Investor sentiment? More like investor whiplash! Midweek drama erupts as Bitcoin ETFs dump $104M like a bad Tinder date, while Ether ETFs scoop up $170M like they’re auditioning for a role on Shark Tank. 🚨

Bitcoin ETFs: The Great $104M Fire Sale (Grayscale’s GBTC Just Wanted Some Space 🤯)

The ETF market flipped its lid midweek. Bitcoin? Suddenly yesterday’s news. Ether? The prom queen of crypto. Who saw this coming? Not me. Not anyone. 🤷♂️

Bitcoin ETFs bled $104.11M like a leaky faucet. Grayscale’s GBTC took a sabbatical with $82.90M-probably off meditating in Bali. Invesco’s BTCO and BlackRock’s IBIT followed with $11.10M and $10.11M exits. Congrats, you’ve been dumped!

Trading volume? A zillion dollars. Assets dipped to $151.32B. Investors aren’t panicking-they’re just “reassessing.” Sure. We’ve all been there. 💸

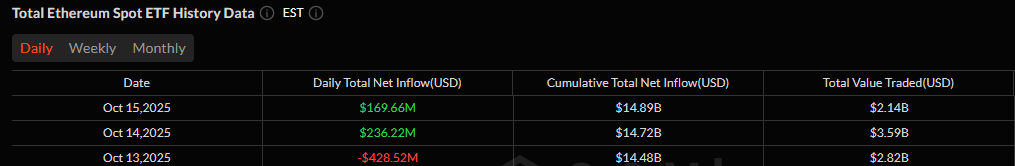

Ether ETFs raked in $169.66M like it’s free money Friday. Blackrock’s ETHA flexed with $164.33M-because why settle for Bitcoin when you can be the It fund at the crypto party? Bitwise’s ETHW added $12.31M. Fidelity’s FETH tossed in $1M for good measure. 🎉

21Shares’ TETH lost $7.98M. Big deal. The rest of Ether’s crew bailed it out like a bad roommate who never pays rent. Total value traded? $2.14B. Assets held steady at $27.37B. Institutional investors are here for the long haul-or until the next shiny thing appears. 🔭

Bitcoin ETFs took a breather. Ether ETFs stole the mic. Is this a trend? A fling? A crypto soap opera? Who knows. But for now, Ether’s winning the popularity contest. Sorry, Bitcoin. Better luck next season. 👋

FAQ (Because You’re All Dying of Curiosity)

- What happened to crypto ETF flows midweek?

Bitcoin ETFs had a midlife crisis, Ether ETFs bought a sports car and a gym membership. 🏎️💪 - Which Bitcoin ETF led the outflows?

Grayscale’s GBTC. It’s not you-it’s them. They just needed space. 🌌 - Who led the inflows on the Ether side?

Blackrock’s ETHA. They’re the golden child now. Sorry, IBIT. 👋 - What does this divergence suggest about investor sentiment?

Bitcoin’s the ex you’re over. Ether’s the new flame you’re texting at 2 AM. 🔥

Read More

- Silver Rate Forecast

- Brent Oil Forecast

- Gold Rate Forecast

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- LINK Soars 20%-Will It Reach $100? 🚀📈

- 🚀 Stellar Plummets Like a Discworld Turtle Off a Cliff! 🌪️

- Solana Resilient? Yeah, Sure, Even Hackers Love It Too!

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

2025-10-16 17:34