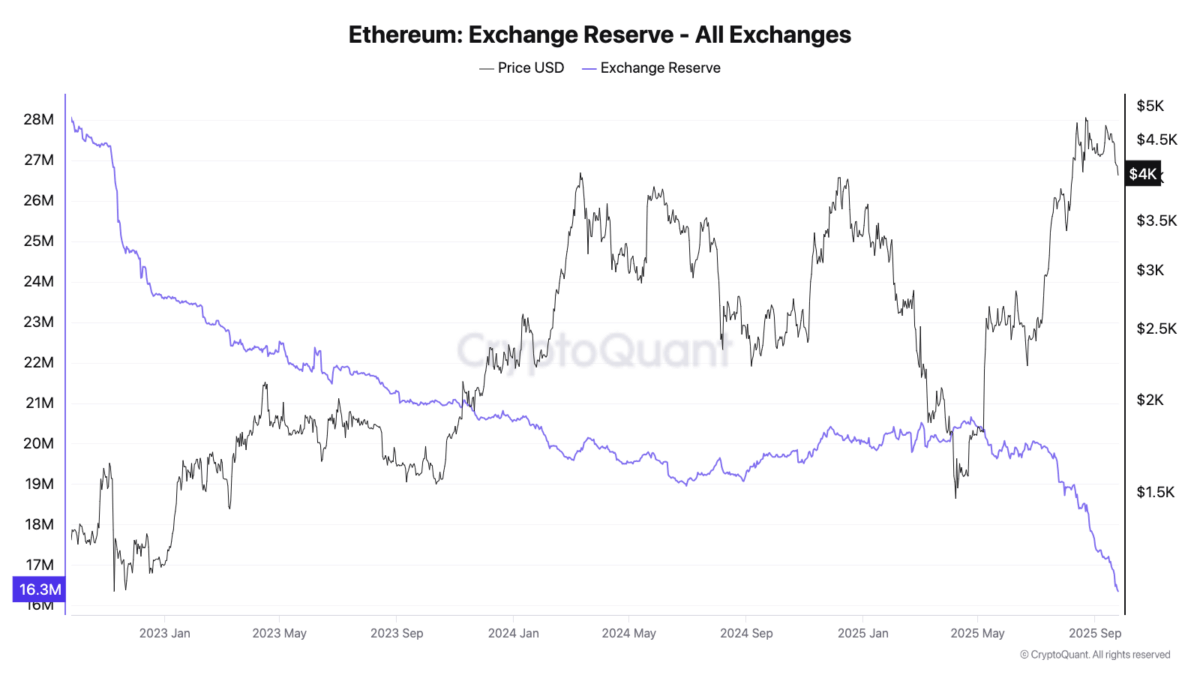

Ah, the ethereal dance of Ethereum! 🕊️ While the suits and ties of Wall Street whisper sweet nothings into its digital ear, the exchanges-those once-proud fortresses of liquidity-now stand as hollow shells, their vaults emptier than a bureaucrat’s promise. Behold, the supply of ETH on centralized exchanges has plummeted to its lowest since 2016, a spectacle as rare as a honest politician. 🏛️✨

As of September 2025, a mere 16.3 million ETH remain in the clutches of these exchanges-a pittance, a crumb, a single tear in the ocean of crypto. And what of its price? Oh, it has waltzed and whirled, a prima donna on the grand stage of volatility. 📉📈

CryptoQuant, that oracle of on-chain wisdom, reveals a tale of exodus. From nearly 28 million ETH in 2023 to this paltry sum today-a migration as grand as the wildebeests crossing the Mara, but with fewer lions and more ledger entries. 🦁📊

Ethereum, currently priced at $4,030, has flirted with both despair and triumph. Below $2,000 in 2023? Check. Above $4,000 in 2024? Check. Back below $2,000 in 2025? Check. And now, a triumphant return to $4,000. A drama fit for the Bolshoi, no? 🎭💸

CryptoOnchain, that harbinger of trends, proclaims: “Ethereum exchange outflows hit a two-year high!” 🌊 Large-scale withdrawals, they say, are the crypto equivalent of a hermit crab finding a new shell-a shift to self-custody or DeFi, leaving exchanges high and dry. Historically, such movements herald bullish tides. 🐂🌊

📊 Ethereum exchange outflows hit a 2-year high!

CryptoQuant data shows that the 30-day SMA of ETH netflow (total) is at its highest level since September 2023. Large-scale withdrawals often indicate a shift toward self-custody or DeFi deployments, reducing exchange liquidity…

– CryptoOnchain (@CryptoOnchain) September 24, 2025

The Institutional Waltz: A Glow-Up for Ethereum

Ah, the institutions-those titans of finance, with their bottomless coffers and insatiable appetites. Since June, they have been on a shopping spree, stacking ETH like it’s going out of style. Analyst Rachael quips, “Ethereum is getting the Wall Street glow-up.” 💄💼

BitMine alone holds 2.4 million ETH, a hoard so vast it makes Smaug look like a penny-pincher. And since April, 68 entities have gobbled up 5.26 million ETH, worth a cool $21.7 billion. Most of it staked for yield, of course-because who keeps treasure in a mere chest when it can grow in the garden of DeFi? 🌱💰

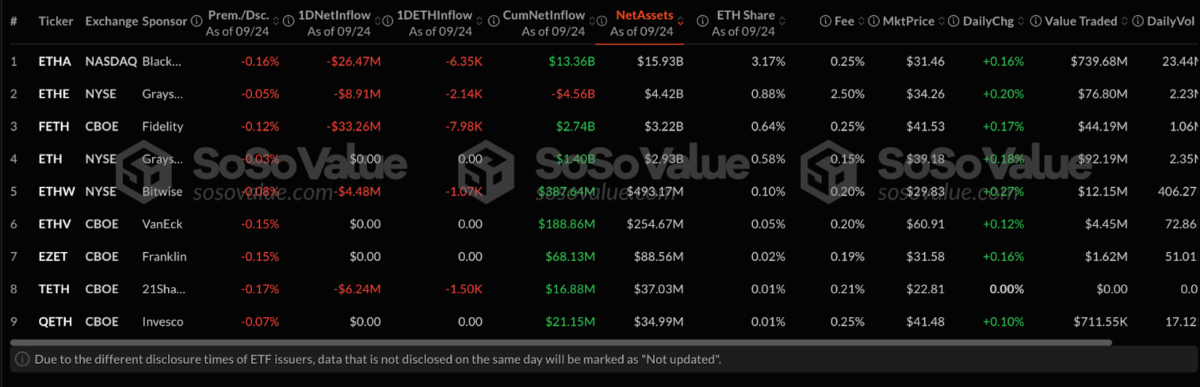

Ethereum ETFs, those financial chimeras, show mixed fortunes. BlackRock’s ETHA reigns supreme with $15.93 billion in assets, yet even it faced a $26.47 million outflow on September 24. Fidelity’s FETH, meanwhile, bled $33.26 million-a sign of shifting sands in investor sentiment. 🏜️📉

And so, as the exchanges weep into their empty vaults, the institutions smile, their coffers brimming with ETH. With less of it available for sale, the stage is set for a grand finale-upward price pressure, should demand continue its relentless march. 🎆📈

But remember, dear reader, in the theater of crypto, the curtain never truly falls. The show must go on, and Ethereum, that enigmatic star, is ready for its next act. 🌟🎬

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- Gold Rate Forecast

- USD CAD PREDICTION

- XRP ETF Crushes Solana – First Day Madness! 🎉🚀

- USD CNY PREDICTION

- TIA PREDICTION. TIA cryptocurrency

2025-09-25 14:35