At 8:45 a.m. Eastern, bitcoin was dancing at $113,366 per coin, a sum so astronomical it could make a gold-digger weep. Market capitalization of $2.25 trillion and 24-hour volume of $44.94 billion? A financial farce, really. The intraday range between $110,822 and $113,484 suggests the market is currently engaged in a modest waltz of optimism, all while pretending it’s not just playing with fire. 🦄

Bitcoin

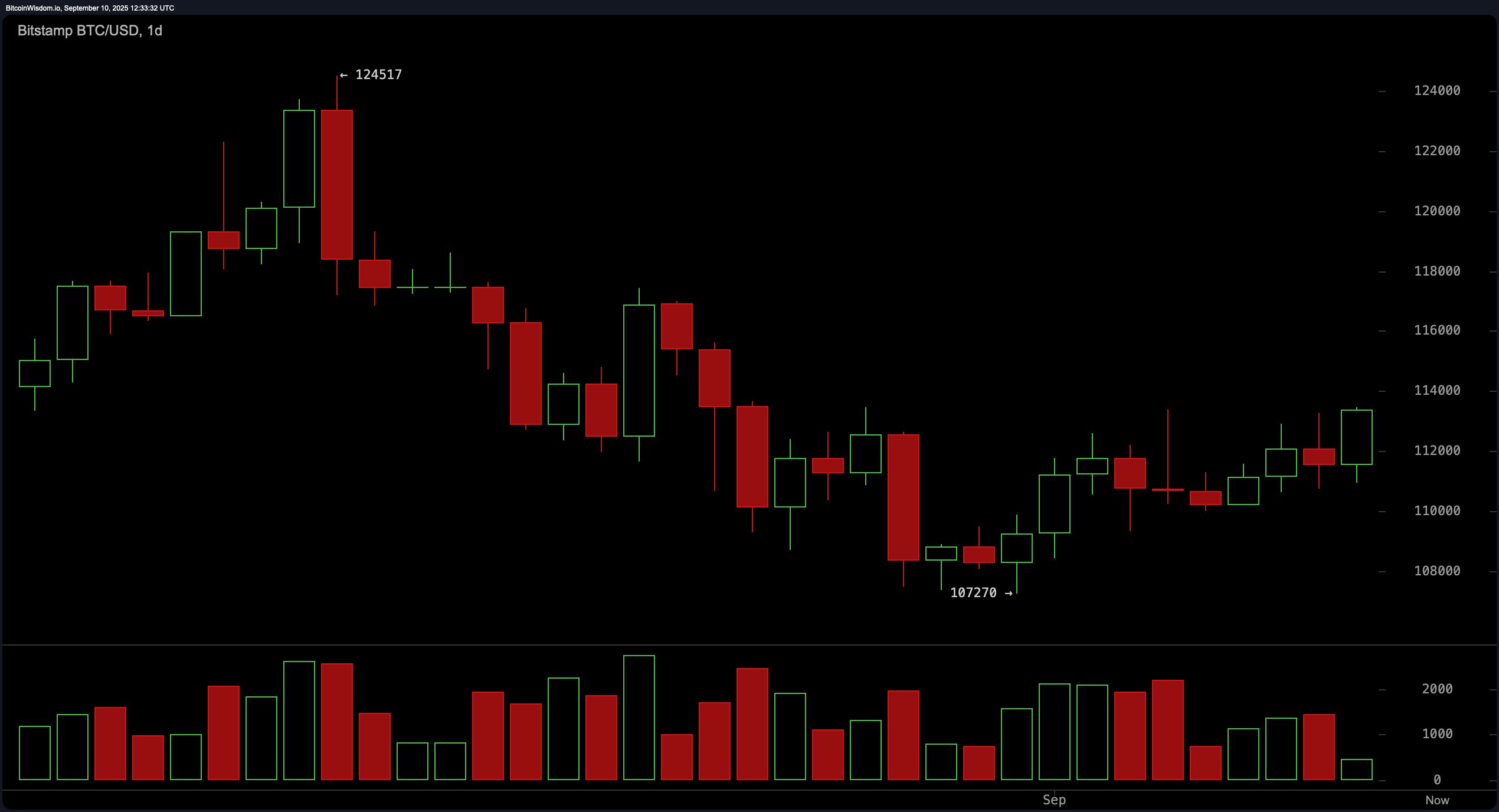

The short-term momentum? A cautious optimism, like a Victorian maiden eyeing a fortune cookie. Bitcoin’s recent drawdown recovery is a tale of two extremes: a fall from $124,517 to $107,270, followed by a bullish reversal so modest it could blush. The falling wedge pattern and bullish engulfing candles? A structural charade, really. Key resistance at $113,500-$114,000 looms like a dragon guarding a treasure chest. Support near $107,000? A safety net for the faint of heart. If the price stumbles into the $110,000-$111,000 zone with declining volume, consider it a dress rehearsal for a grander performance. 🐉

The 4-hour chart? A Shakespearean drama of stabilization and accumulation. A double bottom at $109,500-$110,000 marks the hero’s humble beginnings, followed by a breakout through a descending price structure. Volume analysis? A subplot of “healthy demand,” as if the market isn’t just bluffing with a deck of cards. The $111,800-$112,200 entry zone is a trap for the unwary, while the $113,500-$114,000 ceiling remains a villain only volume can defeat. 🎭

The 1-hour chart? A consolidation phase where Bitcoin climbed from $110,768 like a Victorian gentleman ascending a social ladder, only to stall at $112,500 with volume thinner than a poet’s wallet. Breakout traders, take note: entries above $112,600 require a volume spike as bold as a debutante’s corset. Conservative investors, meanwhile, may prefer accumulation near $111,800 with risk controls tighter than a miser’s purse. Profit-taking near $113,700? A risky waltz with fate. 💸

Indicators? A masquerade of neutrality. RSI at 50, Stochastic at 76, CCI at 35-all whispering “indecision” like a chorus of gossiping gossips. ADX at 14? A trendless tango. Yet the momentum oscillator and MACD flash bullish signals like a jester’s bells-bright, but not to be trusted. 🎩

Moving averages? A tale of two timelines. Short-term averages cheer the bullish action, while mid-range averages scoff with bearish disdain. Long-term indicators, however, smile knowingly, as if Bitcoin’s recovery is just the prelude to a grand opera. 🎭

As Bitcoin consolidates beneath resistance, volume becomes the star of the show. Traders, your cue: watch $113,500-$114,000 like a hawk eyeing a picnic. Fail to pierce this ceiling, and the market may stage a dramatic reversal. Succeed, and the path to $114,500-$115,000 opens like a velvet rope at a nightclub. 🎉

Bull Verdict:

Bitcoin remains in a bullish recovery phase, buoyed by short-term averages, chart patterns, and momentum indicators. A breakout above $113,000-$113,500 could trigger a retest of $114,000-a price so lofty it could make a phoenix weep. 🐉

Bear Verdict:

Despite Bitcoin’s recovery, resistance near $113,500-$114,000 remains a fortress. Oscillators yawn in neutrality, while mid-range averages scoff at bullish dreams. A failed breakout may send Bitcoin tumbling toward $110,000-$107,000, where the bears host a champagne toast. 🍾

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- USD THB PREDICTION

- Bitcoin’s Descent: Bounce or Breakdown? 🚀💸

- DeFi Meltdown: Yearn Finance’s yETH Pool Drained by a Rogue Algorithm 🤖💸

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- Dogecoin Price Analysis: Can DOGE Make a Comeback or Is It Just Another Doggone Fad?

- Bitcoin, Privacy & Sh*tcoins: The Wild Debate You Didn’t Know You Needed 🚀

- SHIB’s Secret Sauce: Gaming, Burning, and a Dash of Decentralization 🚀💰

2025-09-10 16:29