Pantera Capital, in its infinite wisdom, has forecasted that the approval of a Solana spot ETF by the end of the year will result in an avalanche of institutional interest. The firm argues that Solana is currently being ignored by institutions compared to Bitcoin and Ether-big mistake, right?

Pantera Capital Predicts an Institutional Frenzy for Solana

In a rather bold statement, Pantera Capital, a firm that is obsessed with all things blockchain, says that the much-anticipated Solana (SOL) spot exchange-traded fund (ETF)-which they’re banking on being approved in the fourth quarter-will open the floodgates for institutional money. Of course, they’re also predicting a corresponding rise in Solana’s price and market cap, which as of Sept. 22, stood just shy of $121 billion. It’s almost as if they know something we don’t!

In a post on X (the platform formerly known as Twitter), Pantera shared its thoughts on why they believe Solana is about to have its “institutional moment.” The firm highlighted that institutions have barely dabbled in Solana compared to their hefty allocations in Bitcoin (BTC) and Ethereum (ETH).

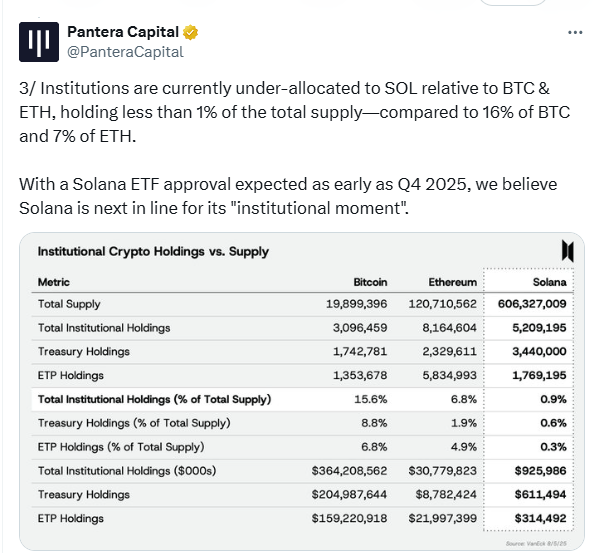

“Institutions are sitting on less than 1% of the total supply of SOL-that’s right, less than 1%-while they hold a staggering 16% of Bitcoin and 7% of Ethereum,” Pantera pointed out in its September 18 post. Yeah, they’re definitely missing the boat here.

This “under-allocation” also appears in the U.S. dollar value of institutional holdings. Institutions currently hold a whopping $364.2 billion in Bitcoin and $30.7 billion in Ethereum. So why are they so hesitant to throw some cash at Solana?

On the flip side, institutional holdings of Solana-mostly through treasuries and exchange-traded products (ETPs)-are stuck below $1 billion. Pantera argued that this underwhelming figure doesn’t reflect Solana’s impressive usage metrics, which, according to them, surpass those of Bitcoin and Ethereum. It’s like a neglected underdog waiting for its time to shine!

“We believe Solana’s adoption is just beginning, and the upside potential is, well, massive,” Pantera declared. Clearly, they’re all in on Solana.

And in case you were wondering how confident Pantera is about Solana’s future, they recently led a private investment in public equity (PIPE) offering to purchase Helius Medical Technologies’ common stock. The company plans to use the funds to create a digital asset treasury strategy, with Solana as the star asset. You know, just a little vote of confidence in case you missed it.

During a period of institutional excitement, Solana saw its price soar from about $144 on July 24 to an impressive $251 by September 18. But, of course, markets being what they are, the price pulled back along with the broader crypto market. As of September 22, SOL was hovering around $220. You know, just taking a breather after all that excitement. 😅

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- 🚨 Last Call for $BEST: The Wallet Revolution Ends in 3 Hours! 🚀

- Silver Rate Forecast

- Nasdaq’s Nano Labs Plots Billion-Dollar BNB Grab—Did Binance Just Get a New Frenemy?

- Altcoin Frenzy: BANK Soars 60% While MET Plays Catch-Up 😱💸

- Privacy Coin Frenzy: Zcash’s $741 Surge Stirs the Crypto World

- USD VND PREDICTION

- BNSOL PREDICTION. BNSOL cryptocurrency

2025-09-23 07:58