So, there I was, minding my own business, sipping on a latte and scrolling through crypto news when I stumbled upon something that made me spit out my soy milk all over my laptop. Ethereum, that darling of the digital world, has apparently entered what they call a “consolidation phase.” Translation: it’s taking a little breather after its wild dance around the $4,500 mark, now hovering somewhere above $4,250. Who knew crypto needed naps too?

But here’s where things get really interesting. The market, always the drama queen, is suddenly unsure if Ethereum is going to take a nosedive or if it’s gearing up for another grand entrance. Yet, amidst all this uncertainty, the big boys-let’s call them the crypto whales-seem to be having a field day. According to the illustrious Darkfost, these whales are making waves, not by selling their ETH, but by moving it out of Binance and into the wild world of decentralized finance. It’s like they’re saying, “Why settle for a fish tank when you can swim in the ocean?”

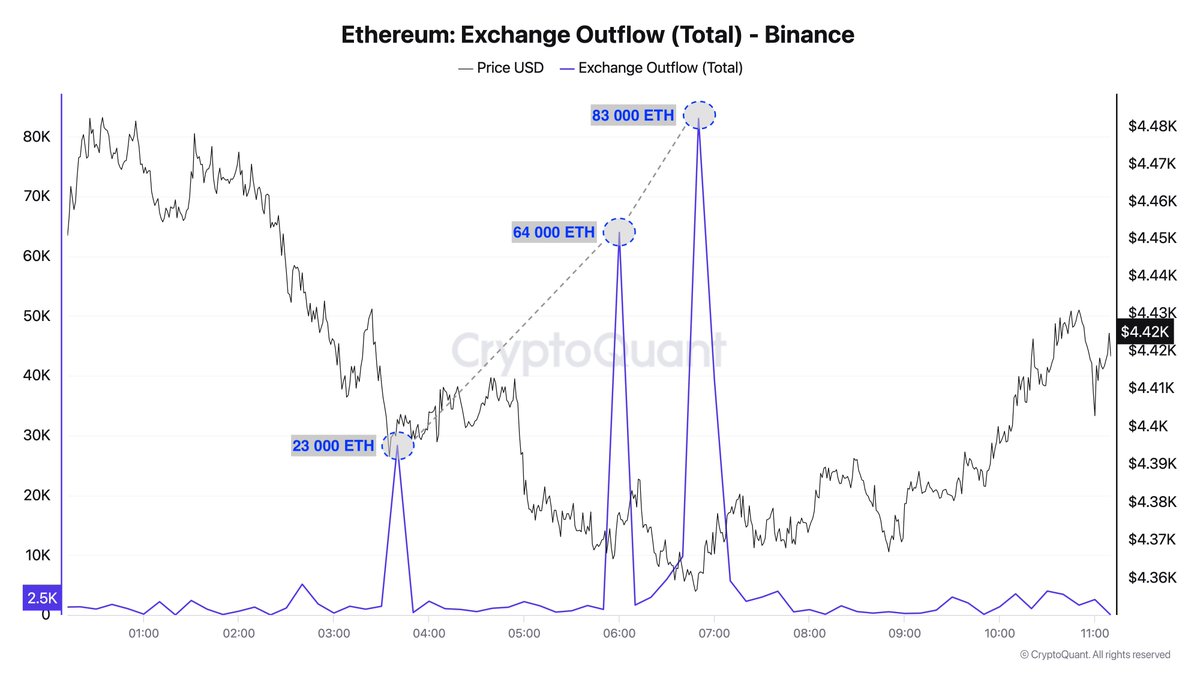

And let me tell you, these aren’t just small fry. We’re talking about transactions that would make your head spin. One moment, 23,000 ETH disappears, then 64,000 ETH, and finally, a whopping 83,000 ETH. That’s nearly $750 million worth of Ethereum, folks! It’s enough to buy a small country-or at least a really fancy yacht. These moves are not just about relocating assets; they’re a bold statement of confidence in Ethereum’s future. It’s like the whales are telling us, “We believe in this, and we’re putting our money where our mouth is.”

Now, if you’re thinking, “Well, that’s all well and good, but what does it mean for the little guy like me?” Fear not, dear reader. The fact that these whales are moving their ETH to platforms like Aave suggests they see long-term potential. They’re not just sitting on their assets; they’re actively using them to generate more wealth. It’s a bit like planting seeds in a garden-you know the flowers will bloom eventually, but you have to be patient and nurture them.

So, as Ethereum continues to test its support levels and navigate this period of consolidation, the actions of these whales are a beacon of hope. They’re not just weathering the storm; they’re preparing for the next big wave. And who knows? Maybe, just maybe, we’ll all be surfing that wave together sooner than we think. 🌊💪

But wait, there’s more! If you thought the drama ended with the whale outflows, think again. The impact on Binance’s reserves has been noticeable, with the exchange’s ETH holdings dropping to 4.2 million. This decline in centralized exchange balances is often seen as a good sign, indicating strong demand as people move their coins into safer, more profitable hands. It’s like when you take your savings out of a low-interest bank account and invest it in something that actually grows.

And if that wasn’t enough to keep you on the edge of your seat, consider this: Ethereum’s recent outperformance against Bitcoin. While Bitcoin seems to be stuck in neutral, Ethereum is getting a steady stream of love from the whales. It’s a clear sign that the market still sees Ethereum as a star player, even during these quieter moments.

In the end, the strength of these outflows and the consistent demand for Ethereum suggest that the market might be laying the groundwork for the next big move. So, whether you’re a seasoned investor or just a curious onlooker, keep your eyes peeled. The show isn’t over yet, and the best part might just be coming up. 🎉🚀

Ethereum (ETH) is currently trading around $4,381, consolidating after a rollercoaster ride that’s kept it below the $4,500 resistance zone. The chart shows ETH holding steady at the $4,300 level, with the 200-period SMA (that red line) acting as a crucial support. As long as this level holds, Ethereum avoids a deeper dip. It’s like the market is playing a game of Jenga, and we’re all waiting to see which block will fall next.

The shorter moving averages-the 50 SMA (blue line) and the 100 SMA (green line)-are converging, which tells us the market is in a bit of a holding pattern. ETH has tried multiple times to break through the $4,450-$4,500 resistance zone, but it’s like trying to climb a greased pole. Sellers are keeping a tight grip, and buyers need a bit more oomph to push through.

For the bulls, breaking above $4,500 is the key to unlocking the next level of gains, aiming for $4,700 and beyond. But if the bears have their way and ETH drops below $4,300, we could see a retest of $4,200, and possibly even a slide down to $4,000. It’s a delicate balance, and only time will tell which way the tide will turn. 🌞🌙

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Bitcoin Predictions: Dead Cat Bounce or Bullish Bliss? 😹💰

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- AI, Crypto, and Gen Z: The Future of Holiday Shopping is Here (And It’s Ridiculous!)

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

2025-09-05 18:25