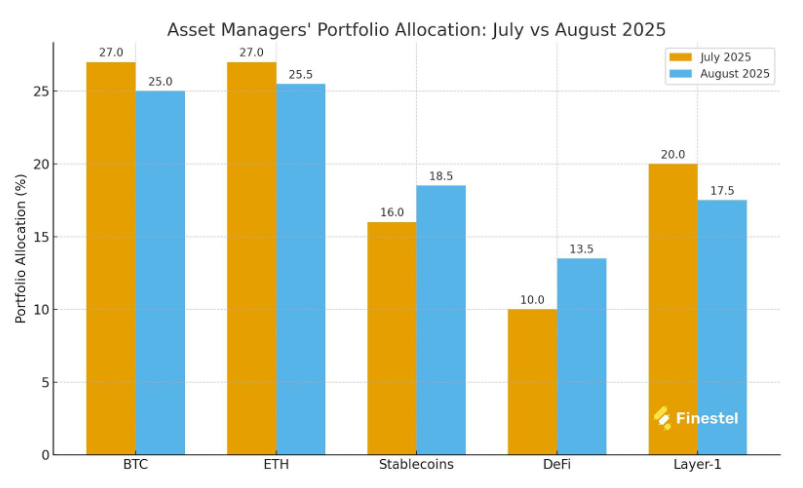

August 2025 in crypto-land was rather like riding a magical rollercoaster engineered by a drunken wizard – Bitcoin skyrocketed to dizzying new heights only to be brutally dunked back near $113,000 by an overly enthusiastic whale who apparently forgot his finger size. Meanwhile, the sharp-eyed asset managers were quietly swapping their Bitcoin hats for shiny Ethereum and DeFi tokens, like sly wizards hedging their bets before the next spell went sideways.

scaling down Bitcoin just when it peaked (because who doesn’t love timing the market perfectly?), while scooping up Ethereum, DeFi magic beans, and sturdy stablecoins for a bit of peace of mind.

One Big Whale (Not the Friendly Kind)

Bitcoin kicked off August lounging casually between $112,000 and $119,000 amid a cocktail of weak U.S. jobs numbers and tariff whispers. Things looked up mid-month when Jerome Powell, the Fed’s own grand conjurer, hinted at a possible rate cut in September.

This sparked BTC to balloon to a fresh all-time high of $124,400, briefly lifting the entire crypto kingdom over the $4 trillion mark. But just as the crowd was reaching for their celebratory hats, a whale (who apparently mistook their keyboard for a piano) slapped down a monster 24,000 BTC sell order. That blunder triggered about $900 million in liquidations and slammed Bitcoin back down to $113,000 by month’s end. Still, Bitcoin closed on a modestly smug note – up 2.5%, as if nothing much had happened.

Ethereum, meanwhile, strutted onto the stage like the overachieving understudy finally hitting their mark, climbing 12.8% to $4,600. ETF inflows, institutional staking flirting around 29.4%, and DeFi activity expanding like a well-fed balloon all helped ETH steal the spotlight after BitMain’s Tom Lee announced plans to add some ETH bling to their balance sheet.

DeFi tokens also got their moment of glory. Platforms like Pendle and Hyperliquid boasted total value locked of $6.75 billion and $3.38 billion respectively-enough to make any yield farmer drool. Add ETH staking yields between 5-10%, “irresistible” to money managers chasing predictability, and you have a recipe for DeFi nirvana.

“DeFi allocations climbed as pros leaned into real-world asset (RWA) tokens and yield farming strategies. Compared to July’s modest 10%, August saw DeFi’s share leap to 13.5%.”

– Finestel, forever obsessing over numbers

Altcoins had their own little party too. Solana (SOL) shot up 15% to $200, XRP (fresh off beating the SEC) climbed 10% to $3, and Chainlink (LINK) soared 18%. Meanwhile, messy memecoins got politely shown the door as asset managers sought “more compliant” company.

Stablecoins, ever the steady tortoise in this hare-brained race, quietly bulked up their market cap to $280 billion, with portfolio allocations growing from 16% to 18.5%. Because who doesn’t like a bit of boring stability when everything else looks like a fireworks show?

Institutional and regulatory bravado also shape-shifted August’s narrative: Bitcoin ETFs sucked in $219 million daily, Ethereum ETFs gulped $900 million weekly, and corporate treasury giants like Google and Wells Fargo flashed their crypto shopping lists. Meanwhile, in the U.S., fresh 401(k) approvals and stablecoin regulations unlocked a floodgate of potential liquidity.

According to the mystical math of Bitwise analysts, even a modest 1% inflow from 401(k) assets could nudge Bitcoin’s price north of $193,970. A whopping 10% shift might ramp that to nearly $869,000-if only markets behaved like obedient riddles.

“In the U.S., 401(k) crypto approvals and new stablecoin rules unlocked billions in potential inflows. Across the pond, Europe’s MiCA and Asia’s revamped licensing regimes added clarity to the chaos.”

– Finestel, delivering clarity amidst the crypto fog

Finestel wrapped up the month’s madness by advising that August was more about fortifying the castle walls than storming new territories. Their savvy allocation advice for what some whisper will be a treacherous September? Bitcoin and Ethereum holding roughly 50%, stablecoins near 19%, DeFi and RWAs at 14%, and a sprinkle of Layer-1 altcoins rounding off the mix at about 17%.

So, if July was a wild carnival, August was more like a chess game played by very nervous grandmasters. In the world of crypto, you don’t just survive by riding waves – you master the art of making strategic duck faces at the storm and letting the data do the heavy thinking. 🦆💼

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- USD CNY PREDICTION

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

2025-09-03 21:57