In the last 30 days, XRP’s price bravely attempted a synchronized swan dive, dropping 9.12% and landing elegantly somewhere south of the $3 mark. Volatility, which is essentially a well-dressed mathematical version of chaos, decided to attend the party uninvited-dragging XRP away from the coveted $3 zone like a petulant child stealing the last biscuit.

Historical XRP Data: Like Nostalgic Disco, but for Digital Money

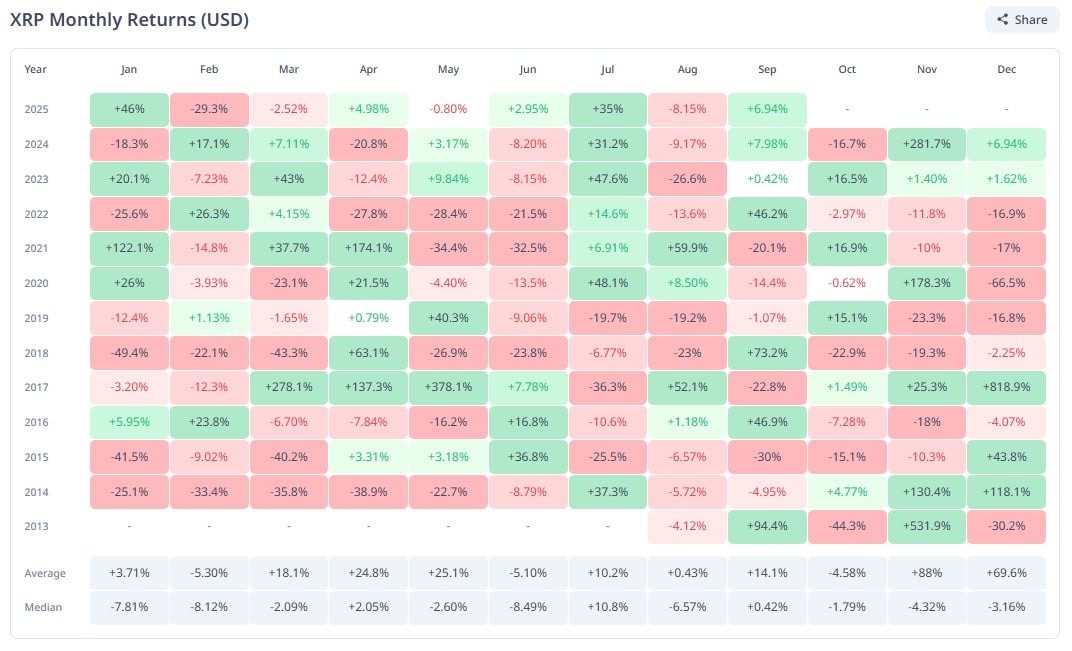

According to the cryptographically obsessed minds at Cryptorank, XRP has spent the last four Septembers donning green hats-closing each month in profit, possibly due to its deeply-held belief in autumnal magic. However, prior to this winning streak, XRP’s performance was reminiscent of a broken umbrella in a hurricane-three long years of soggy red numbers.

For those keeping score, XRP’s greatest growth spurt occurred during 2013, when it ballooned by 94.4%. This phenomenon can only be explained by sunspots or quantum entanglement, followed by a less dramatic but still suspicious 73.2% in 2018. Other years, like 2016 and 2022, scrambled in with 46.9% and 46.2%, which in crypto terms is the equivalent of discovering extra fries at the bottom of the bag-unexpected, joyful, but statistically unlikely. 🥳

On average, XRP enjoys a 14.1% September glow-up. Historical repetition, which the universe specializes in whenever it’s feeling cheeky, could send XRP galloping to $3.50 this September-unless, of course, somebody invents a quantum potato first.

Presently, XRP is trading at $2.96, or approximately the price of wanting to be $3 but having misplaced the last few cents under the couch cushions. It had previously flirted with $3.03 before selling pressure kicked in, possibly triggered by traders who remembered that profit tastes better than regret.

Should XRP repeat its 14.1% average September performance, there’s a mathematical chance it could reach $3.38. If the stars align, the moon winks approvingly, and the market collectively decides to stop binge-watching soap operas, it *could* reach $3.50. Or $3.51, but let’s not get carried away.

XRP’s RSI and Technical Indicators: The Oracle Speaks (and then sighs)

Meanwhile, XRP’s Relative Strength Index has been strutting around with the “overbought” sash, which in technical circles triggers mild panic and, occasionally, interpretative dance. This led to investors pulling back-fleeing the party like they’ve spotted someone approaching with a PowerPoint presentation.

Trading volume took the opportunity to decline by 32.45%, now lounging lazily at $4.42 billion. If XRP investors want to see $3.50, they must either pray to the gods of market repetition or invent time travel. 🕰️

U.Today notes that XRP’s technical indicators suggest this whole sideways price movement is merely a temporary mood swing. The Bollinger Bands, meanwhile, are quietly preparing a bear trap, which is probably just a euphemism for “surprise party” in finance. If the price surges unexpectedly, bears may find themselves wishing they had RSVP’d ‘No’. 🐻🤦♂️

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- Bitcoin’s Descent: Bounce or Breakdown? 🚀💸

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- AI and Copyright: Mark Twain’s Take on the Modern Patent Circus

- Crypto Chaos: How Hackers Are Pulling Off the ‘Classic EIP-7702’ Wallet Heist

- Top 10 Fast-Growing Blockchains of 2025 – Who’s Gaining Users? 🎯

2025-09-10 16:10