Ah, the crypto market-a beast that never sleeps, always rising like a Phoenix, or maybe more like a caffeinated bat out of hell. In the third quarter of 2025, the market did what it does best: surge. A whopping 16.4% increase, adding $563.6 billion to the total market cap, which now stands proudly at $4 trillion. It’s like we blinked, and suddenly we’re back at the dizzying heights of the late 2021 bull run-who knew it could feel so nostalgic? 🤑

CoinGecko’s freshly minted Q3 2025 Crypto Industry Report called this the “second leg of recovery.” Oh, how poetic. And all that recovery was made possible by liquidity pouring in, institutional big shots returning to the party, and, of course, the magic of frantic trading activity. It’s like the market caught a second wind after its rather sleepy first half of the year.

2025 Q3 total crypto market cap and trading volume | Source: CoinGecko

Average daily trading volume? Oh, just a casual 43.8% rise to $155 billion, reversing the slightly disappointing declines of Q1 and Q2. Turns out, the market loves a good comeback story!

CoinGecko’s 2025 Q3 Crypto Industry Report is now LIVE 📊

The crypto market kept up its momentum in Q3, climbing to its highest level since late 2021. Liquidity surged with majors like $ETH and $BNB hitting new all-time highs.

Here are 7 key highlights you shouldn’t miss 👇

– CoinGecko (@coingecko) October 16, 2025

Stablecoins and DeFi: The Comeback Kids

Stablecoins, those reliable old pals, saw an 18.3% increase in market cap, reaching a new high of $287.6 billion. The USDe token from Ethena led the charge, up 177.8%, as if someone had sprinkled it with a magical “grow faster” dust. Meanwhile, Tether’s USDT added a solid $17 billion to its vault but, surprisingly, lost a bit of its market share to rising competitors. I guess even giants have to share the spotlight sometimes.

DeFi, that wacky and decentralized cousin of traditional finance, is back in full force too. The total value locked (TVL) surged 40.2% to $161 billion by September’s end, and the DeFi market cap itself climbed to $133 billion. It’s a party, and Ethereum’s price surge surely added some bubbly to the festivities, peaking at $181 billion in late September. 🚀

Q3 2025 DeFi market cap and share of overall market | Source: CoinGecko

DeFi’s slice of the crypto pie grew from a humble 3.3% to 4%. A small percentage, but enough to make some traditional finance types break a sweat. Apparently, decentralized services and governance are hot right now. Who knew?

Ethereum and BNB: The Overachievers

Ethereum (ETH) was the true overachiever of the quarter, skyrocketing 68.5% to finish Q3 at $4,215. That’s not just a bump; it’s a full-on moon landing. The price even touched an all-time high of $4,946 in August, leaving crypto enthusiasts swooning. Trading volume also did a double-take, nearly doubling from $19.5 billion a day in Q2 to $33.4 billion in Q3, mainly fueled by those hot new ETH spot ETFs. 💥

Meanwhile, Binance Coin (BNB) didn’t want to be left out. It hit a new all-time high of $1,048 before settling at $1,030. A healthy 57.3% increase is nothing to scoff at. In fact, by October, it had already breached $1,300, thanks to the launch of perpetual DEX Aster and PancakeSwap’s integration into Binance’s Alpha program. It’s like a crypto version of the “cool kids club,” and BNB is the VIP.

Centralized and Decentralized Exchange Volumes: A Tale of Two Markets

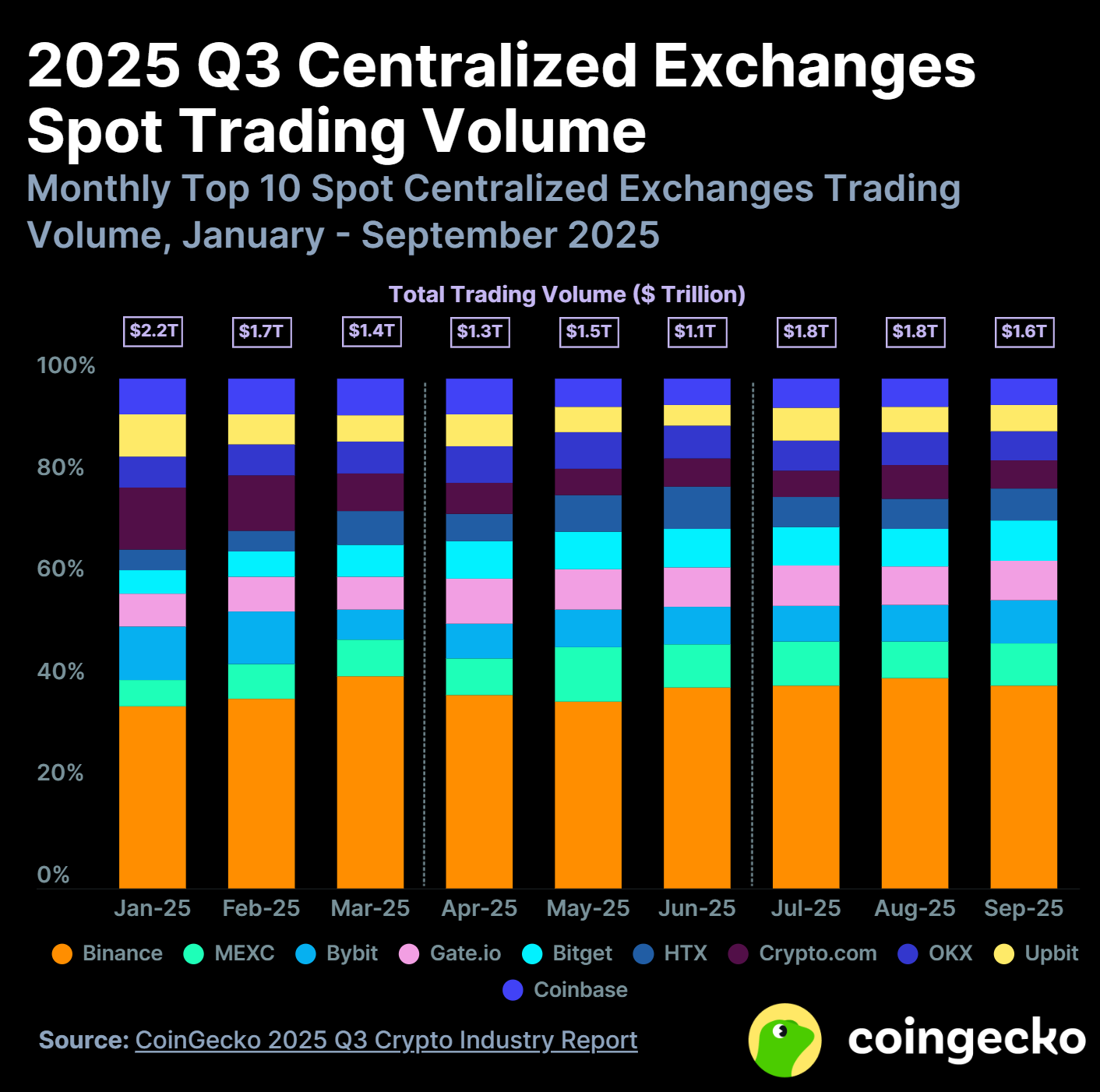

Centralized exchanges (CEXs) aren’t going quietly into the night either. Quarterly spot volumes surged 31.6% to $5.1 trillion. Binance, Bybit, and Upbit led the charge, leaving competitors trailing behind. Binance increased its trading volume by 40.2%, keeping a cozy 40% market share to itself. Bybit, moving up from 6th to 3rd, gave us all something to talk about, while Coinbase remained stuck at 10th despite a 23.4% rise in volume. Maybe it’s time for Coinbase to find some new tricks?

Q3 2025 CEX spot trading volume | Source: CoinGecko

Meanwhile, decentralized perpetual exchanges (Perp DEXes) are flexing their muscles with a jaw-dropping 87% volume increase, reaching $1.8 trillion. Hyperliquid is still in the lead with a 54.6% market share, but newcomers like Aster, Lighter, and edgeX are hot on its heels. Aster, in particular, has been raking in daily volumes as high as $84.8 billion in September, mostly thanks to the rise of the BNB ecosystem. Ah, the sweet smell of competition.

Read More

- Silver Rate Forecast

- Brent Oil Forecast

- Gold Rate Forecast

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- Steak ‘n Shake & Bitcoin: Utterly Baffling!

- XRP Whales Hoard Crypto Like Scrooge McDuck 😂💸 – Will Market Survive This Greed?

- Is Hyperliquid About to Explode? (Spoiler: Probably Not) 🔥

- LINK Soars 20%-Will It Reach $100? 🚀📈

2025-10-16 18:49