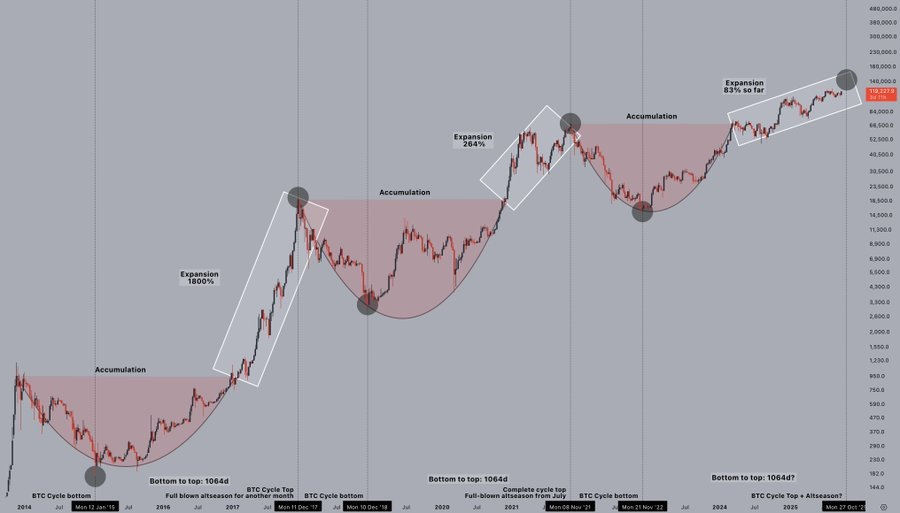

Ah, Bitcoin – the mysterious diva of the financial world, constantly twirling in its own cryptographic ballet. Traders, ever the diligent spectators, are now observing its every pirouette with bated breath. CryptoJelle, a self-proclaimed soothsayer of the digital currency realm, has noticed an interesting pattern: Bitcoin’s last two market cycles were precisely 1,064 days from the humble bottom to the heavenly peak. How utterly predictable, isn’t it?

And now, dear reader, if the heavens favor us and history decides to bless us with its repetitive charm, Bitcoin may once again reach its pinnacle on October 27th, 2025. The sheer drama of it all!

The Cycle Pattern: 1,064 Days to the Top

Ah, but let us not get carried away. According to our wise oracle Jelle, Bitcoin’s past cycles are nothing short of poetic repetition. The first cycle, between 2015 and 2017, witnessed Bitcoin soaring from beneath a paltry $500 to the lofty heights of nearly $20,000 – an ascension of over 1,800%. One would almost think it was a fable. The second cycle, from 2018 to 2021, began with a humble $3,100 and culminated in a dramatic $69,000 – a dazzling 2,100% gain. How terribly exciting!

Now, let us examine the current cycle, which began after Bitcoin had the decency to dip below $16,000 in November 2022. And lo and behold, Bitcoin has since rebounded with the grace of a phoenix, soaring over 83% and recently trading above $120,000. Bravo, Bitcoin, bravo! 👏

Institutional Influence and Macro Factors

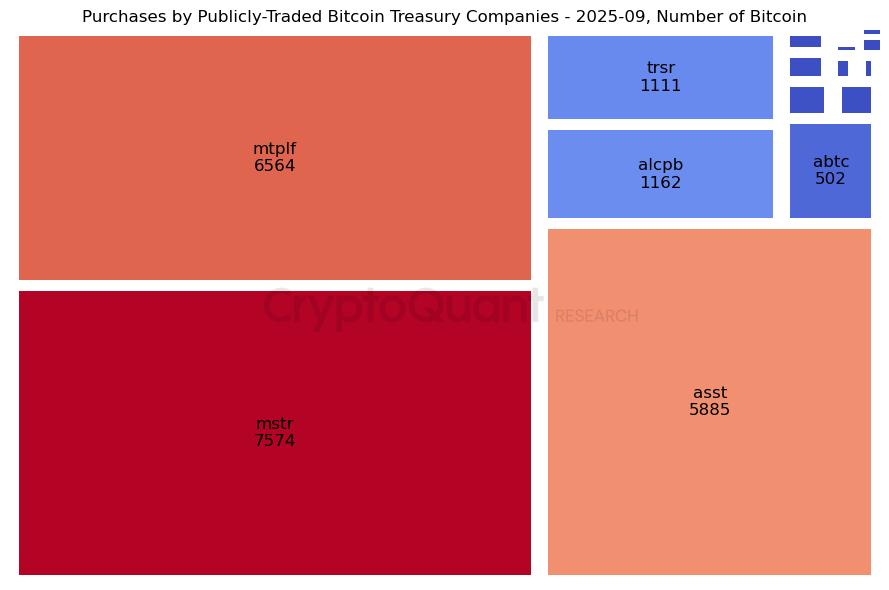

But wait! This time, dear friends, it’s not just retail traders causing all the ruckus. The fine institutions have decided to play their part in this theatrical production, with ETF launches and corporate treasury purchases taking center stage. The plot thickens!

In September, several publicly-traded companies took it upon themselves to add a generous amount of Bitcoin to their coffers:

- Strategy: 7.6K BTC

- Metaplanet: 6.6K BTC (with an additional 5.3K announced yesterday – how terribly considerate of them!)

- Strive: 5.9K BTC (via PIPE – no, not the plumbing kind, the financial one)

Yet, as all good drama warns us, too much institutional involvement could alter the narrative. Experts whisper that this might stretch the cycle, transforming a sharp, exhilarating rise into a more drawn-out, gradual ascent. How utterly anticlimactic! 😒

What About Altcoins?

But ah, Bitcoin is not the only star in this circus. Even after Bitcoin has ascended to its throne, altcoins – those charming underdogs – may still have some fire left in them. Historically, these smaller coins love to extend their rallies well beyond Bitcoin’s zenith, like a firework that refuses to die out too soon. So, fear not, dear altcoin enthusiasts, your time may come in late November.

And with that, let us conclude: October might just prove to be a pivotal moment in the crypto drama. Traders would do well to stay on their toes, for while Bitcoin may be basking in the spotlight, altcoins are waiting in the wings. But, as always, proceed with caution, for in the world of crypto, nothing is ever quite as it seems. 🎭

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- USD CAD PREDICTION

- Gold Rate Forecast

- USD THB PREDICTION

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- UFC & Polymarket: Fists, Foresight, and Frenzy!

2025-10-03 10:12