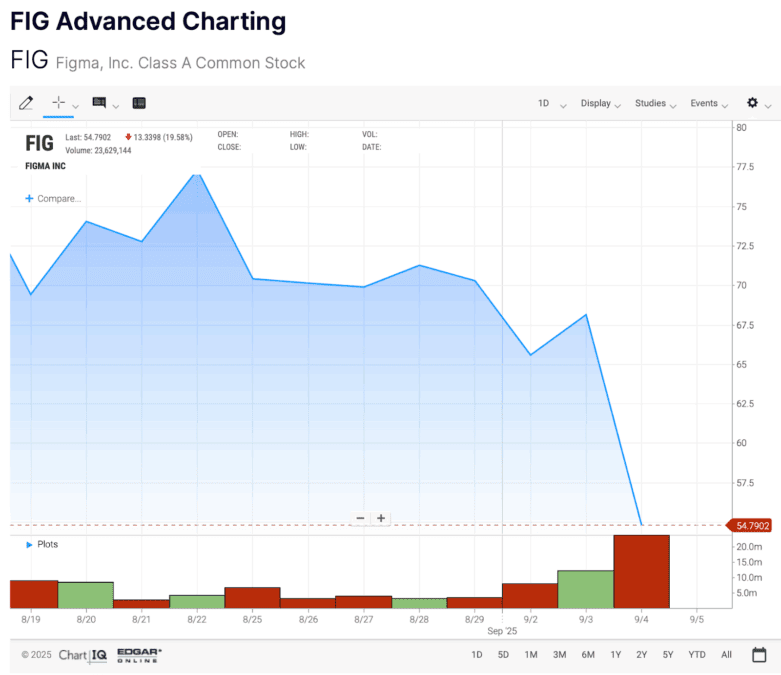

It was in the quiet hour after trading, that Figma, the celebrated artisan of design software, suffered a blow: its shares plummeted by fourteen percent. One can imagine the faces of investors-at first glowing with the rapture of revenue exceeding their expectations, and then paling as the mood turned, as moods so often do in the halls of commerce, toward something altogether darker. The cause of their disquiet lay not in the numbers, but in the specter of time and cryptic prophecy: the expiration of the lockup and the company’s flirtation with the enigmatic Bitcoin.

Bitcoin: The New Balalaika on the Corporate Ledger

Sifting through the earnings report, there amid the pages gilded with the ink of ambition, investors discovered a trove-or perhaps a Pandora’s box: $90.8 million nestled in a Bitcoin ETF, part of a cash mountain rising to $1.6 billion. The CEO, Dylan Field, offered reassurance as only one who is not a Russian novelist can: “We’re not trying to be Michael Saylor here,” he proclaimed, evoking the specter of crypto maximalists with the same casual indifference as a farmer discussing last year’s harvest. One pictured a man gazing at the horizon, wondering if the next storm will bring rain or only more headlines on financial news sites.

And so, Figma joined the growing league of tech firms who dabble in crypto strategies. They are not warriors nor priests-they are balance sheet chess players, sliding the Bitcoin rook forward while looking sidelong at napping regulators and hungry rivals. BitMine Immersion with its Ethereum, Strategy with its Bitcoin-each company sheltering under the digital wing, hoping it is not a vulture.

The Great Unveiling: Shares, Bitcoin, and Wall Street’s Grand Carnival 🎭

Here then, as in Tolstoy’s great gatherings, the crowd grew restless upon hearing of the lockup expiry: September the fourth, when one quarter of employee-held shares would flood the market like peasants streaming through a breached dam. August 2026-another milestone, another festival of uncertainty. And with Bitcoin dancing on the ledger, volatility leapt like a bear entering a ballroom.

Yes, the earnings outperformed-but was it victory, or victory’s shadow? The market reaction, the trembling hands grasping at digital coins, showed more than profit: it displayed the new unease about crypto exposure in public equity. Nasdaq’s scrutiny tightens, and firms cling to bitcoin, their new talisman-a gesture at strategy, a wink at danger.

Thus, Figma’s descent stands as a parable for our times. Bitcoin holdings may signal cleverness, they may signal folly, but mostly they signal this: even as the world changes, Wall Street remains a place of questions, not answers. Somewhere, in a dacha far from Moscow, Tolstoy might nod with amusement-or perhaps with weary resignation-at the spectacle of men and women once more trying to outwit fate with accounts and algorithms. Or, as the contemporary analysts put it: “to the moon-unless the lockup drops us first.” 🚀😅

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- USD CNY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Cardano vs. Quantum: Charles’ ‘Clinic’ Chaos

- Ethereum’s Rarely Seen Oversold Signal: Rebound or Just a Brief Respite?

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

2025-09-04 23:53