Well, now, if you ever thought the Ethereum market was a calm lake, you’d better think again, because it’s more like a whirlpool these days, with whales stirring up quite the commotion. According to the folks over at Onchain Lens, one particularly savvy whale decided to cash in big time. This aquatic investor, who had been quietly gathering 3,289 ETH between September 2021 and December 2024 for a cool $6.43 million, decided to take a leap and deposited 2,074 ETH, worth about $8.97 million, into Kraken. And just like that, a profit of $6.07 million 🐳💰.

A whale deposited the last 2,074 $ETH, worth $8.97M, into #Kraken, making a profit of $6.07M.

The whale accumulated 3,289 $ETH for $6.43M between Sept 4, 2021, to Dec 9, 2024.

Address: 0x92cbb22a9b9fc01da9914c9b39ed904dd61b859c

Data @nansen_ai – Onchain Lens (@OnchainLens) September 6, 2025

But wait, there’s more! Another whale, perhaps feeling a bit sea-sick, closed out a 15x ETH long position with a whopping $35.39 million loss. Not content with just that, this daring diver then took a 25x leveraged Bitcoin short position, valued at $122.6 million. One can only imagine the stomach-churning ride this must have been 🌊🌊.

And let’s not forget the good old Ethereum whale who had been as silent as a submarine for a while. This one moved 150,000 ETH to a staking address, according to EmberCN. It seems the ICO era isn’t over yet, as three wallets from those early days transferred a total of $646 million in ETH, marking their first activity since February 2022. Talk about waking up the sleeping giants! 🦕;

These transactions are just a small part of a larger trend where ICO whales are making a grand return. Last month alone, one whale sent $19 million in ETH to Kraken, while another moved 2,300 ETH to the exchange. It’s like a marine migration, but with digital dollars.

Traders Face Heavy Liquidations

Now, if you’re thinking all this whale activity is just a ripple in the pond, think again. Coinglass data shows that Ethereum’s total open positions are sitting at a whopping $9.04 billion, with short positions slightly edging out the longs at 52.86%, totaling $4.78 billion. The longs, at 47.14%, are valued at $4.26 billion. Margins are still balanced, with a $1 billion total margin split between longs at $473.25 million and shorts at $527.97 million. But the losses are where the real story lies, reaching a staggering $237.29 million, with short positions taking the brunt of it at $215.31 million and longs down $21.99 million.

Funding fees are telling their own tale, with long traders paying $39.46 million while shorts raked in $138.86 million, indicating a strong bearish sentiment. It’s a bit like a tug-of-war, but with everyone pulling in different directions.

High Volatility Despite Bullish Ratios

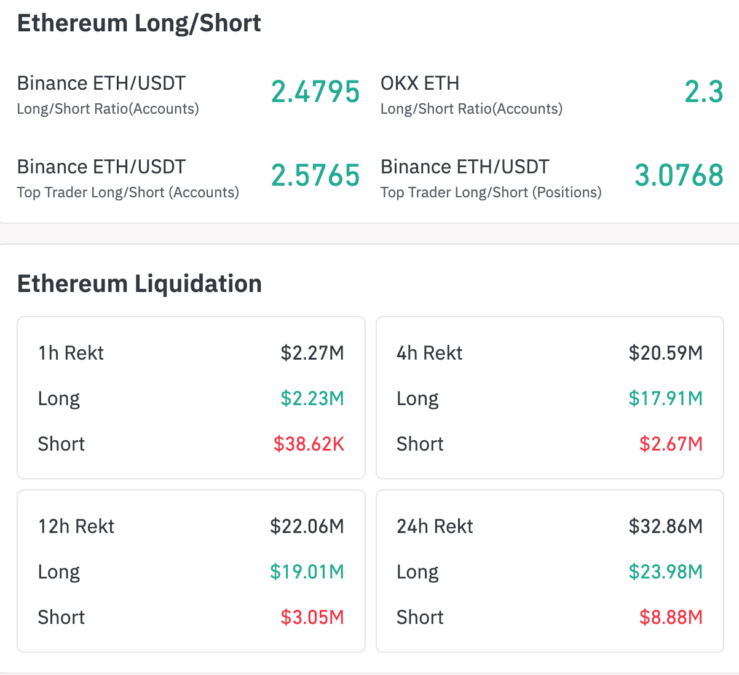

Despite the bearish positions, sentiment on exchanges is surprisingly bullish. According to the platform data, the ETH/USDT long-to-short ratio on Binance is at 2.48, and among the top traders, it climbs to 3.07. Over at OKX, the ratio is similarly optimistic at 2.3. However, over the last day, with $23.98 million coming from long liquidations and $8.88 million from the shorts, a total of $32.86 million in liquidations were recorded amid high volatility. Most of these $20.59 million liquidations happened in just about four hours, hitting the long traders the hardest.

Ethereum’s market is a wild ride right now. With big whale moves, heavy betting with leverage, and sudden liquidations, it’s a rollercoaster of opportunities and risks. So, buckle up, because it’s going to be a bumpy ride! 🎢;

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- Brent Oil Forecast

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- LUNC’s Wild Ride: Bull or Just a Bull🐂 in a China Shop?🛒

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

2025-09-07 00:06