North America has somehow climbed to second place in the global crypto popularity contest, thanks largely to Americans who apparently treat Bitcoin like a Monopoly money subscription. The government’s recent nod to spot Bitcoin ETFs and its institutional “rules” (read: vague hand-waving) have convinced the public that crypto is now “legit.” Retail investors? Hooked. Institutions? Desperate to keep up. It’s like the difference between your neighbor who “loves art” and the guy who buys everything at the auction.

This surge has made the U.S. the region’s reluctant party host-everyone shows up, but no one knows what the dress code is.

America’s Crypto Dominance Explained

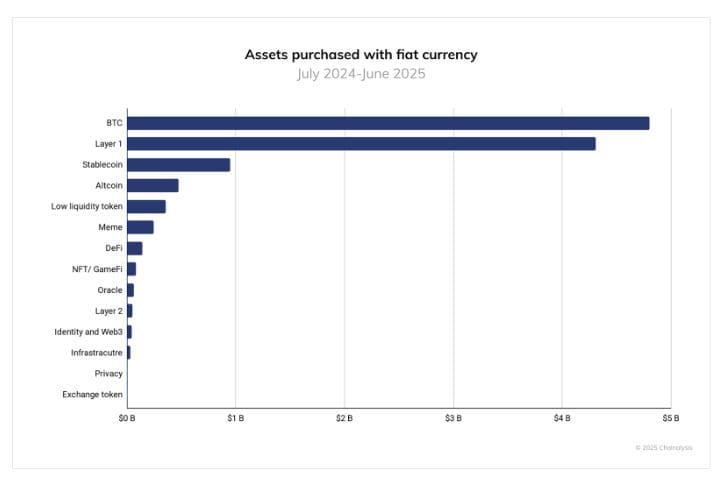

According to Chainalysis, the U.S. managed to secure second place in categories like centralized services (because nothing says “trust” like a middleman with a LinkedIn profile), DeFi usage (for those who enjoy financial jargon that sounds like it belongs in a sci-fi novel), and institutional activity (because adults also need to play with crypto). In 12 months, the U.S. processed $4.2 trillion in fiat-to-crypto transactions. For context, that’s enough to buy every avocado toast in the country for the next 47 years. South Korea, meanwhile, is playing catch-up with $1 trillion-because who needs a $4.2 trillion lead when you can just shrug and say “We did okay.”

Stablecoins? Still the crypto world’s version of emotional support goldfish. USDC’s rise has been less “global phenomenon” and more “regulated American bureaucracy,” while USDT’s dominance is now a footnote in the story of how the U.S. turned crypto into a bureaucratic puzzle. Monthly volumes swung wildly from $1.24 trillion to $3.29 trillion, peaking in late 2024-because nothing says “stability” like a number that changes faster than your dating app preferences.

APAC Leaves North America Behind

Asia-Pacific (APAC), the region where people still think crypto is a thing you “mine” in a cave, somehow outpaced North America by 69% in on-chain activity. India, Vietnam, and Pakistan are now crypto’s version of the Avengers-except their real-world powers include surviving government crackdowns and dodging sketchy exchanges. The U.S. can’t even compete with this crew’s enthusiasm; we’re still arguing about whether crypto is a “speculative asset” or a “revolution.”

Latin America isn’t far behind, with a 63% adoption spike that makes you wonder if they’re just using crypto to avoid their actual banks. Sub-Saharan Africa? They’re treating digital assets like Wi-Fi-essential, untrustworthy, and occasionally life-saving for remittances. Together, these regions are proving that crypto isn’t just for Wall Street types in ironic beanies; it’s for anyone who’s tired of waiting for the system to work. Meanwhile, the U.S. is still busy debating whether to regulate crypto or just throw it a party.

Read More

- You Won’t Believe Polygon’s Wild Stablecoin Frenzy—But POL Has Other Plans

- FLR PREDICTION. FLR cryptocurrency

- Brent Oil Forecast

- USD HKD PREDICTION

- GBP AED PREDICTION

- Shiba Inu’s Death Cross: A Drama Queen’s Fakeout 🎭💰

- EUR AED PREDICTION

- EUR PLN PREDICTION

- CRV PREDICTION. CRV cryptocurrency

- Ethereum Staking: From Panic to Party Time! 🎉💰

2025-09-03 15:32