The price of XRP, that most enigmatic of digital tokens, now lies in a state of weary stagnation, as if the very essence of its value has been sapped by the relentless march of time. At $2.82, it clings to existence like a beggar at a feast, having slipped 7% in a week and 6% in a month, though its three-month ascent of 32.5% whispers of a brighter fate, if only the stars align.

Behold, the spot market, that fickle lover, locked in a rigid embrace, neither embracing nor rejecting, but merely enduring. The buyers, like timid sparrows, perch on the edges of dips, while the sellers, those relentless hawks, swoop to scatter them. A dance of futility, where neither side dares to claim victory.

Buyer-Seller Standoff Keeps XRP in Check

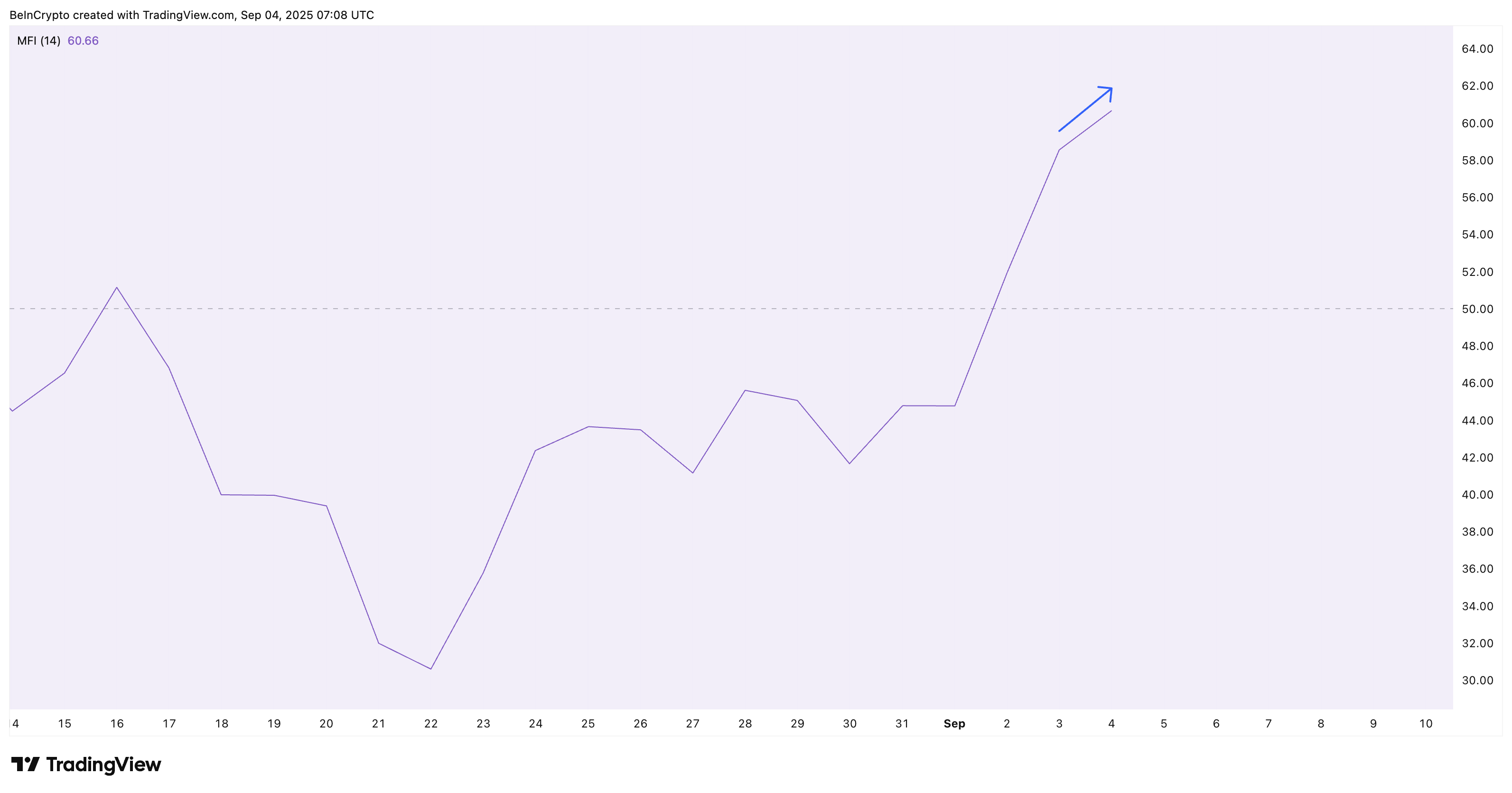

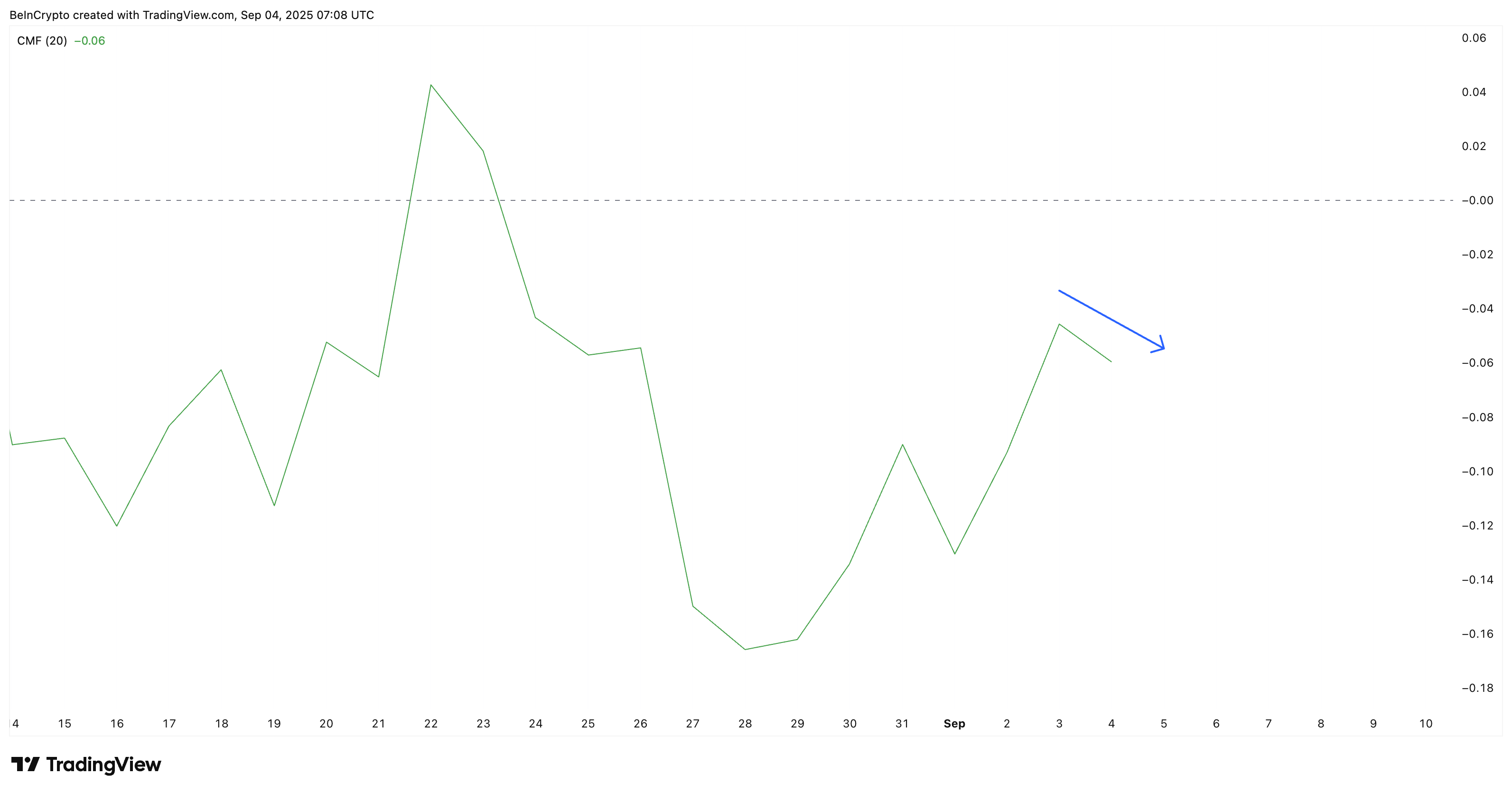

Two gauges, like twin sentinels, stand watch. The Money Flow Index, that vigilant sentinel of market sentiment, has ascended, yet the Chaikin Money Flow, that cautious observer, has descended, creating a paradox that leaves traders in a state of bewildered contemplation. 🧐

This contradiction-money flowing in, yet capital retreating-mirrors the human soul’s eternal struggle between hope and fear. Traders, like wayward pilgrims, buy with trembling hands, while selling continues with the grim determination of a man condemned to the gallows. A tug-of-war where the rope is frayed, and the outcome is as uncertain as the dawn. ⚖️

Thus, XRP remains in neutral, a ship adrift on a sea of indecision, until one side, like a storm, overwhelms the other. Yet, amid this despondency, a flicker of hope persists, as if the cosmos itself whispers, “Not yet.”

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. 📧

Derivatives Offer Short Squeeze Hope

If the spot market cannot decide, let the derivatives, that sly foxes of finance, take the stage. Liquidation maps reveal a cluster of shorts, like a pack of wolves, lurking above $3.18. On Bitget, a tempest of $1.79 billion in short liquidations clashes with mere $617 million in longs, while Binance mirrors this imbalance, with $430 million in shorts against $152 million in longs. A battlefield where the shorts, though numerous, are as vulnerable as a moth near a flame. 🔥

This precarious balance leaves room for a short squeeze, a sudden eruption of chaos that could transform a stalemate into a crescendo of upward motion. Yet, as with all things in this world, the specter of risk looms ever near.

For should the price dip below $2.69, the longs, those brave souls, may find themselves in a perilous position, their bets unraveling like a tapestry torn by a child’s hands. A descent into deeper correction, where despair reigns supreme. 🌑

XRP Price Action Outlook: $2.69 or $2.91 Will Decide

For now, XRP, that most stubborn of creatures, trades within a descending triangle, a structure that leans bearish unless the stars decree otherwise. Sellers, those grim reapers of the market, hold the reins, capping any upward aspirations. 🧱

The first glimmer of hope arrives if the price reclaims $2.91, a threshold that could weaken the triangle’s grip and open the gates to $3.00+. Yet, for the shorts, this would be a moment of dread, as their vulnerabilities lie in the shadows of this level. 🕳️

On the downside, a fall below $2.79 exposes $2.69, a support that, if breached, could unleash a torrent of long liquidations, dragging XRP into the abyss. A battle of wills, where the victor remains unknown, and the outcome hangs by a thread.

Thus, the struggle continues: buyers, though present, are weak as a leaf in the wind; sellers, the masters of the structure; and derivatives, the wild card in a game where the rules are ever-changing. For now, the only hope for the bulls is that the overloaded short side, like a dam bursting, unleashes a flood of upward momentum. 🌊

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- USD CNY PREDICTION

- Gold Rate Forecast

- Shiba Inu Shakes, Barks & 🐕💥

- Brent Oil Forecast

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Silver Rate Forecast

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

2025-09-04 19:04