Ah, Bitwise – that clever little rascal – has gone and done it again! In February 2025, they registered a Delaware trust entity, and come March, they were filing an S-1 with the SEC. Yes, you heard that right, they’re expanding the crypto-investment buffet beyond the mundane offerings of Bitcoin and Ethereum. Delightful, isn’t it?

And, of course, the APT token did what any sensible asset would do when its fate is bound to Bitwise: it soared. In March 2025, APT decided to make a dramatic 18% leap, landing at a fabulous $6.48. Fast forward to October 2025, the momentum didn’t just fade away – it sprinted ahead with a nearly 30% surge, hitting a delectable $5.37. Trading volume? Oh, just a modest $3.98 billion. No biggie, really.

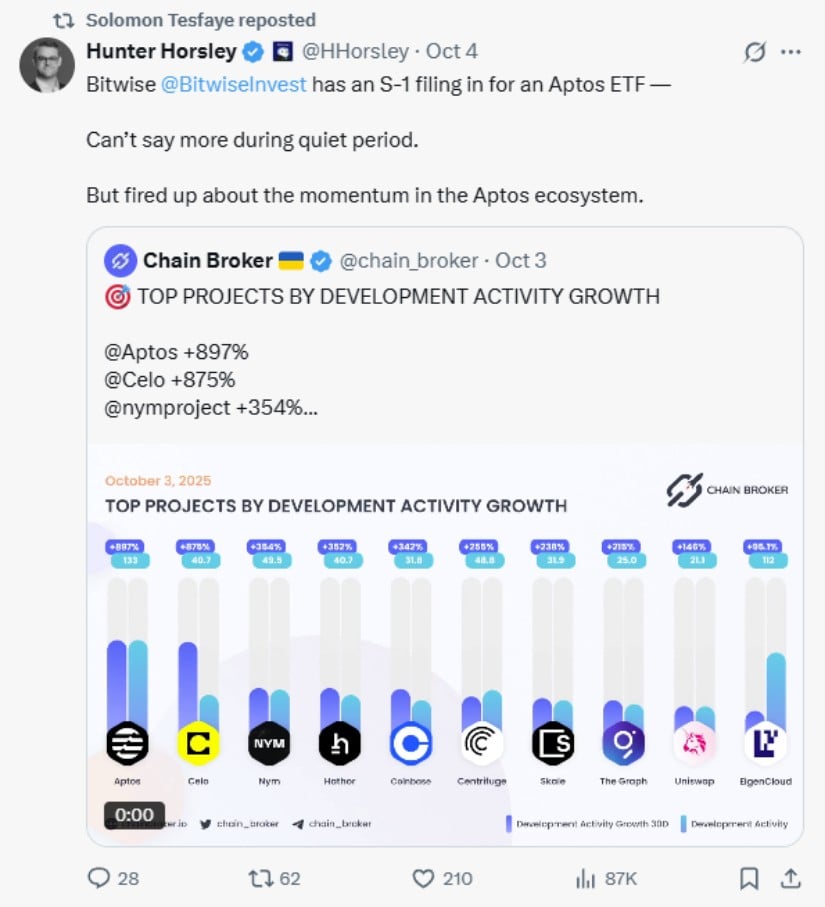

Now, the CEO of Bitwise, one Hunter Horsley, let us in on a little secret over social media in October 2025: “Can’t say more during quiet period,” he coyly remarked, while also hinting that he’s ‘fired up’ about the Aptos ecosystem. Because, of course, why wouldn’t he be?

Developer Activity: The New Rockstar of Blockchain

What’s that? Developer activity is skyrocketing in the Aptos ecosystem? Of course it is! According to Chain Broker, Aptos is outpacing the competition with an 897% increase in developer activity. Take that, Celo, Nym, and Skale – it’s not even a fair race at this point.

Why, you ask? Well, it’s simple. Aptos finalizes transactions in less time than it takes to make a gin and tonic (under a second, darling) and with fees that cost less than your morning coffee. It’s no wonder that decentralized finance and payments can’t get enough of it. It’s a smooth operator, really.

Wall Street Loves a Bit of Aptos

In a plot twist that could only happen in the world of high finance, major players like BlackRock – you know, the world’s largest asset manager – have been courting Aptos. In November 2024, BlackRock expanded its BUIDL fund to include Aptos, and get this: it’s the only non-Ethereum blockchain in their portfolio. Who’s feeling exclusive now?

Franklin Templeton wasn’t far behind, dipping their toes in the Aptos waters with their OnChain U.S. Government Money Fund. Roger Bayston, the Head of Digital Assets, couldn’t have been more pleased with Aptos’s “high standards.” Can you hear the applause from the finance crowd?

And who can forget Libre’s audacious move in September 2024? The firm launched tokenized investment funds on Aptos, giving the platform the kind of street cred it deserves. Aptos is officially no longer the new kid on the block; it’s the one everyone’s talking about.

Stablecoins and DeFi: Aptos’ Wild Ride to Glory

Oh, what a year it’s been for Aptos! By November 2024, the Total Value Locked (TVL) in decentralized finance had topped $1 billion, growing an utterly charming 700% from the start of the year. Yes, darling, it’s been a heady ride!

And who could forget Tether’s bold move, launching USDT natively on Aptos in October 2024? The supply grew by a staggering eightfold to $680 million, making it the dominant stablecoin on the network. Circle’s USDC has also had a lovely time, with market caps skyrocketing over 1,000%. They’ve all been living their best lives on Aptos.

With nearly $1 billion in DeFi liquidity flowing through applications like Thala, Echelon, and Amnis Finance, Aptos isn’t just a flash in the pan. It’s the whole darn kitchen.

Regulatory Affairs: Aptos’ New Best Friend

And if you thought the drama couldn’t get any juicier, in June 2025, Aptos secured a spot on the Commodity Futures Trading Commission’s Digital Asset Markets Subcommittee. Avery Ching, Aptos’s co-founder and CEO, will now be rubbing elbows with big names like BlackRock and Goldman Sachs. Well, isn’t that just darling?

In addition to that, Aptos has also teamed up with World Liberty Financial, a Trump family venture (no, really), to launch a USD1 stablecoin on its network. It’s like a fairy tale, but with blockchain and real-world assets.

European Ventures Are Already Live

Now, don’t think Bitwise is sitting around waiting for U.S. regulators to get their act together. Oh no. In November 2024, Bitwise launched an Aptos Staking ETP on Switzerland’s SIX Swiss Exchange. It’s got a glorious ticker – APTB – and offers a rather lovely 4.7% annual staking reward after fees. Tantalizing, isn’t it?

This European debut has set the stage for the U.S. launch, which – spoiler alert – will probably take a little longer. American regulators do love their delays, after all. But don’t worry, darling, it’ll be worth the wait.

Is SEC Approval Just a Matter of Time? Perhaps, But We’ll See

And now, the grand finale. The SEC will be reviewing Bitwise’s application for months to come. It’s a rigorous process that involves weighing market risk, investor protection, and regulatory compliance. Given the SEC’s track record with altcoins, don’t expect a decision before the summer of 2025, if we’re being entirely honest.

But if approved, the Bitwise Aptos ETF will allow all of you traditional investors to dip your toes into the wonderful world of APT without the need for cryptocurrency wallets. Coinbase Custody will handle the cold storage of assets. Safety first, darlings!

The cryptocurrency ETF wave is already growing. After Bitwise’s announcement, Bitcoin spot ETFs attracted $3.24 billion, with BlackRock’s IBIT leading the charge. Just a little bit of competition for you!

The Bottom Line: A Bit of Substance Beneath the Sparkle

Bitwise’s Aptos ETF filing is not just another speculative fantasy. No, it’s built on solid growth. The 897% surge in developer activity, the $1 billion DeFi milestone, and institutional endorsements from the likes of BlackRock and Franklin Templeton show there’s real meat on this bone. While the SEC approval may be delayed (thanks, bureaucracy!), the 30% surge in APT prices speaks volumes. The market is ready for Aptos. Let’s just hope the regulators can catch up!

Read More

- USD COP PREDICTION

- Silver Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- Brent Oil Forecast

- SEC’s Quantum Quandary: Is Your Bitcoin Bristling with Risk?

- Gold Rate Forecast

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- UFC & Polymarket: Fists, Foresight, and Frenzy!

- USD THB PREDICTION

2025-10-06 02:36