Alas, the mighty Bitcoin has succumbed to the weight of its own destiny, plummeting beneath the revered 100-day moving average, now languishing at $113.4K. What a miserable sight it is to witness the great king of crypto bruised and battered after the recent sell-off. Yet, here we are, at a critical juncture-awaiting the whims of demand to determine which path the market shall tread next.

Technical Analysis

By Shayan

The Daily Chart

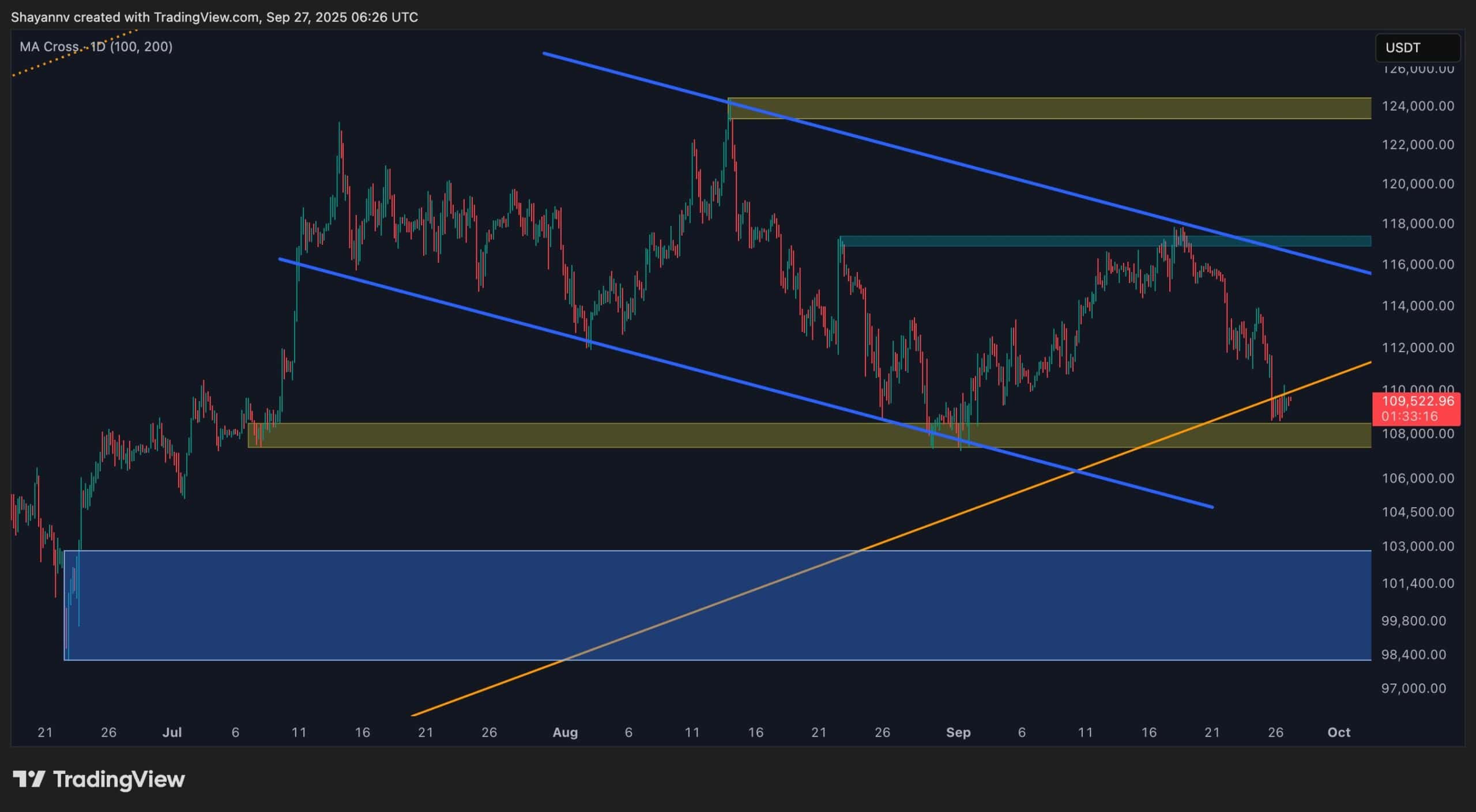

Upon the daily canvas, Bitcoin, once a glorious figure, now finds itself caught in a tangled web between the 100-day moving average ($113K) and the 200-day moving average ($104K). This dreadful zone is a barren no-man’s land, where indecision reigns supreme. Here, neither buyer nor seller can claim victory, as if the entire market is holding its breath, unsure of the next move.

The bearish trend persists in its painful march, like a relentless soldier of fortune, as the descending channel stands tall and unyielding. The bulls, poor souls, must gather their strength to defend the critical $109K level. Should they falter, a deeper descent could drag us toward the 200-day moving average and the dreaded demand zone between $100K and $102K.

Meanwhile, lurking beneath $107K lies a potential pitfall-a sell-side liquidity pocket that, like an insidious trap, could ensnare the unwary and drag the price even lower before any glimmer of hope emerges.

The 4-Hour Chart

In the shorter time frame of 4 hours, Bitcoin’s misery continues. Rejected with disdain at the $117K mark, the market fell into an abyss, triggering a cascade of sell orders like a flood of soldiers fleeing the battlefield. Yet, there is hope! The price has formed a bullish flag structure, hovering just above a crucial demand zone below $110K.

Now, this zone is the final bastion of defense for the bulls. If they can hold their ground here, a rally toward recent highs may yet be within reach. But, alas, if this level succumbs to the sellers’ relentless pressure, a swift plunge toward the $100K zone seems inevitable. The battle continues, with the fate of Bitcoin hanging in the balance.

Sentiment Analysis

By Shayan

According to the Binance BTC/USDT liquidation heatmap (a two-week view), the recent chaos has been fueled by an insatiable thirst for liquidity. Above the $117K mark, an army of stop-losses and overleveraged longs was ruthlessly liquidated, amplifying the downward pressure. The market, like a wounded beast, howls in agony as the supply overwhelms any attempts at recovery.

Yet, in a surprising twist, there is hope-below the current price, no major liquidity clusters exist. It seems the sellers may have exhausted their ammunition, for now. With Bitcoin stabilizing around $109K, further declines may be stifled, but only until fresh order flow rises from the depths. For now, the market stands poised at the precipice-will it rise again or succumb to the abyss?

In this great tale of imbalance, the $117K liquidity band overhead remains a formidable cap, a symbol of supply dominance. Meanwhile, the $109K demand base is the last line of defense, and must hold firm to prevent a plunge toward the $100K zone. The market is but a grand theater of uncertainty, with every move a mystery, every decision fraught with peril.

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- USD CAD PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- Bitcoin Frets and Fears: The Great Crash of 2025! 🚨💥

2025-09-27 20:18