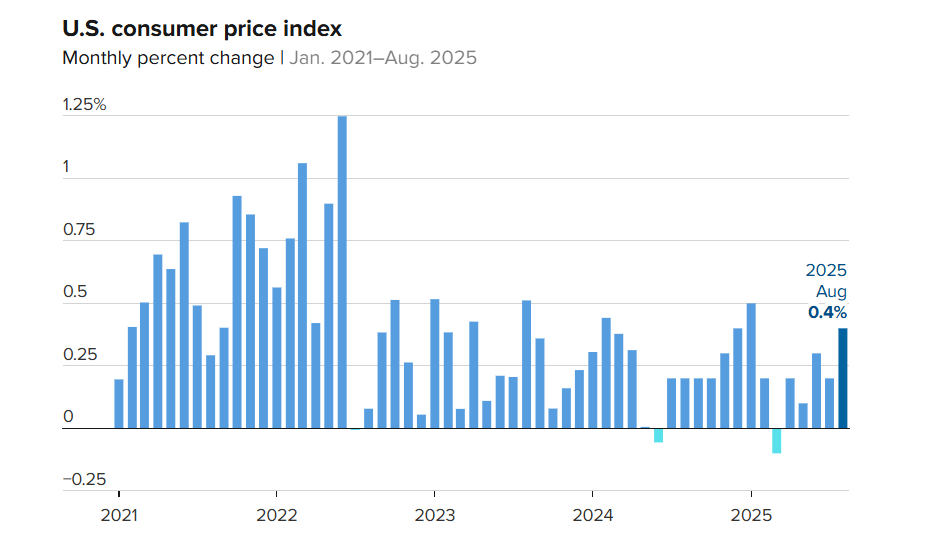

The Bureau of Labor Statistics published August’s Consumer Price Index (CPI) data just a day after it revealed lower-than-expected wholesale inflation.

BTC Takes a Tumble, Then a Triumphant Turn After Latest CPI Report

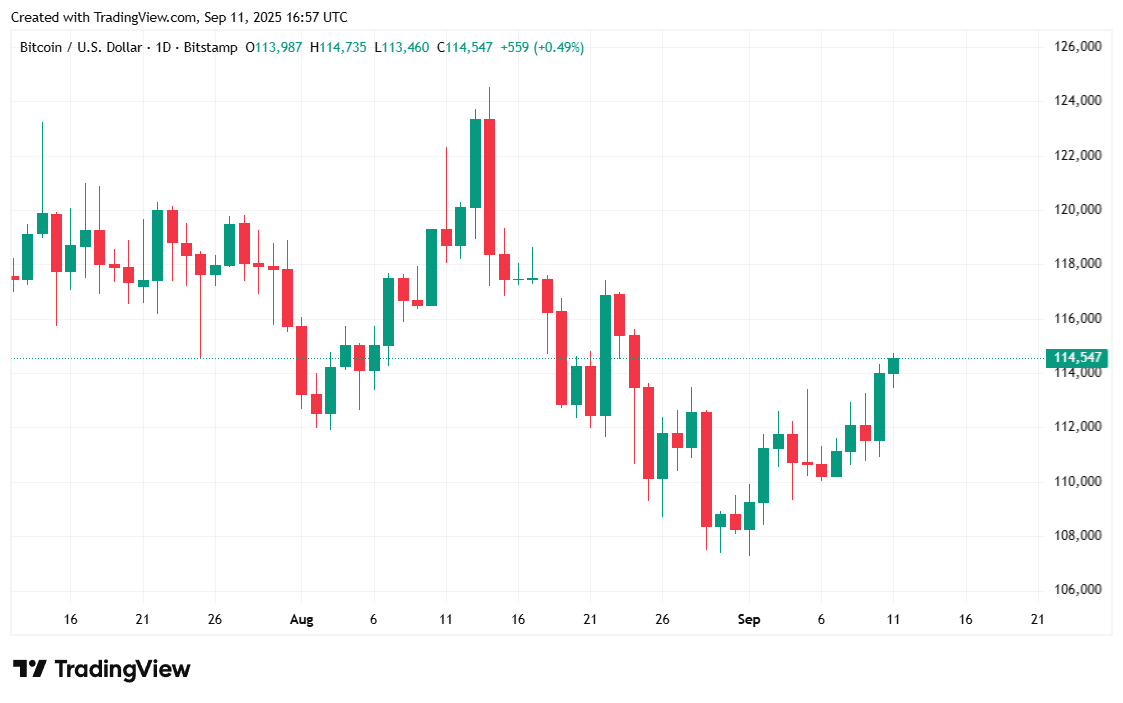

Bitcoin, the darling of the digital world, dipped to the dizzying depth of $113K on Thursday morning, after the Bureau of Labor Statistics (BLS) announced slightly hotter-than-expected inflation in its August Consumer Price Index (CPI) report. The news, oh the irony, comes just a day after the BLS revealed August wholesale inflation had the audacity to ease 0.1% as measured by the Producer Price Index (PPI).

But just hours after the CPI announcement, the cryptocurrency had the nerve to reclaim $114K as gloomy employment data from the Department of Labor showed a record jump in jobless claims, a development that dramatically increases the chances of an interest rate cut by the U.S. Federal Reserve next week. How delightfully dramatic!

August’s CPI climbed 0.4%, pushing the annual inflation rate to 2.9%, mostly spurred by increases in shelter costs. Core inflation, where the volatile categories of food and energy are removed, rose 0.3% and stood at an annual rate of 3.1%. The core figure is typically favored by the Fed, who, one might say, have a taste for the refined metrics of economic life. 🌟

But the real eye-opener was not inflation, but rather the surprise jump in weekly unemployment insurance claims from 236,000 to 263,000 for the week ending September 6. It’s the highest jump in jobless claims since October 2021 and will likely compel the Fed to finally start cutting rates to stimulate an increasingly sluggish economy. The anticipation of a rate cut appears to be what triggered bitcoin’s recovery soon after a somewhat disappointing CPI report. Oh, the suspense!

“The main market mover this morning is jobless claims, which came in far higher than expected,” said economist and Queen’s College President Mohamed Aly El-Erian on X. “Inflation may still sit above the Fed’s target, but the greater risk to the economy lies in the pace and severity of labor market weakening.”

Overview of Market Metrics

Bitcoin, ever the diva, was priced at $114,499.05 at the time of reporting, up slightly by 0.75% in the last 24 hours according to Coinmarketcap. The digital asset has been trading between $113,181.30 and $114,714.55 over the past day, a veritable rollercoaster ride of emotion. 🎢

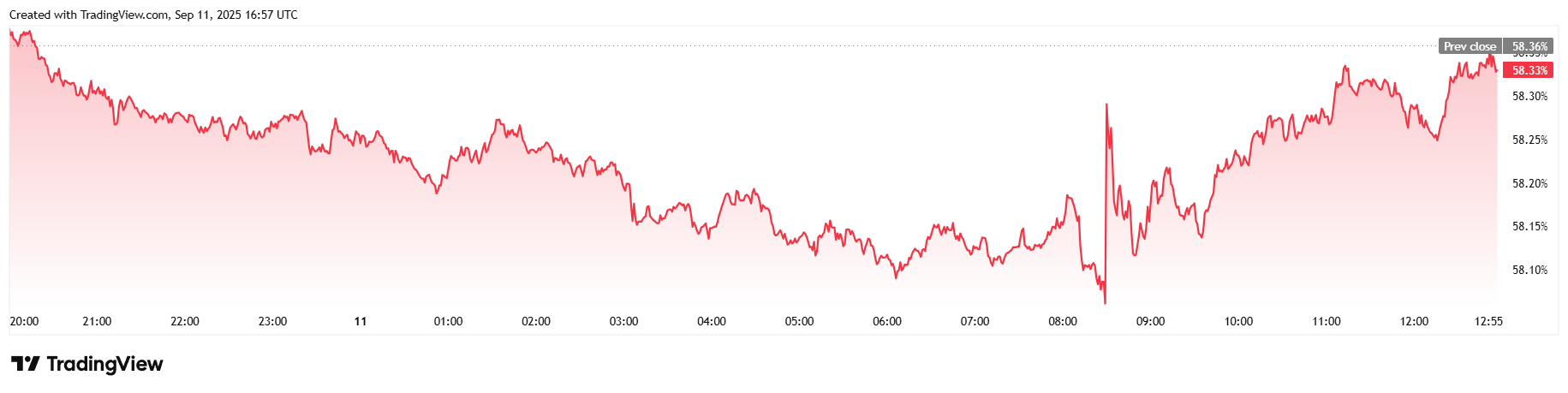

Twenty-four-hour trading volume eased slightly, dipping 8.45% since Wednesday and standing at $48.38 billion at the time of writing. Market capitalization was in line with price, climbing 0.72% to $2.28 trillion. Bitcoin dominance was mostly flat, inching downward by 0.06% to 58.33% over 24 hours. A slight wobble, but nothing a stiff drink can’t fix. 🥂

Total bitcoin futures open interest climbed slightly by 0.60% to $84.91 billion since yesterday, according to Coinglass. Bitcoin liquidations totaled $37.96 million over 24 hours and were relatively evenly split between short and long liquidations, $13.63 million and $17.53 million, respectively. A perfect balance of hope and despair, wouldn’t you say? 😏

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- 7-Year-Old Crypto Tycoon Ditches Bitcoin for Ethereum: A Tale of Digital Fortunes 🤑💰🚀

- Bitcoin’s Bizarre Bull Run: ETFs, Elves, and Explosive Tokens! 🚀

- Crypto’s Fancy New Suit: Institutions Crash the Retail Party 🎩💼

- USD CNY PREDICTION

- Bitcoin Faces ‘Nation-State Rug Pull’ Risk, Warns Willy Woo

- DOGE’s Wild Ride: Whales, Flags, and Golden Crosses 🌊🚀

- You Won’t Believe This Cryptic Cash Crunch! 😲💸

2025-09-11 21:44