insight explains why Ethereum has attracted growth capital. Nonetheless, in the traditionally weakest month for crypto, structural flows continue to favor Bitcoin. This aligns with our earlier discussion on withdrawing activity. 🔄

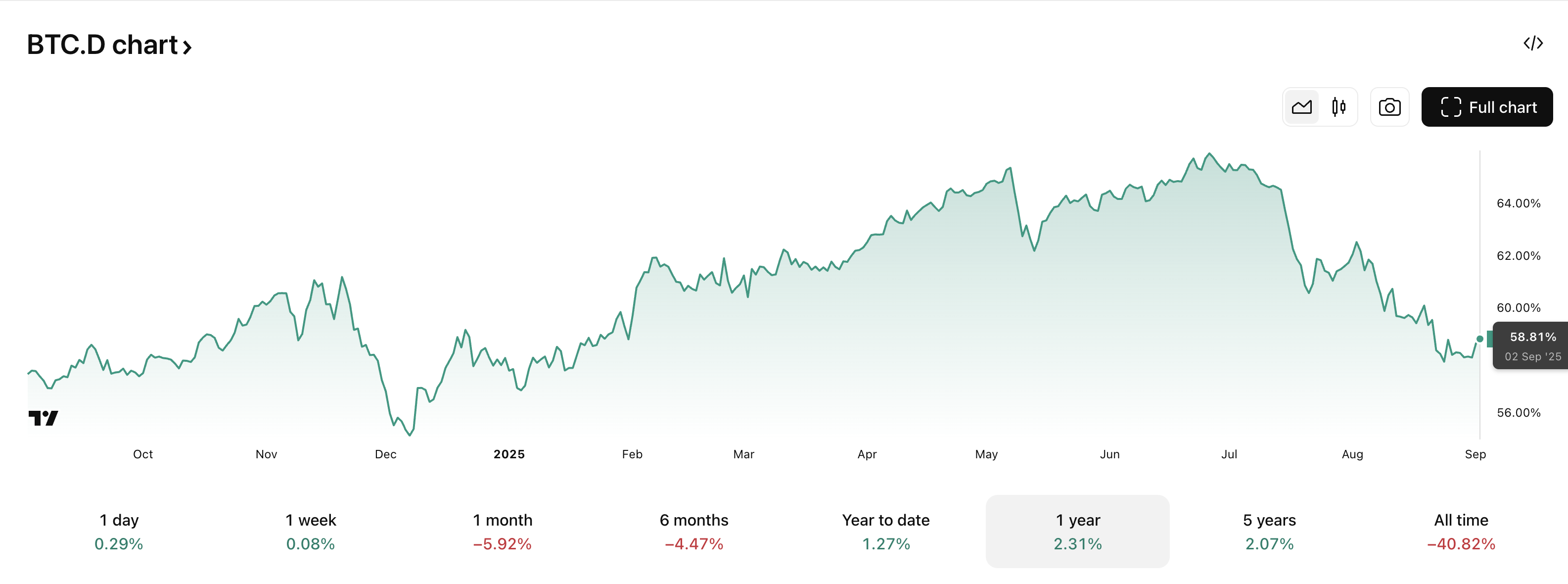

ETH/BTC Ratio and Market Dominance Point To Strength In Bitcoin

The ETH/BTC ratio has slipped from 0.043 last September to 0.038 today, indicating Ethereum’s underperformance relative to Bitcoin despite ETF momentum. Meanwhile, Bitcoin’s dominance has risen from 57.46% to 58.82%, while Ethereum’s dominance has fallen from 15.02% to 13.79%. 📊

These figures reinforce why markets still regard BTC as the risk benchmark, especially in the weakest month for crypto. Even with Ethereum’s better near-term ETF flows, Bitcoin maintains structural leadership. 🏆🏆

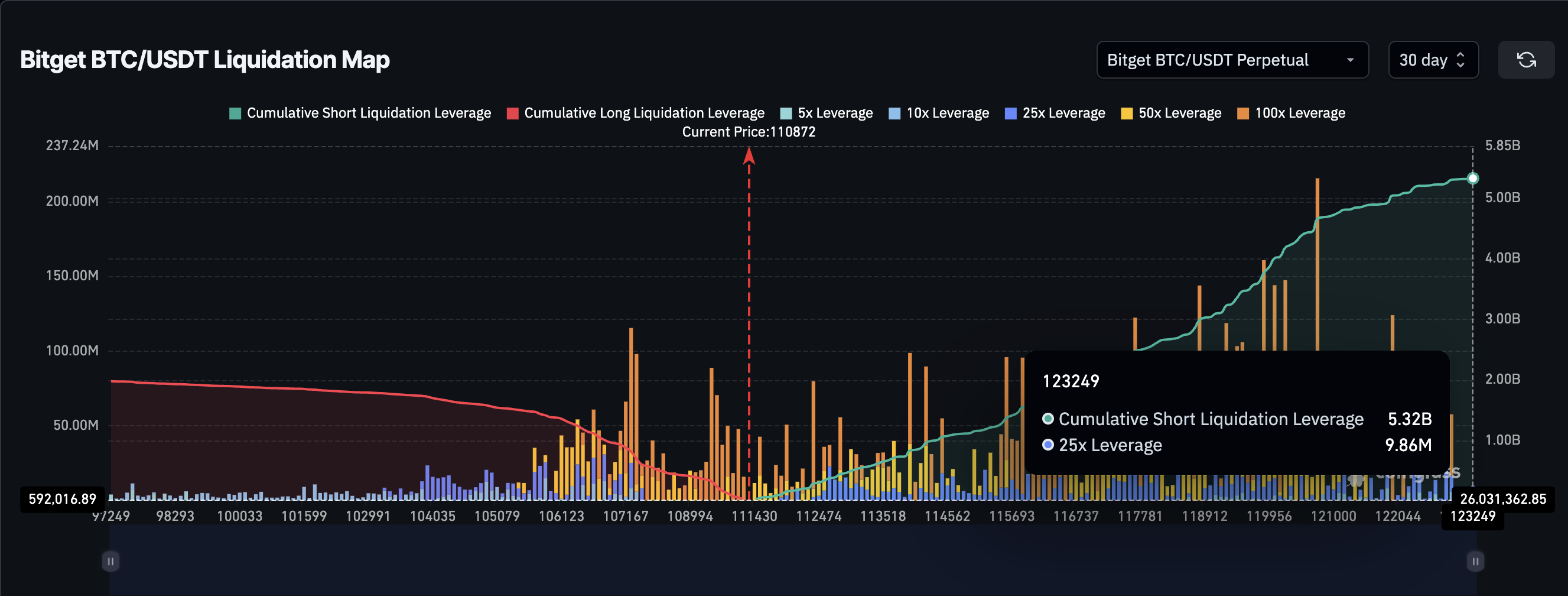

Short Squeeze Potential Tilts Toward Bitcoin

Another intriguing element is liquidation data. In the 30-day timeframe, Bitcoin has $5.24 billion in short positions stacked against just $1.83 billion in longs. This imbalance increases the likelihood of a short squeeze if prices rise. Ethereum, in contrast, presents a more balanced picture, with $6.55 billion in shorts and $6.10 billion in longs. 📉📈

If September brings any unexpected upside during what is usually the weakest month for crypto, Bitcoin is better positioned to rally sharply on forced liquidations. 🚀💥

The X Community also believes derivatives hold the key in September:

September Expectations vs. Reality

Everyone is repeating the same narrative right now: “September is always red.”

That mindset is exactly why most traders will end up on the wrong side.Here’s the truth:

– Yes, historically September has been weak.

– But markets don’t…

– CryptoStrix (@CryptoStrixx) August 30, 2025

Analysts Still Warn of Choppiness

Despite these setups, forecasts from analysts remain cautiously optimistic. For Bitcoin, they caution that failing to hold $107,557 support could lead to a deeper correction toward $103,931, even as upside remains possible if resistance near $111,961 breaks. For Ethereum, the outlook is similarly uncertain. Analysts highlight resistance around $4,579 and downside risks if the price closes below $4,156. Choppy range-bound movement remains the base case, reinforced by high profit supply and divergence on RSI signals. Selling pressure could still overshadow rallying attempts if the usual September narrative holds. 🌪️

September’s Outlook: Weakest Month for Crypto, But Context Has Changed

September has historically been the weakest month for crypto, with both Bitcoin and Ethereum struggling. The rare gains in 2023 and 2024 did little to alter this trend. However, 2025 presents a different setup: both coins are near record highs, ETFs are driving flows, and another rate cut is anticipated. The last September rate cut-a 50 bps move in 2024-aligned with stronger Bitcoin flows, not Ethereum. 📅📊

September is usually a bearish month for Ethereum.

Will this time be different?

– Mister Crypto (@misterrcrypto) September 1, 2025

In 2025, high profit supply and weak self-custody still point to potential selling. Both BTC and ETH may face headwinds, but if there is upside, Bitcoin is more likely to lead, given the increasing accumulation demand. Altcoins linked to Ethereum may not benefit, leaving the broader market under pressure. 🌠🔥

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Bitcoin’s Descent: Bounce or Breakdown? 🚀💸

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- USD THB PREDICTION

- KCS PREDICTION. KCS cryptocurrency

- The Unquenchable Appetite of Ethereum: A Tale of Desire, Dreams and Digital Chaos

- Ethereum’s Wild Ride: Whales, Wipeouts, and What’s Next? 🐳💸

2025-09-03 15:12