In a move that screams “We’re hip with the kids,” Fidelity Asset Management quietly rolled out a blockchain version of its Treasury money market fund. Because who doesn’t want digital finance to feel like a rollercoaster where the safety bar is a smart contract?

Meet the Fidelity Digital Interest Token (FDIT)-basically one share of the Fidelity Treasury Digital Fund (FYOXX) but living its best life on the Ethereum blockchain. No paper, no middlemen, just pure internet magic.

What is Fidelity Digital Interest Token (FDIT)?

According to the oh-so-trusty RWA.xyz, this fund debuted in August, packing an exclusive party of only US Treasury securities and cash. Fidelity charges a modest 0.20% fee to keep the lights on, while the Bank of New York Mellon plays the responsible babysitter (custodianship, for those not fluent in financial jargon).

As of press time, FDIT’s assets have soared over $200 million, but here’s the kicker: there are only two holders. One’s holding about $1 million in tokens, and the other apparently just collected whatever’s left over from the blockchain couch cushions.

Fidelity’s lips are sealed tighter than a jar of pickles on this one-no public comments yet. Suspense is real.

This whole shindig follows Fidelity waving its magic wand at the SEC to get approval for an on-chain share class. Which is fancy talk for “We want to tokenize this baby, legally.”

So yeah, Fidelity is jumping headfirst into the real-world asset (RWA) tokenization pool, where traditional finance is trying to keep up with those shiny new fintech kids.

Over the past year, the global asset management bigwigs have been experimenting with blockchains to speed up markets, slash settlement times, and hopefully cut some overhead costs-because who honestly enjoys paperwork?

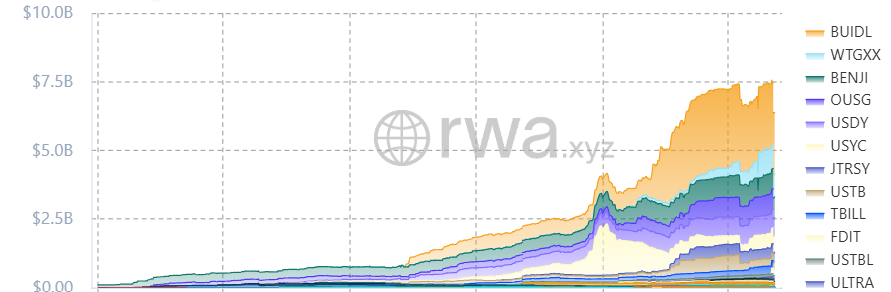

And guess who’s crashing the party? BlackRock. The absolute giant of asset management is flexing with its USD Institutional Digital Liquidity Fund (aka BUIDL), the biggest tokenized Treasury product out there with over $2 billion in muscle.

Not to be outdone, Franklin Templeton and WisdomTree have thrown their hats into the ring, helping push the whole tokenized Treasury market past $7 billion, RWA.xyz says. It’s like the tokenization Avengers assembling.

If you’re wondering whether this trend is just a flashy fad, McKinsey analysts have some news: tokenized securities might hit a $2 trillion market cap before the decade finishes. So buckle up, folks, the future’s looking blockchainy and possibly lucrative-or at least wildly entertaining. 🚀💰

Read More

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Breaking News: Fed Bids Adieu to Crypto Oversight! Is This a Good Thing? 🤔

- Bitcoin Miners Go Green as AI Deals and Bitcoin Surge Create Perfect Storm

- Trump’s Family Buys Wild Amount of Bitcoin Mining Machines?! ASIC Madness!

- Bitcoin ETFs Make It Rain While Ether Buys a One-Way Ticket Out 🪙📉

- 🚀 ETH’s Wild Ride: Will It Break Free or Crash Harder? 🌕

- Gold Rate Forecast

- Bitcoin Mania: Health Firm Goes Full Crypto! 🚀

- Shiba Inu Shakes, Barks & 🐕💥

2025-09-07 19:26