Bitcoin’s options pit remained a chaotic waltz Monday evening as the price cooled to $124,843 at 8 p.m. EST after a quick rip to the $126,272 lifetime high. One must wonder: is this a grand masquerade of volatility, or merely the market’s way of saying, “I’m flambéing your expectations”? 🔥

On the options board, calls still carry the baton, though one might argue they’re merely parading in a world where puts are the uninvited guests. Coinglass.com stats reveal calls represent 59.77% of open interest (OI) versus 40.23% for puts – roughly 245,840 BTC in call OI against 165,501 BTC in puts – and the past 24 hours leaned the same way, with calls at 51.9% of volume versus 48.1% for puts (about 38,748 BTC in calls, 35,914 BTC in puts). Translation: dip-buyers prefer options with defined risk – or perhaps defined delusion. 🤡

Where traders are clustering: Dec. 26, 2025, calls dominate open interest, led by the $140,000 strike (9,893 BTC OI), then $200,000 (8,577 BTC), $120,000 (6,895 BTC), $150,000 (6,389 BTC), and $160,000 (5,463 BTC). There’s meaningful interest at $130,000 (4,727 BTC), while an Oct. 31 $124,000 call sits high at 6,538 BTC – tidy positioning for near-dated strength, or perhaps a bold gamble to outwit the market’s chronic indecision. 🎩

Today’s flow favored short-dated calls on Deribit – Oct. 31 $128,000, $124,000 and $126,000 led volumes (2,306 BTC, 1,737 BTC and 1,349 BTC). Bears weren’t absent: the Oct. 24 $108,000 put printed 1,703 BTC and the Oct. 17 $110,000 put 1,279 BTC. Over on Bybit, a Dec. 26 $40,000 USDT-settled protective put showed up with about 1,403 BTC of volume – the institutional way to say “insurance still matters,” or perhaps desperation dressed in calm. 🕶️

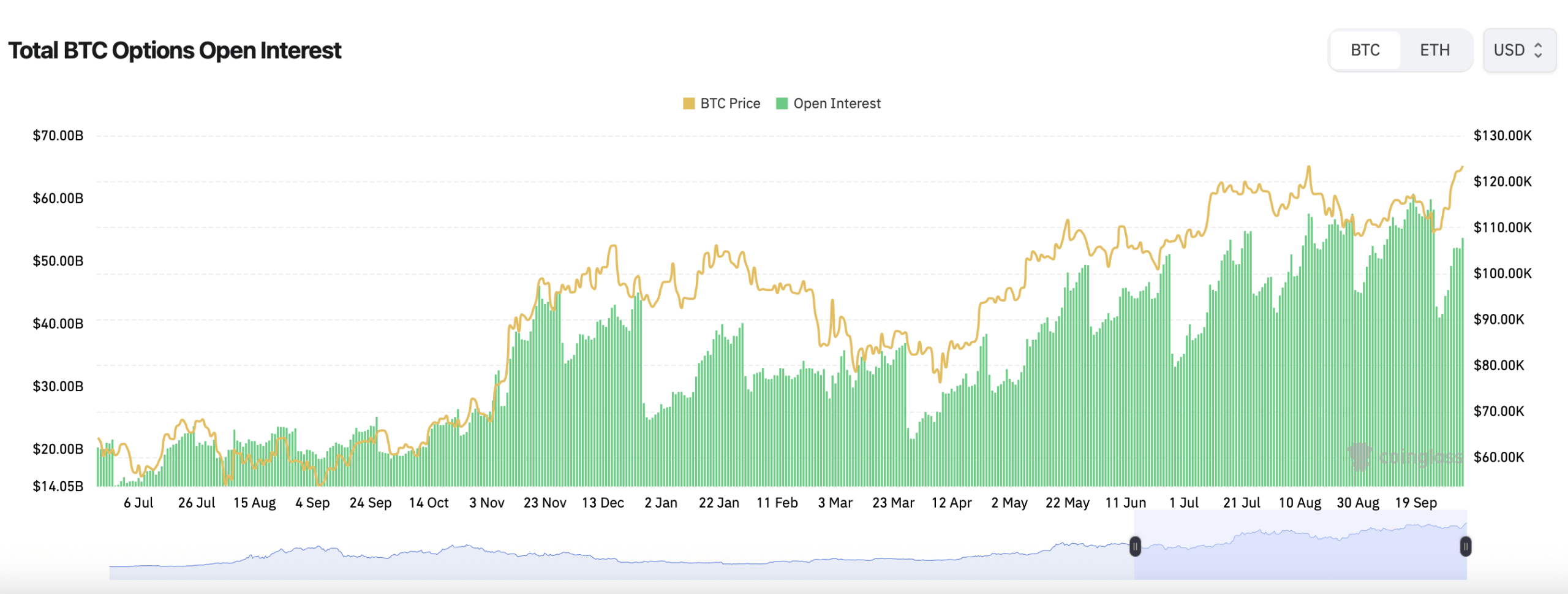

Total bitcoin options open interest sits near record territory on Coinglass, in the high-$50 billions range, having marched higher with price through Q3 into October. That rise fits the classic “trend, then options amplify it” playbook: calls fund upside while puts finance structure – a symphony of speculation conducted by hope and hubris. 🎻

Max pain – the level where option sellers feel least pain – maps the incentive field. For Oct. 31, it hovers around $125,000. For the Oct. 10 cluster, it shifts closer to $116,000. Into year-end rolls, it trends nearer $110,000. Said plainly: dealers would love a stasis zone near $125K near term, while deeper gravity into the winter expiries would suit premium sellers just fine – or perhaps the market’s way of whispering, “Don’t get too comfortable”. ❄️

Context matters. Bitcoin kicked off October with fireworks, peaking above $125,500 and living up to “Uptober,” roughly 12% off last week’s $110,000 prints, while gold also notched records – a neat snapshot of capital tiptoeing toward hard-asset hedges. That macro tone fed directly into options: more call spreads, more calendars, more upside structure – with just enough put activity to keep risk officers sleeping at night, or perhaps pretending to sleep. 🛌

Jean-David Péquignot, chief commercial officer (CCO) for Deribit by Coinbase, told TopMob that the recent leg higher reflects a confluence of catalysts – U.S. government shutdown jitters, about $3.2 billion in spot exchange-traded fund (ETF) inflows, and thinning exchange inventory – a cocktail he labeled a self-reinforcing cycle. He sees targets between $128,000 and $138,000 if momentum persists, with a tactical air pocket to $118,000 if policy winds shift – or perhaps the market’s way of playing 20 questions with your portfolio. ❓

And Péquignot flagged the volatility tells: “Amid the rally, bitcoin options markets remain very active, signaling sophisticated institutional positioning for continued upside,” the Deribit executive stated in a market note sent to our newsdesk. “1-week BTC ATM implied volatility has picked up from 30% in early October to 38% but 1-month IV has only increased by 2.5%, suggesting an orderly move given the spot price action.” In other words, chaos disguised as strategy. 🎭

He added that the flow composition skews bullish without tipping into mania: “Call spreads and call calendar spreads show strong trading activity, as calls dominate ca. 62% of options volumes on Deribit. Options traders are betting on a rally extension into Q4 but aren’t all-in on euphoria with calls layered with protections,” Péquignot remarked – a delicate dance of greed and restraint. 🕺

The Deribit exec added:

“Largely positive towards the end of September, the 30-day Put-Call skew has dropped close to neutral territory, confirming this bullish re-positioning. And the Put/Call ratios for end-October expiry and beyond show a large Open Interest in calls vs puts. Short call positions for end-October had to be rolled higher, shifting strikes to 126k-130k.”

His risk checklist is simple and practical: “From here, watch for volatility spikes and any shift in put volume as a red flag for near-term corrections. Bulls have their eyes on $130K+, and bears might find opportunities in overbought squeezes.” In other words, brace for turbulence or prepare to be disappointed. 🚁

Bottom line for traders: upside lures at $126,000-$130,000 remain the magnet in the near term, December still carries aspirational $140,000-$200,000 targets, and max-pain gravity plus dealer hedging can make the $124K-$128K band feel sticky. Keep spreads defined, respect gamma, and let the options market pay for your patience – or perhaps your therapy bills. 💸

Read More

- XRP’s Great Stalemate: Bulls vs. Bears 🧠💥

- USD THB PREDICTION

- Brent Oil Forecast

- XRP’s Daring Dance on $2.16: Will It Waltz or Wilt? 💸📉

- Crypto Chaos: 3 Stocks Dancing on the Edge of Madness 🌪️💸

- Bitcoin Frets and Fears: The Great Crash of 2025! 🚨💥

- SushiSwap’s Stirring Saga: The DeFi Drama That Left Us in Stitches! 😂🍣

- Truebit’s Midlife Crisis Costs $26M – 2026’s Hacking Spa Day 🛁💰

- How Bitcoin’s Miners Keep Their Cool (And Why That Matters!)

- UFC & Polymarket: Fists, Foresight, and Frenzy!

2025-10-07 04:29