Ethereum, that most capricious of assets, hath descended beneath the fabled threshold of $4,000, causing quite the commotion among investors. 📉💸

The Bulls, ever hopeful, Regard the Dip as a Most Favorable Opportunity

Ethereum (ETH), that most mercurial of tokens, hath dipped below the $4,000 mark, a feat not seen in over a month, as bearish sentiment doth ripple through the crypto realm. According to Bitstamp data, ETH fell to a mere $3,967, a most distressing sight, before rebounding slightly to close just above $4,000, marking a 24-hour loss of 4.4%. 🧠💸

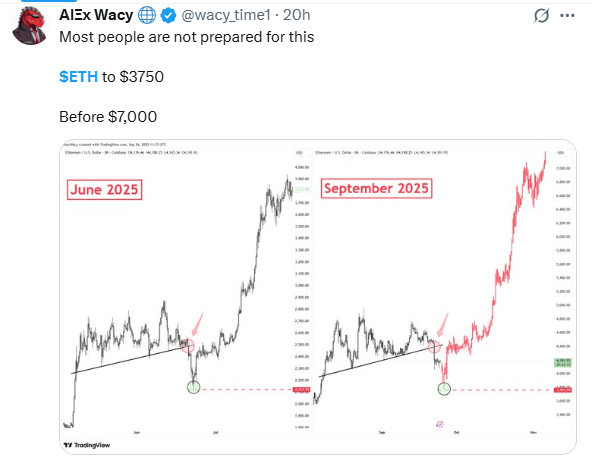

This retreat hath pushed ETH’s seven-day losses to 12.5%, placing it among the worst-performing high-cap altcoins. Since peaking above $4,750 on Sept. 13, ETH hath dropped nearly 20%, and some technical analysts foresee further declines before the asset stabilizes. Yet, the bulls remain undeterred, viewing the correction as a precursor to a renewed uptrend. 🤷♂️📈

Tom Lee, that esteemed executive of Bitmine, doth remain optimistic, predicting ETH shall attain a new all-time high before year’s end. While some analysts forecast a 2025 peak around $7,000, Lee envisions a more ambitious range of $10,000 to $12,000. A most audacious prediction, if I may say so. 🎩💼

The Market’s Turbulence and the Whales’ Wily Ways

Supporting this bullish outlook, social media analysts hath reported aggressive whale activity during the dip. Analyst Zyn, that most astute of observers, highlighted that 10 new wallets acquired approximately 201,000 ETH-worth $855 million-via exchanges and over-the-counter trades on September 25 alone. “This oft occurs when ETH is nearing a bottom,” Zyn remarked, with a knowing wink. 🕵️♂️💰

Michaël van de Poppe, founder of MN Fund, echoed this sentiment, suggesting the worst of the downtrend may be over, stating there was “much more downside to come.” A most reassuring statement, I’m sure. 🤔

However, the price drop had immediate consequences. ETH’s decline hath triggered $178.5 million in long position liquidations, with the largest single liquidation totaling $29.12 million on Hyperliquid. The downturn also put pressure on a high-risk trader known as Machi Big Brother, who reportedly deposited $4.72 million in USDC on Hyperliquid to avoid liquidation, according to Lookonchain. A most desperate measure, if you ask me. 💸🚫

ETH’s volatility doth continue to test investor resilience, but for many bulls, the current dip is but a trifling obstacle on the path to long-term growth. 🧠📈

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- Gold Rate Forecast

- USD CAD PREDICTION

- XRP ETF Crushes Solana – First Day Madness! 🎉🚀

- TIA PREDICTION. TIA cryptocurrency

- USD CNY PREDICTION

2025-09-25 13:29