Bitcoin, the defiant nobleman, clings to its £110.5K throne, defying the whims of the market. Its total market capitalization, a gilded crown of £2.20 trillion, glints with uncertainty. Over the last hour, it flirts with prices between £110,700 and £111,010, while the trading volume, a fickle lover, dances at £36.27 billion. The intraday range? A rollercoaster from £110,344 to £112,502-oh, the drama! 🎭

Bitcoin

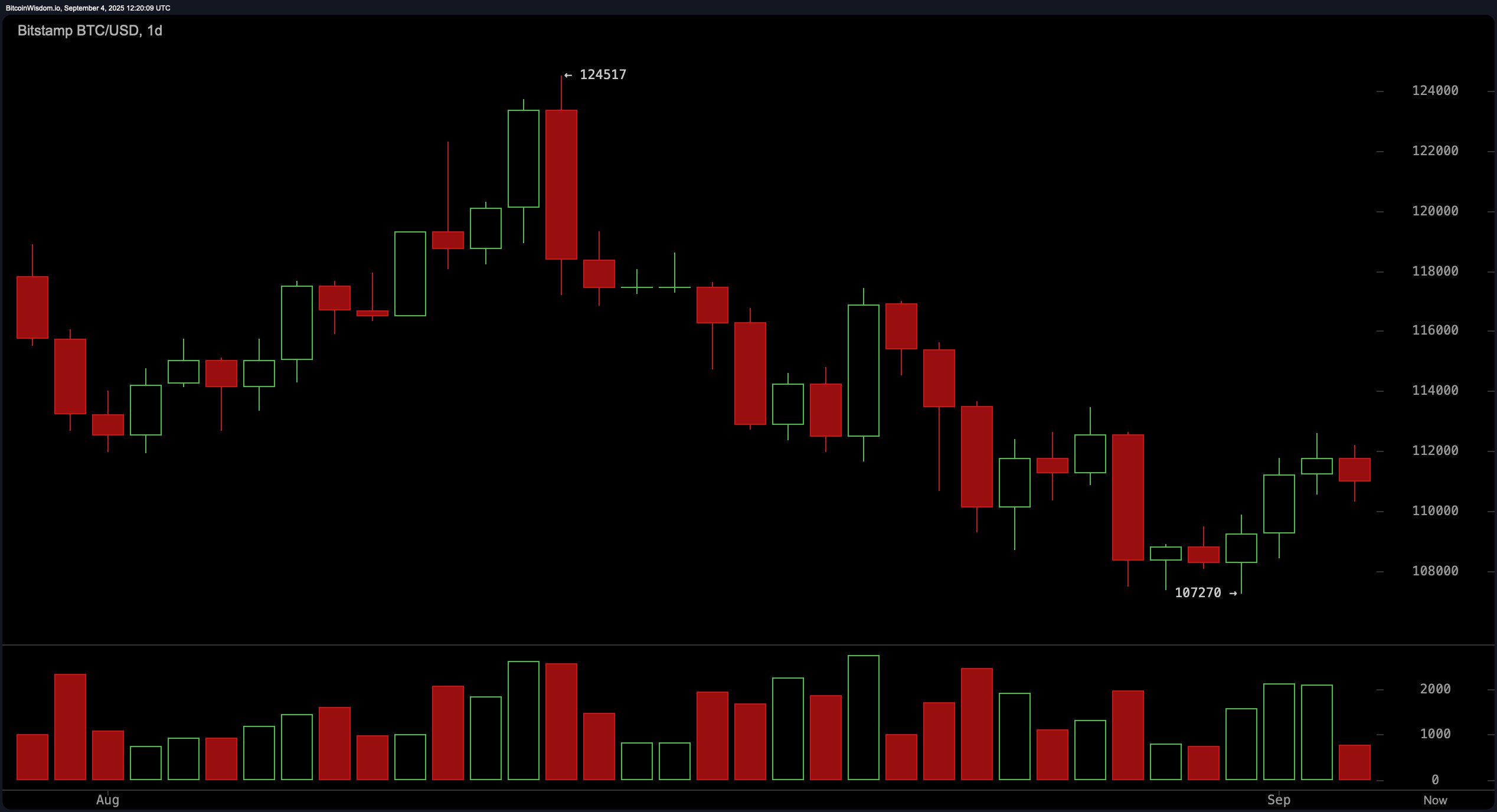

On the daily chart, Bitcoin enters a consolidation phase, a weary knight retreating to his castle after a skirmish at £107,270. Price action, a series of higher lows and closes, whispers of a possible short-term reversal. The EMA (10-day) stands at £111,037, while the SMA (10-day) hovers at £110,442-optimism, but bearish pressure looms above the 20-, 30-, and 50-period MAs, like a shadowy sorcerer in the £112,000-£115,000 realm. The RSI, Stochastic, and CCI, all neutral as a stone, mirror the market’s indecision. 🧐

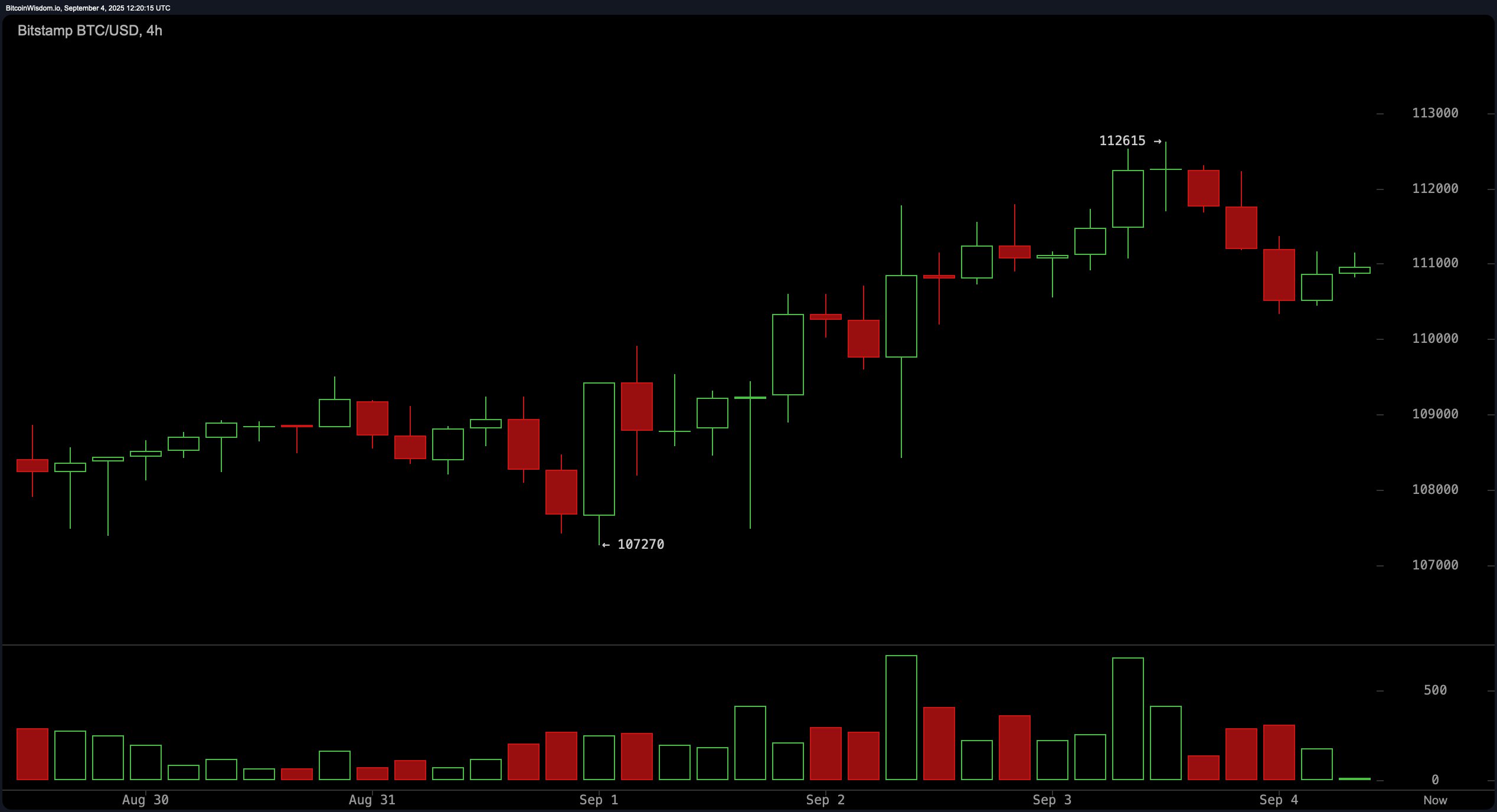

The 4-hour chart, however, wears a more bullish grin. After a valiant bounce off £107,270, Bitcoin stages a V-shaped recovery, peaking near £112,615. Though it has since retreated, it clings to £110,800, bolstered by rising volume. The momentum oscillator, a cheerful jester, glows at 970, while the MACD, a grumpy old man, grumbles at −1,547. A mixed bag of hope and despair. 🤷♂️

The 1-hour chart, a cunning trickster, shows higher lows after its fall from £112,615. Buyers, like loyal subjects, gather around £110,300-£110,800, while red volume candles fade. Traders, ever the gamblers, eye scalping opportunities above £111,200. A close above £112,000 could reignite the rally. But beware-the market is as fickle as a drunk tightrope walker. 🕷️

Oscillators, the tragic heroes of this tale, sit in neutral zones, their verdicts as clear as mud. The MACD, a bearish curmudgeon, clashes with bullish momentum, creating a divergence that traders must watch like a hawk. The market, a fickle lover, awaits a catalyst to choose its path. 🌪️

If Bitcoin sustains support above £110,500 and breaks decisively above £112,500 with rising volume, the technical structure favors a continued rally. Momentum indicators, like loyal courtiers, nod in approval. 🎩

Bear Verdict:

A failure to hold above £110,000, especially with an hourly close below £110,300 on increasing volume, would signal a breakdown. The price, a wobbly candle, could flicker toward £109,000 and retest the £107,270 support. Mixed signals and mid-term MAs, like scheming courtiers, reinforce the risk. ⚔️

Read More

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- USD CNY PREDICTION

- Silver Rate Forecast

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Brent Oil Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

2025-09-04 15:59