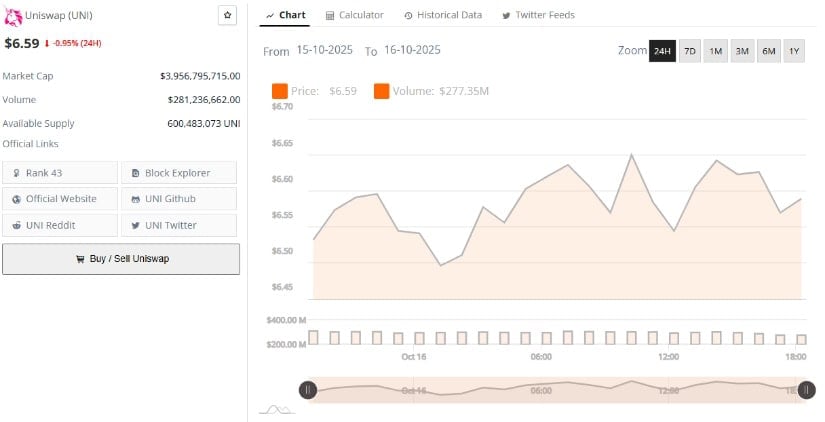

Ah, Uniswap, ever the fickle character in the cryptocurrency drama. After creating a stir earlier in the week with its heart-stopping volatility, it has now decided to take a breather, settling at a more pedestrian $6.59. There it rests, like a weary traveler, cautiously nibbling at the breadcrumbs of what could be a modest recovery. The traders, those eternal optimists, are eyeing this with a mixture of skepticism and hope, wondering if this is the calm before the storm… or just a long-winded nap.

Open Interest Takes a Dramatic Dive: A Liquidation Gone Wild

Ah, the sweet sound of liquidation. Data from Coinalyze reveals that after a dizzying descent toward $2.00 (where Uniswap nearly met its doom), the open interest on the exchange has plunged faster than a lead balloon. It plummeted from a lofty 300 million to a much more humble 144 million. No, it’s not a typo. That’s a *massive* unwinding of derivatives, folks. The market, much like a disgruntled shopper after a Black Friday sale, has decided it’s time to pack up and leave.

But wait, what’s this? The price chart, still a bit shaken from the liquidation mess, seems to have found a semi-comfortable spot between $6.30 and $6.50. Not bad, not bad. This is where Uniswap is making a quiet attempt at equilibrium, like someone trying to rest their tired feet after running a marathon. And don’t be fooled by the lack of open interest-this is simply the market holding its breath, waiting for the next big move. Will it be a slow, steady climb or another chaotic tumble into the unknown?

Market Data: The Calm Before… Maybe a Storm?

According to BraveNewCoin, UNI is now trading at a tantalizing $6.59, down by a mere 0.95% in the last 24 hours. With a market cap of $3.95 billion and a 24-hour trading volume of $281 million, it continues to rank as the 43rd most popular cryptocurrency. A mere trinket, yet it still stands tall, albeit slightly wobbling. The circulating supply sits at 600,483,073 tokens, making it as abundant as your cousin’s collection of low-budget, unsold NFTs.

The market is quietly huddling in the $6.00-$7.00 range, like an introvert at a party, unsure whether to stay or make a swift exit. Reduced volume means cautious players are waiting for a clearer signal before diving in again. But don’t get too comfortable; this period of consolidation could be the groundwork for a dramatic change-though, of course, that depends on whether Bitcoin can stop its drama and maintain its stability above those ever-important psychological levels. Will the DeFi king pull its weight? Time will tell.

Technical Indicators: A Picture of Hesitation and Confusion

As of this very moment, the daily UNI/USDT chart from TradingView looks like a pie chart of confusion, with just a hint of optimism. At $6.46, it’s suffering minor losses, like a soldier who’s seen better days but is still standing. The Chaikin Money Flow (CMF) sits at +0.16, indicating a slight resurgence of capital inflow. But don’t get too excited; momentum is still weak, and this may just be the market teasing us with an illusion of recovery.

The MACD, however, is not as kind. It’s still stuck in negative territory, with red bars on the histogram like a gloomy weather forecast. But the lines are flattening, hinting at a possible stabilizing trend-though one can never be sure with this market. A breakout above $7.00 could signal a revival of bullish enthusiasm, but if the coin can’t hold above $6.20, brace yourself for another plunge to those terrifying lows around $5.80. It’s all a bit too dramatic for anyone’s taste, don’t you think?

Read More

- Silver Rate Forecast

- Brent Oil Forecast

- Gold Rate Forecast

- Oh, The Drama! Crypto Whales Evacuate as Market Prepares to Shuffle 🌪️

- Will Solfart Fart Its Way to Crypto Fame? 🤔

- 🇬🇧 BoE’s £20K Cap: Aave Founder Calls UK “Losers” – Crypto Drama Unfolds! 💸

- LINK Soars 20%-Will It Reach $100? 🚀📈

- Bitcoin Stuck in $90k Limbo: Will It Break Free or Crash Harder? 🚀💔

- 😱 Oops! Crypto Shorts Gone Wild: $190M Down the Drain! 🚀

- Shocking UK Law Turns Cryptos into Private Property-The Future of Digital Assets?

2025-10-17 00:13