Traders, with the nervous energy of a man about to step on a squeaky floorboard, are now watching closely to see if this marks the start of a recovery from oversold conditions. 😬

TD Sequential Signals Possible Reversal 🧠

The 4-hour chart reveals SEI trading at $0.288, a figure that would make even the most stoic of traders raise an eyebrow. 🤔 The recent selloff pushed the token into heavily oversold territory, and now the TD Sequential indicator has flipped into a buy setup at the monthly open. This shift comes after the same tool successfully signaled the previous market top, giving weight to its current bullish call. 🕵️♂️

Volume analysis, ever the gossip of the market, highlights increased activity during the sharp drop, suggesting that capitulation may have occurred as weaker hands exited their positions. 🚪 The quick bounce from the $0.278 low, which is as reliable as a weather forecast in a tornado, further reinforces the idea that sellers could be losing momentum. ⚠️

Looking forward, the first hurdle for bulls is reclaiming the $0.30 level, which would confirm early recovery momentum. A break above this zone could open the way toward $0.32-$0.33, while failure to hold $0.278 risks extending the decline. With the buy signal in play, the crypto finds itself at a critical juncture where trader conviction will dictate the next big move. 🎭

Buy Signal Gains Momentum Amid Market Pullback 🧙♂️

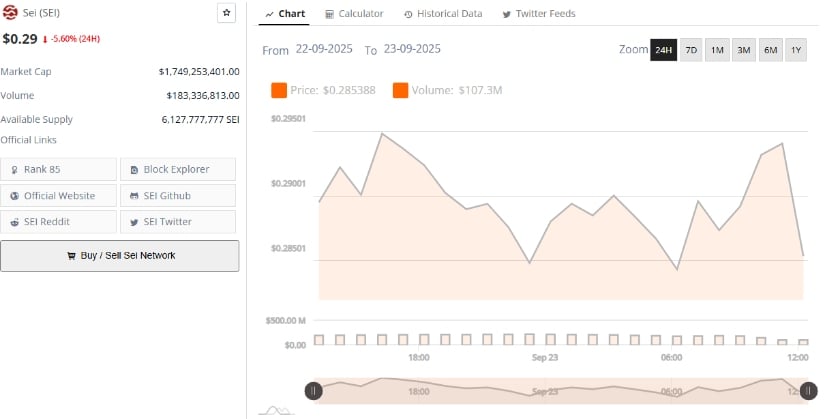

Analyst Ali, with the conviction of a man who’s just discovered the secret to eternal youth, declares the token trading at $0.29, down 5.60% in the past 24 hours, with a market cap of $1.74 billion and a trading volume of $183 million. 🧙♂️ Despite the decline, the TD Sequential indicator flashing a buy setup suggests the recent weakness may be setting the stage for a reversal, especially as price action finds support near $0.28. 🌟

The broader data highlights strong liquidity, with over 6.12 billion tokens in circulation and steady trading activity. If the $0.28 level holds and price climbs back above $0.30, it could confirm bullish momentum, opening the path toward $0.32 in the near term. This alignment of technical signals and market structure strengthens the view that downside pressure may be easing. 🌈

Here’s a clean version with a strong subheading and two detailed paragraphs:

Momentum Weakness Persists Despite Daily Gains 📉

At press time, SEI/USDT is trading at $0.2951, reflecting a modest 1.72% daily increase, yet technical indicators suggest the recovery lacks strength. The MACD line, ever the reluctant participant, sits at 0.0004 below the signal line at 0.0040, while the histogram remains negative at -0.0036, hinting at mild bearish pressure. 🧠

Price action continues to face resistance between $0.3500 and $0.3900, while stronger support is found closer to $0.1300, creating a wide range that underscores the uncertainty in short-term direction. 🌀

The Relative Vigor Index (RVI), ever the skeptic, further highlights this caution, printing at 38.92 below its moving average of 44.43. With the RVI failing to climb above its average and staying well under the neutral 50 mark, bullish conviction remains weak. 🧐

Therefore, the movement in recent sessions reflects hesitation from both buyers and sellers, making a clear breakout unlikely until momentum strengthens. For now, traders may prefer to wait for decisive signals, particularly a bullish MACD crossover, before positioning aggressively. 🤷♂️

Read More

- Gold Rate Forecast

- USD COP PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- USD CAD PREDICTION

- USD CNY PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- Crypto’s $9.3B NFT Frenzy: Punks, Apes, and Penguins, Oh My!

- IP PREDICTION. IP cryptocurrency

- Bitcoin Plummets Below $98K: Fear Grips Market Like a Bad Soap Opera 🎭

2025-09-23 23:20