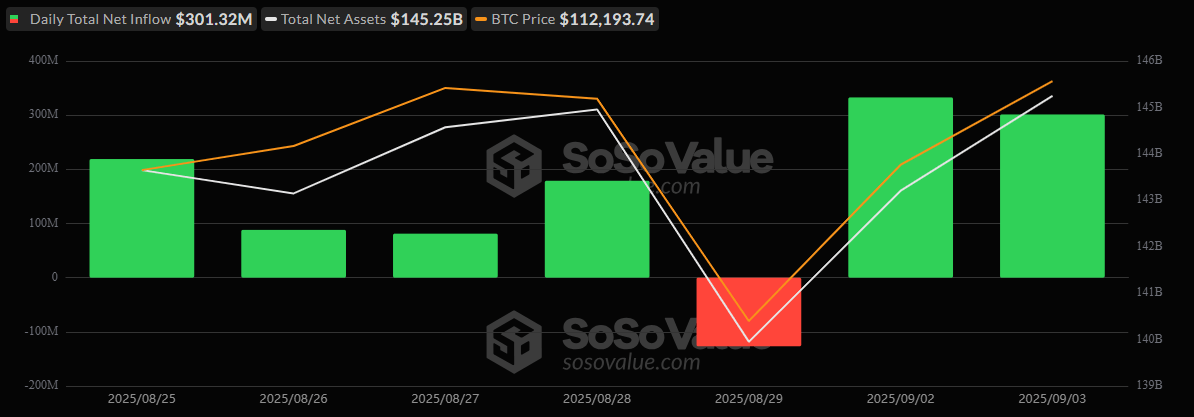

In a turn of events that could make even the most seasoned Wall Street owl raise an eyebrow, Bitcoin ETFs decided to throw a party with a hefty $301 million in inflows on September 3rd, leaving Ether ETFs sulking with their third day of outflows-losing a staggering $38 million. Apparently, someone forgot to tell Ether it’s supposed to stay resilient. 🤔💸

Crypto ETFs Go Rogue: BTC Blooms While ETH Takes a Dip, Flies the Coop

It seems like the momentum has taken a sharp turn back towards bitcoin, which is now strutting around with a swagger, while Ether-well-Ether’s just busy counting the leaves falling off its portfolio. Wednesday’s ETF flows demonstrated what could only be described as a “heavily weighted” tug of war with investors swinging their capital like a drunken monkey on a banana. 🍌

Bitcoin ETFs amassed a cool $301.32 million in inflows, with the superstar Blackrock’s IBIT taking most of the cake-an impressive $289.84 million. Grayscale’s Bitcoin Mini Trust? $28.83 million. Fidelity’s FBTC? A modest $9.76 million. Valkyrie’s BRRR decided to dip its toes with a sweet $790.88k. Nice. 💼💰

There was one tiny drama queen-Ark 21Shares’ ARKB-logging a $27.90 million outflow, probably saying, “I’m out. Bye.” Overall, the trading volume kept steady at a mind-boggling $2.78 billion-because who doesn’t love a good number-and Bitcoin ETF net assets climbed to a rather hefty $145.25 billion. 🎯

Meanwhile, the less amused party-Ether ETFs-took another hit, losing $38.24 million, which, considering current trends, is basically Ether’s version of a “bad hair day.” Some glimmers of hope appeared with Fidelity’s FETH grabbing $65.78 million, Grayscale’s Ether Mini Trust snagging $26.55 million, and Bitwise’s ETHW inviting $20.81 million in inflows-proof that perhaps Ether’s still got its feelings intact, somewhere backstage. 🥲

But then-dramatic pause-Blackrock’s ETHA decided to make a grand exit, shedding a whopper $151.39 million, making sure Ether is now officially in the red for three days straight. Total traded value? A cool $2.07 billion-a reminder that in the world of crypto, “steady” is just another word for “chaotic.” 🚀

And so the divergence persists, casting a spotlight on investor hesitation around Ether, while Bitcoin-once again-stands tall, clenching its fists as the preferred institutional choice for the time being. Guess Ether will have to try harder next time. Or maybe just buy a nice sandwich. 🍔

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Shiba Inu Shakes, Barks & 🐕💥

- USD CNY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Silver Rate Forecast

2025-09-04 16:58